The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX)

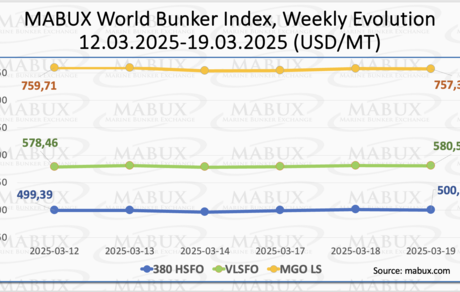

At the end of the 12th week, the MABUX Global bunker indices showed no clear trend, fluctuating in different directions. The 380 HSFO index saw a marginal increase of 0.62 USD, rising from 499.39 USD/MT last week to 500.01 USD/MT, staying above the 500 USD mark. The VLSFO index gained 2.11 USD, reaching 580.57 USD/MT from 578.46 USD/MT last week, but remained below 600 USD. Meanwhile, the MGO index declined by 2.39 USD, dropping from 759.71 USD/MT to 757.32 USD/MT. At the time of writing, the market was experiencing a slight downward trend.

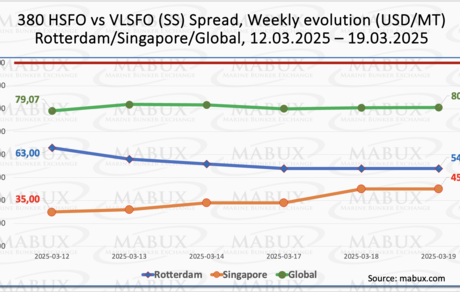

The MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – saw a moderate upward correction, rising by $1.49 (from $79.07 last week to $80.56). This brought it back to the $80.00 mark, though it remains below the $100.00 breakeven level. However, the weekly average of the index declined by $1.31. In Rotterdam, the SS Spread dropped by another $9.00, falling from $63.00 last week to $54.00, while the weekly average at the port decreased by $5.50. Conversely, in Singapore, the 380 HSFO/VLSFO spread widened by $10.00, climbing from $35.00 last week to $45.00, with the weekly average increasing by $7.66. Overall, there has been no significant shift in SS Spread dynamics, which continues to favor the cost-effectiveness of using conventional VLSFO over the 380 HSFO + Scrubber combination. More detailed information is available in the Differentials section of www.mabux.com.

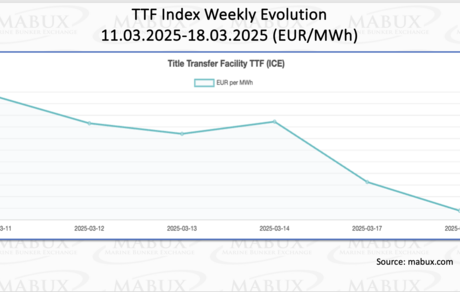

Warm temperatures in Europe gave way to freezing weather early last week. The current winter heating season, coupled with cold temperatures and periods of weak wind power generation, has led to significant gas withdrawals from storage. This, along with the end of Russian pipeline gas supplies through Ukraine, has driven up prices. In February, the IEA warned of tighter LNG market conditions in 2025. Low EU gas inventory levels by the end of this winter will require higher gas imports than in the past two years, increasing European demand in global LNG markets and tightening market fundamentals. One advantage for Europe is that European prices have outperformed Asian markets this year, where ample supplies and sluggish demand have prevented spot LNG price spikes. However, the need to replenish European gas stocks from much lower levels than in previous years has pushed summer 2025 TTF futures prices above winter 2026 prices, significantly slowing the pace of gas storage refilling.

As of March 18, European regional storage facilities were filled to 34.53%, down 1.35% from the previous week and 36.80% lower than at the start of the year (71.33%). Despite a general increase in temperatures, gas withdrawals from storage continue. At the end of the 12th week, the European gas benchmark TTF continued to decline, dropping by 1.955 euros/MWh to 40.755 euros/MWh, compared to 42.710 euros/MWh the previous week.

