The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

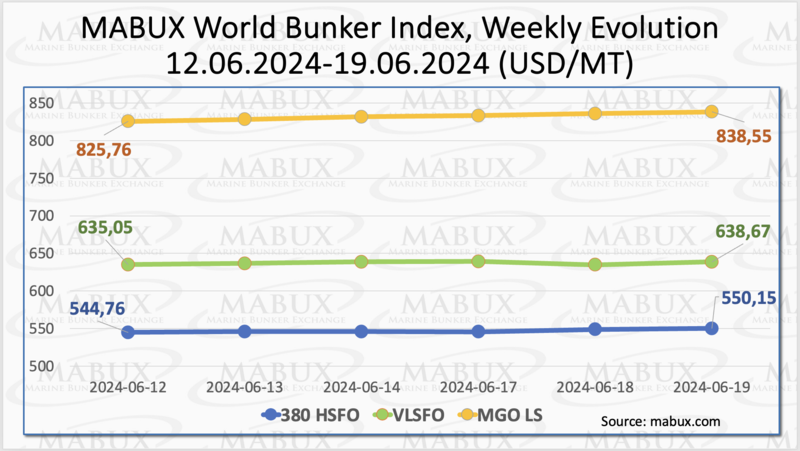

During Week 25, the MABUX global bunker indices continued their upward trend. The 380 HSFO index saw an increase of 5.90 USD, rising from 544.76 USD/MT to 550.15 USD/MT. The VLSFO index climbed by 3.62 USD, moving from 635.05 USD/MT to 638.67 USD/MT. The MGO index showed the most significant growth, adding 12.79 USD to reach 838.55 USD/MT, up from 825.76 USD/MT last week. As of the current update, the global bunker market maintains a moderate upward trend.

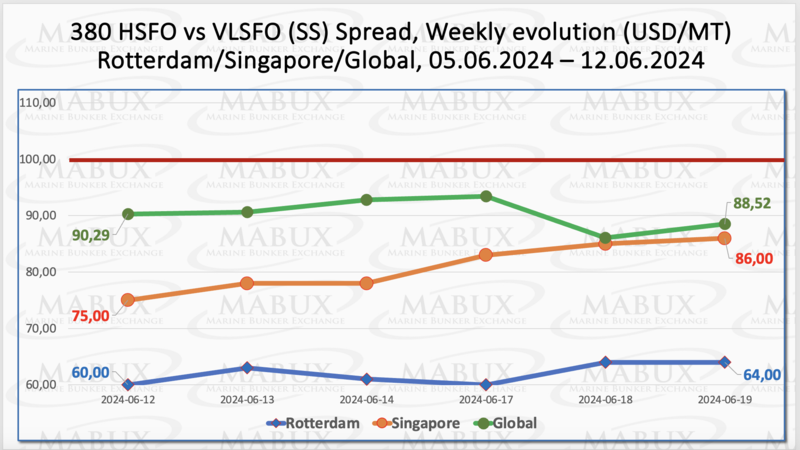

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - decreased slightly: minus $1.77 ($88.52 versus $90.29 last week). Despite this dip, the spread remains stably below the $100.00 mark (the SS Breakeven). Conversely, the average weekly value increased by $2.05. In Rotterdam, SS Spread increased for the first time in three weeks, adding $4.00 (from $60.00 last week to 64.00). The average weekly value at the port, however, decreased by $5.17. In Singapore, the difference in the price of 380 HSFO/VLSFO continued to widen: plus $11.00 ($86.00 versus $75.00 last week), gradually approaching the $100.00 threshhold. The weekly average at the port added $7.83. Overall, the SS Spread has stabilized at these levels and hints at an upward correction. We anticipate the SS Spread to trend upward next week. More information is available in the “Differentials” section of www.mabux.com.

