Joint product of IAA PortNews and the Institute for Natural Monopolies Research (IPEM)

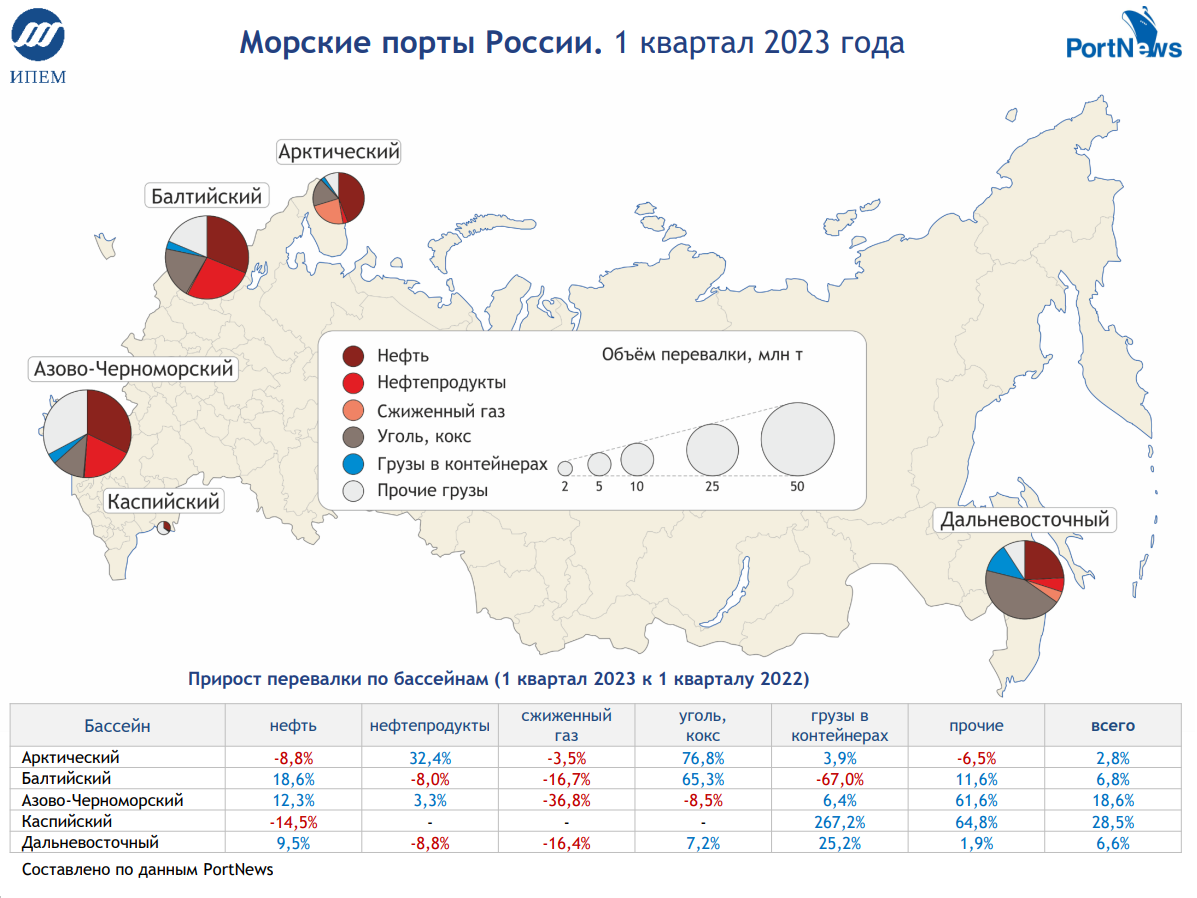

In the first quarter of 2023, cargo handling in Russian ports rose by 10%, year-on-year, to 220.2 million tonnes. High growth rates are due to the low base of 1Q’2022 and to high absolute volumes of transshipment. For the second quarter in a row, the throughput exceeds 220 million tonnes which could not be achieved in the previous three years. Such a high result is explained by the reorientation of trade links and relatively high global prices for commodities. However, the dynamics is different in various groups of products.

The decrease of the final results was registered in five segments: ferrous metal (-25.5%), ore (-21.6%), containerized cargo (15.8%), liquefied gas (9%) and petroleum products (-33%).

The supplies of ferrous metal were affected by the European embargo and actual reduction of imports in some countries. Ore exports started to decline with the demand decrease in Europe (due to rejection of the Russian product and the output cuts at furnaces). Since the largest iron ore enterprises are located in the western regions of the country it is difficult for them to redirect exports eastwards. The dynamics of container handling is still influenced by two major factors - a decrease in the number of foreign countries’ containers in use and a more essential decrease in container imports compared to exports amid the sanctions and restrictions. The decline in handling of liquefied gas is due to a high base in the first quarter of 2022. The handling of petroleum products is falling under the pressure of official restrictions on the imports of Russian petroleum products by European countries effective from February 2023.

A considerable growth was seen in the segment of crude oil (+9.2%) and coal (+18.3%). Those cargoes managed to overcome the embargo imposed by European countries thanks to redirection of trade flows.

The growth in handling of fertilizers and grain was even higher, by 56.5% and by 107.7%, respectively. Such a dynamics is due to the absence of principal restrictions on their supply. Besides, the segment of fertilizers was driven by the launching of a new dedicated terminal, Ultramar. Grain segment was positively affected by a high harvest.

The growth was registered in all basins. The lowest one (+2.8%) was shown by the Arctic Basin because of the reduction of oil and liquefied gas supplies. In the Far East Basin (+6.6%) the growth is hindered by the limited capacity of railway infrastructure, in the Baltic Basin (+6.8%) – by the reduction of supplies to Europe. The maximum growth was seen in the Azov-Black Sea Basin (+18.6%) and in the Caspian Basin (+28.5%) where the abovementioned negative factors are not that strong.

In the first quarter of 2023, container handling measured in twenty-foot equivalent units fell by 15.7%. The growth of container handling in the Arctic Basin (+3%), the Azov-Black Sea Basin (+11.3%), the Far East Basin (+11.3%) and the Caspian Basin (+363.5%) does not offset the fall in the Baltic Basin (-59.9%) so far.

Infographics is available here >>>>

When using the review materials, reference to the joint project of IPEM and PortNews is required.