The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

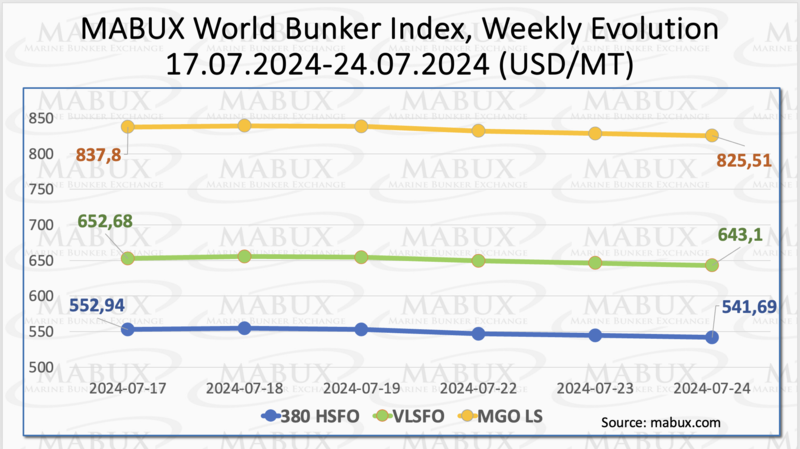

In the 30th week, the MABUX global bunker indices continued their moderate downward trend. The 380 HSFO index fell by 11.25 USD: from 552.94 USD/MT last week to 541.69 USD/MT, breaking through the 550 USD mark. The VLSFO index decreased by 9.58 USD (643.10 USD/MT versus 652.58 USD/MT last week), falling below 650 USD. The MGO index declined by 12.29 USD (from 837.80 USD/MT last week to 825.51 USD/MT). At the time of writing, the world bunker indices demonstrated a slight upward correction.

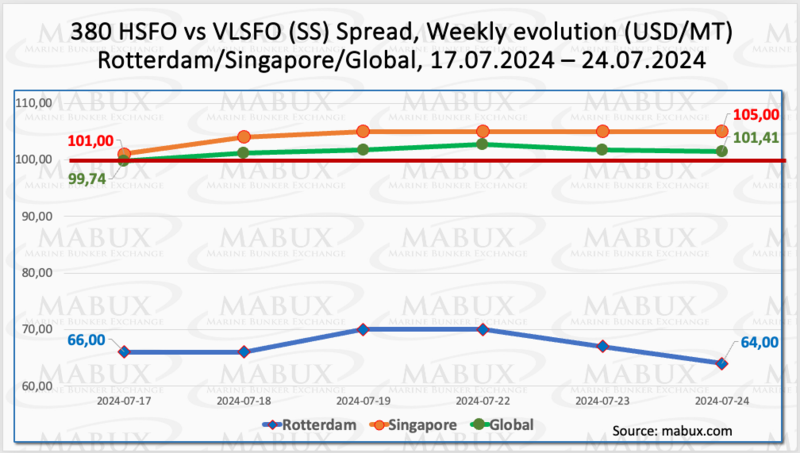

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - returned to the phase of the moderate growth: plus $1.67 ($101.41 versus $99.74 last week), breaking again the $100.00 mark (SS Breakeven). The weekly average also increased by $1.75. In Rotterdam, the SS Spread narrowed by $2.00 to $64.00 from $66.00 last week, while the weekly average, on the contrary, widened by $3.84. In Singapore, the 380 HSFO/VLSFO price differential rose by $4, from $101.00 last week to $105.00, remaining above the $100.00 mark. The port's weekly average increased by $5.84. At the moment, there is no clear trend in the dynamics of the Global SS Spread and SS indices in ports, and the indicators change in different directions. We expect that a similar situation with SS Spread will continue next week. More information is available in the “Differentials” section of www.mabux.com.