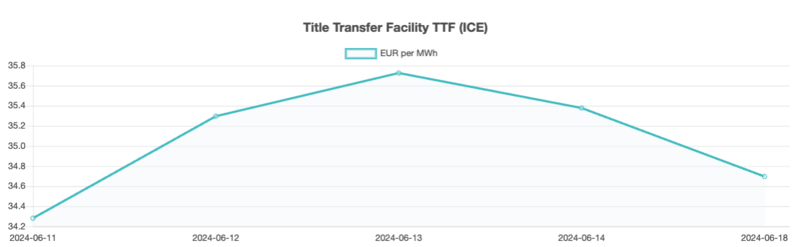

As of June 11, the EU's gas storage sites were 72.3% full. The refilling season has commenced, elevating gas storage levels from 58% at the end of winter—a record-high for that period, attributable to a milder winter and reduced industrial demand. Despite this, the pace of gas inventory build-up has been slower than usual, contributing to rising European gas prices. This increase in prices also reflects recent supply risks from Norway and Russia. Additionally, Asia's competition for LNG supply has intensified due to severe heat waves in South and Southeast Asia, leading to a diversion of cargoes away from Europe. During Week 25, the European gas benchmark TTF showed a slight increase, adding 0.415 EUR/MWh (34.700 EUR/MWh versus 34.285 EUR/MWh last week.

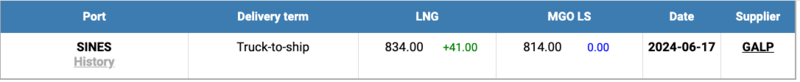

The price of LNG as bunker fuel in the port of Sines (Portugal) began to rise again, reaching 834 USD/MT on June 17 (plus 41 USD compared to the previous week). At the same time, the difference in price between LNG and conventional fuel on June 17 showed a 20 USD advantage for MGO LS, contrasting with a 4 USD advantage for LNG the week before. On that day, MGO LS was quoted in the port of Sines at 814 USD/MT. More information is available in the LNG Bunkering section of www.mabux.com.

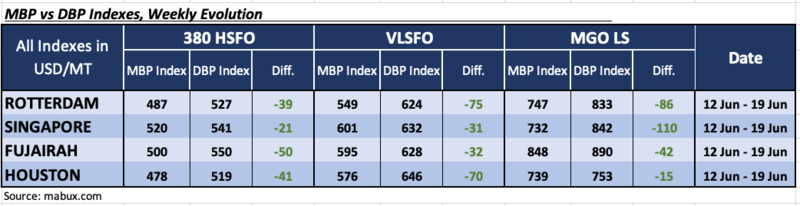

In Week 25, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) indicated underpricing of all types of fuel segments in the four largest hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, weekly underprice averages rose by 4 points in Rotterdam, 12 points in Singapore, 18 points in Fujairah, and 11 points in Houston.

In the VLSFO segment, average weekly undervaluation levels showed an increase of 18 points in Rotterdam, 8 points in Singapore, 12 points in Fujairah, and 13 points in Houston.

In the MGO LS segment, weekly averages grew by 16 points in Rotterdam, 13 points in Singapore, 26 points in Fujairah, and 10 points in Houston. The MDI index in Singapore exceeded the $100 mark once again.

By the end of the week, the pattern of undervaluation in all selected ports remained unchanged. We expect the trend of fuel underpricing to persist into the next week. We expect the fuel underpricing trend to continue next week.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on www.mabux.com.

Since October 2023, Integr8 Fuels has reported a significant shift in shipping routes, with many vessels now opting to navigate around Africa instead of using the Red Sea. This change has resulted in a notable increase in the demand for HSFO (High Sulphur Fuel Oil). Concurrently, ports along the African coast and nearby Spain have experienced a 30% rise in VLSFO (Very Low Sulphur Fuel Oil) sulphur off-specification incidents. The primary cause has been traced to contamination from barges also transporting HSFO. Currently, sulphur levels are the most common off-spec issue for VLSFO. Blending practices aim for a 0.50% sulphur limit, but straying too far from this target can affect shipowners' profit margins. Over the past six months, there has been an observed increase in average sulphur content in VLSFOs in both the ARA (Amsterdam-Rotterdam-Antwerp) and Singapore regions. In Singapore, the likelihood of encountering VLSFO with a sulphur content of 0.51-0.53% has more than doubled in the past six months. Despite this, only 0.3% of VLSFOs in Singapore exceed the sulphur specification. In contrast, the ARA region has seen 2% of VLSFOs test off-spec for sulphur.

We expect the global bunker market to continue its steady upward movement next week.

By Sergey Ivanov, Director, MABUX

All news