The Bunker Review was contributed by Marine Bunker Exchange (MABUX)

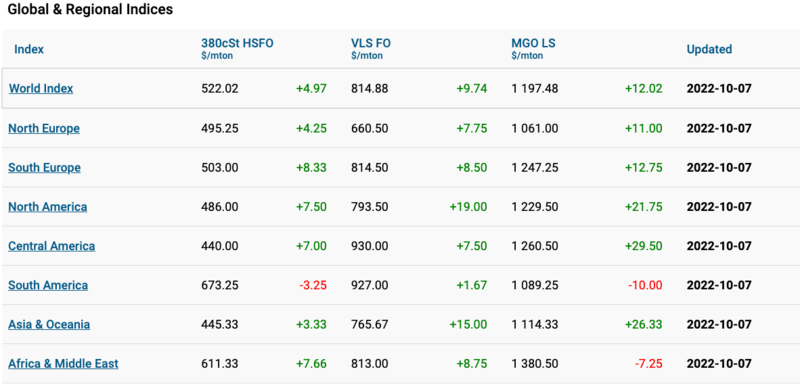

MABUX World Bunker Index (as index calculated on current prices for 380 HSFO, VLSFO and MGO) continued firm upward evolution on October 07:

380 HSFO - USD/MT – 522.02 (+4.97)

VLSFO - USD/MT – 814.88 (+9.74)

MGO - USD/MT – 1 197.48 (+12.02)

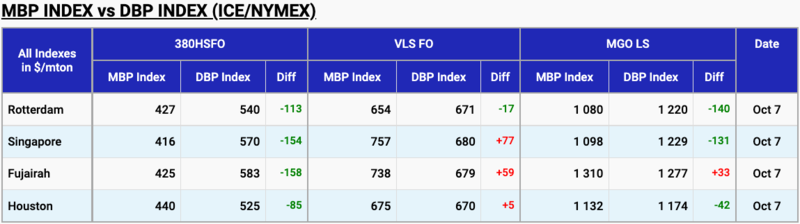

As of October 07, the MABUX MBP/DBP Index (MDI) (comparison of market bunker prices vs. the MABUX digital bunker price benchmark) registered irregular changes in the HSFO segment, Houston's return to the overcharge zone in the VLSFO segment, and no any single trend in the MGO LS segment.

According to MDI, 380 HSFO fuel was significantly undervalued on October 07 in all four selected ports. Undercharge margins were registered as: Rotterdam – minus $113 (minus $110 the day before), Singapore – minus $154 (no change), Fujairah – minus $158 (minus $166), Houston – minus $85 (minus $97). The MDI index changed irregular in this fuel segment: the underestimation rose in Rotterdam, dropped in Fujairah and Houston, and remained unchanged in Singapore.

In the VLSFO segment, Houston returned to the overprice zone again: plus $ 5 versus minus $ 5 a day earlier and joined Singapore – plus $ 77 (plus $ 70) and Fujairah – plus $ 59 (plus $ 51). The only underestimated port in this fuel segment remained Rotterdam – minus $17 (minus $20 the day before).

In the MGO LS segment, three of the four selected ports remain undervalued: Rotterdam – minus $ 140 vs. minus $ 165 the day before, Singapore – minus $ 131 (minus $ 171) and Houston – minus $ 42 (minus $ 15). Fujairah remains in the underprice zone – plus $33 (plus $72). There was no single trend in the dynamics for underestimation and overestimation.

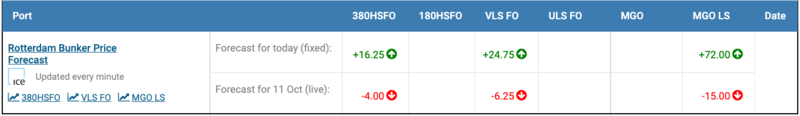

We expect global bunker indices to continue firm uptrend on Oct 10: 380 HSFO – plus 10-20 USD/MT, VLSFO – plus 15-25 USD/MT, MGO LS – plus 20-45 USD/MT.

Source: www.mabux.com

All news