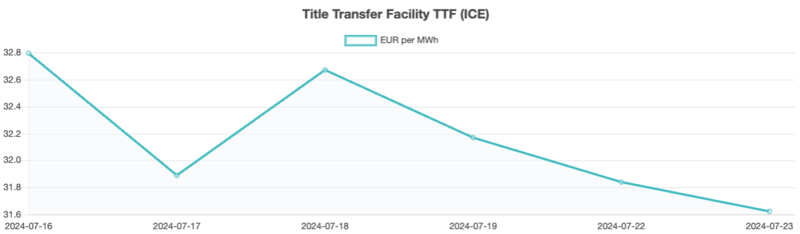

Global liquefied natural gas (LNG) markets are in a prolonged state of flux due to ongoing geopolitical tensions and conflicts. This instability has led to significant price volatility across global energy markets. Although LNG prices have recently declined, they remain extremely high—double the average price of the past five years—putting significant pressure on net importers of this fossil fuel. During week 30, the European gas benchmark TTF showed a moderate decline: minus 1.175 EUR/MWh (31.622 EUR/MWh versus 32.797 EUR/MWh last week.

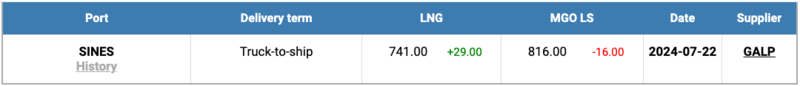

The price of LNG as bunker fuel in the port of Sines (Portugal) showed an increase for the first time in the last four weeks, reaching 741 USD/MT on July 22 (plus 29 USD compared to the previous week). Meanwhile, the price difference between LNG and conventional fuel decreased to 75 USD in favor of LNG, down from 120 USD a week earlier. On July 22, MGO LS was quoted in the port of Sines at 816 USD/MT. More information is available in the LNG Bunkering section of www.mabux.com.

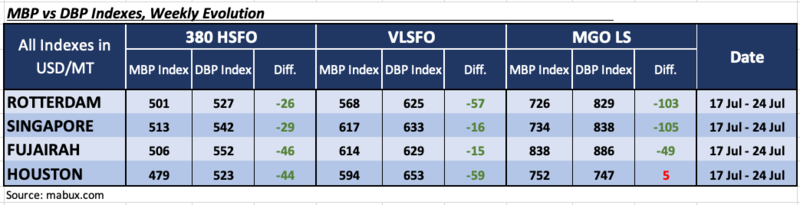

In Week 30, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) indicated the following bunker price trends in the world's four largest hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four ports remained undervalued, with weekly averages up 1 point in Rotterdam, 3 points in Singapore, and 4 points in Houston, but down 1 point in Fujairah.

In the VLSFO segment, all four ports were in the undercharge zone, with average weekly levels declining by 5 points in Rotterdam, 4 points in Singapore, and 4 points in Houston. The MDI index in Fujairah remained unchanged.

In the MGO LS segment, Houston was the only overvalued port, while the weekly average decreased by 15 points, staying close to the 100% correlation mark between market price and the MABUX digital benchmark. The three other ports remained undercharged. The weekly averages narrowed by 5 points in Rotterdam, 5 points in Singapore, and 16 points in Fujairah. MDI indices in Rotterdam and Singapore were close to the $100 mark.

Over the week, the balance of overvalued/undervalued ports did not change, still registering the only overvalued port in the MGO LS segment - Houston. In other ports, all types of bunker fuel remained undervalued.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on www.mabux.com.

The International Council on Clean Transportation (ICCT) compared the proposed North Atlantic Emissions Control Area (ECA) to a scenario without ECA regulations. The ICCT found that, depending on the dominant method used to comply with the regulations, the ECA could lead to an 82% reduction in SOx emissions, a 64% reduction in PM2.5 soot particles, and a 36% reduction in black carbon (BC) emissions. If adopted, the proposed North Atlantic ECA could become the world’s largest, covering waters from Greenland in the north to Spain in the south. The ICCT has recommended that the Atlantic ECA member states include the full exclusive economic zones of Spain, Portugal, France, the United Kingdom, Ireland, Iceland, the Faroe Islands, and Greenland. In March, the climate action NGO Opportunity Green, along with several other NGOs, called on the UK government to extend the existing North Sea and English Channel ECA to all UK waters. They also urged the UK to collaborate with neighboring coastal states to integrate into the proposed North Atlantic ECA.

We expect the world bunker indices to continue their moderate downward movement next week in the absence of potential growth movers in the market.

By Sergey Ivanov, Director, MABUX

All news