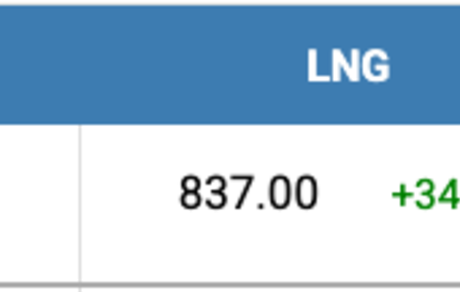

The price of LNG as bunker fuel in the port of Sines (Portugal) rose by 34 USD by the end of the week, reaching 837 USD/MT on March 17. Meanwhile, the price gap between LNG and conventional fuel widened to 121 USD in favor of MGO LS, compared to 71 USD the previous week. On March 17, MGO LS was quoted at 716 USD/MT in the port of Sines. More details can be found in the LNG Bunkering section on the www.mabux.com website.

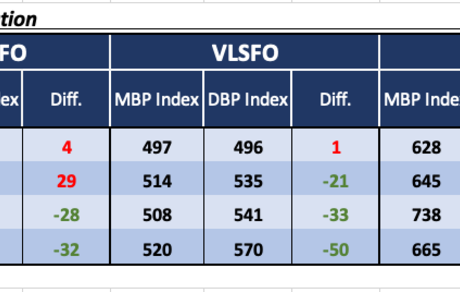

Over the 12th week, the MABUX Market Differential Index (MDI)—which compares market bunker prices (MBP) to the digital bunker benchmark MABUX (DBP)—continued to show mixed movements across the world’s four largest hubs: Rotterdam, Singapore, Fujairah, and Houston.

• 380 HSFO segment: Rotterdam and Singapore remained in the overvalued zone, with the average weekly MDI decreasing by 2 and 4 points, respectively. Meanwhile, Fujairah and Houston remained undervalued, with their levels of undervaluation increasing by 5 and 4 points, respectively. Notably, the MDI in Rotterdam reached the 100% correlation mark between MBP and DBP.

• VLSFO segment: Rotterdam was the only overvalued port in this segment, with its average MDI decreasing by 7 points. Singapore, Fujairah, and Houston remained undervalued, with weekly average MDI values dropping by 3 points in Singapore and 2 points in Houston, while Fujairah saw a 2-point increase. The MDI in Rotterdam came close to the 100% correlation mark between MBP and DBP.

• MGO LS segment: Rotterdam returned to the overvalued zone, becoming the only overcharged port in this segment. The weekly average overpricing increased by 4 points. In contrast, Singapore, Fujairah, and Houston were undervalued, with average MDI decreasing by 12, 14, and 10 points, respectively. Rotterdam remained near the 100% correlation mark between MBP and DBP.

The overall balance of overvalued versus undervalued ports shifted again toward overvaluation, with two overvalued ports in the 380 HSFO segment and one in both the VLSFO and MGO LS segments. No significant changes in balance are expected next week.

More detailed information on the correlation between market prices and the MABUX digital bunker benchmark is available in the Digital Bunker Prices section of www.mabux.com.

Bunker fuel sales at the Port of Singapore continued their downward trend, with total marine fuel sales (including alternative fuels) reaching 4,145,110 metric tonnes (mt) in February 2025. This represents an 8.1% decline from the 4,509,330 mt recorded in February 2024. Sales of very low sulphur fuel oil (VLSFO) dropped sharply, falling 19.2% year-on-year (YoY) from 2,554,600 mt to 2,065,100 mt. In contrast, high sulphur fuel oil (HSFO) saw a slight YoY increase from 1,601,000 mt to 1,624,400 mt. Among distillates, sales of low-sulphur marine gasoil rose to 305,700 mt, while marine gasoil fell to 8,900 mt YoY. Alternative fuel sales showed mixed trends. VLSFO bioblend sales surged to 85,000 mt, up from 15,600 mt in February 2024. HSFO bioblend shipments reached a record-high 21,000 mt. The Port of Singapore also recorded its first-ever B100 sales, totaling 3,800 mt. Liquefied natural gas (LNG) sales climbed 11.5% YoY to 30,000 mt, compared to 26,900 mt in February 2024. However, there were no recorded sales of methanol, ammonia, or ultra-low sulphur fuel oil (ULSFO) in February 2025.

We believe the global bunker market has reached a state of relative balance and do not anticipate significant changes in bunker fuel prices next week.

By Sergey Ivanov, Director, MABUX