The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

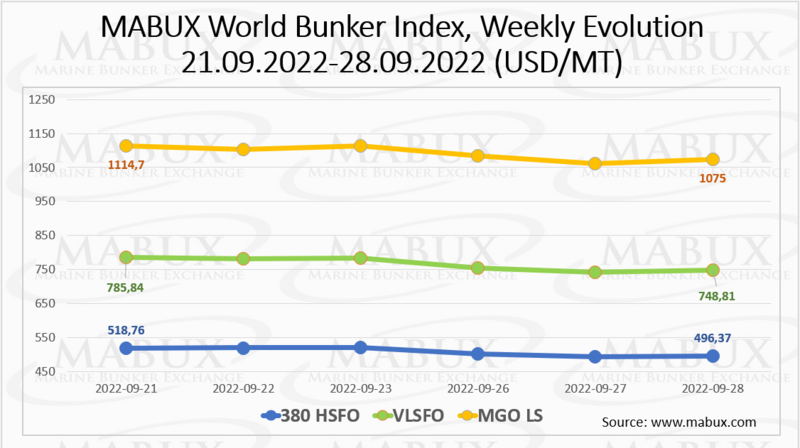

Over the Week 38, MABUX global bunker indices continued moderate sliding downward. The 380 HSFO index fell by another 22.39 USD: from 518.76USD/MT last week to 496.37 USD/MT. The VLSFO index, in turn, fell by 37.03 USD: from 785.84 USD/MT to 748.81 USD/MT. The MGO index lost 39.70 USD (from 1114.70 USD/MT to 1075.00 USD/MT) and crossed the 1100 USD mark.

The Global Scrubber Spread (SS) weekly average - the price differential between 380 HSFO and VLSFO –declined over the Week 39 - minus $8.43 ($258.21 vs. $266.64 last week). In Rotterdam, the average SS Spread continued to decline: $214.33 vs. $241.00 (down $26.67). In Singapore, the average weekly price differential of 380 HSFO/VLSFO also decreased – by minus $2.50 ($284.33 vs. $286.83 last week). The indicators of the Global SS Spread and the values of SS Spread in the largest hubs are still very close to each other. More information is available in the Price Differences section of mabux.com.

Three unexplained gas leaks detected on September 26 in the Nord Stream 1 and 2 pipelines from Russia to Germany have prompted the European Union and Russia to point at sabotage. On September 29 Sweden's coastguard said it had discovered a fourth gas. It means that the link, which has been shut over the past month, won’t bring any fuel to Europe for a long time. Price for LNG as a bunker fuel at the port of Sines (Portugal) fell on September 26 by another 733 USD/MT to 2591.00 USD/MT (versus 3324 USD/MT a week earlier). Spread between LNG price and price for MGO is now reduced: LNG prices are about 2.5 times higher than the most expensive type of traditional bunker fuel: the price of MGO LS at the port of Sines was quoted on September 28 at 1062.00 USD/MT.

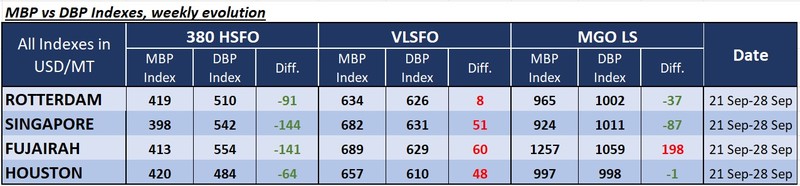

Over the Week 39, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an underpricing of 380 HSFO fuel grade in all four selected ports. The underestimation margins declined during the week in all port except of Houston and amounted for: Rotterdam - minus $91, Singapore - minus $144, Fujairah - minus $141 and Houston - minus $64.

VLSFO fuel grade, according to MDI, remained, overpriced in all selected ports: plus $8 in Rotterdam, plus $51 in Singapore, plus $60 in Fujairah and plus $48 in Houston. In this fuel segment, the MDI index still does not have any firm dynamics: the overprice premium in up in most of selected port.

In the MGO LS segment, MDI registered underpricing in three ports out of four selected over the Week 39: Rotterdam – minus $37, in Singapore – minus $87, and Houston – minus $1. MGO LS fuel remained overvalued in Fujairah - plus $ 198. MDI level decreased for all selected ports.

The meeting of the IMO’s Sub-Committee on Carriage of Cargoes and Containers (CCC 8), held on 14-23 September, agreed guidelines for LPG as a marine fuel and also progressed the discussion on hydrogen and ammonia. A working group at the Sub-Committee has also further developed draft interim guidelines for ships using hydrogen as fuel and initiated discussion on the development of interim guidelines for the safety of ships using ammonia as fuel. At this week’s meeting, the Sub-Committee also invited interested member states and international organizations to develop guidance for LPG bunkering to assist crews, bunker suppliers and ports in delivering LPG fuel to ships.

The global bunker market is still in a state of high volatility. We expect that downward trend may continue in Global bunker market.

By Anastasia Pervova, Marketing analytic, MABUX

All news