The Weekly Review was contributed by Marine Bunker Exchange (MABUX)

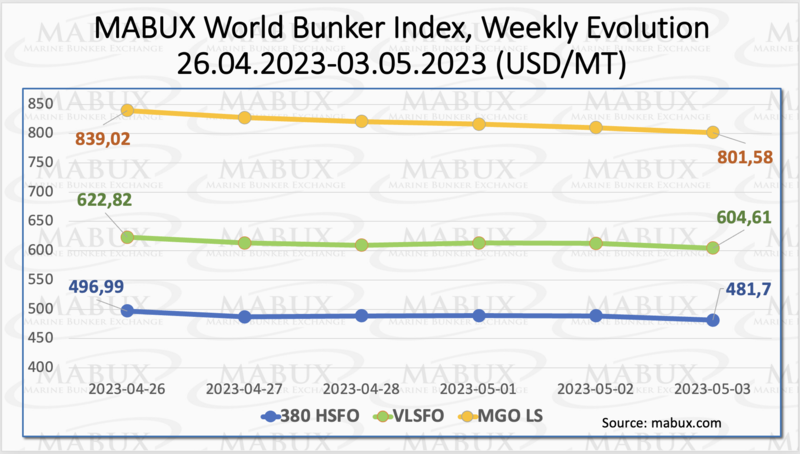

Over Week 18, the global MABUX bunker indices demonstrated a sustainabale downward trend. The 380 HSFO index experienced a further decrease of 15.29 USD, falling from 496.99 USD/MT in the previous week to 481.70 USD/MT. The VLSFO index, in turn, also dropped by 18.21 USD (604.61 USD/MT versus 622.82 USD/MT last week), and was close to hitting the 600 USD mark. The MGO index lost 37.44 USD (from 839.02 USD/MT last week to 801.58 USD/MT). At the time of writing, the market continued to experience downward dynamics.

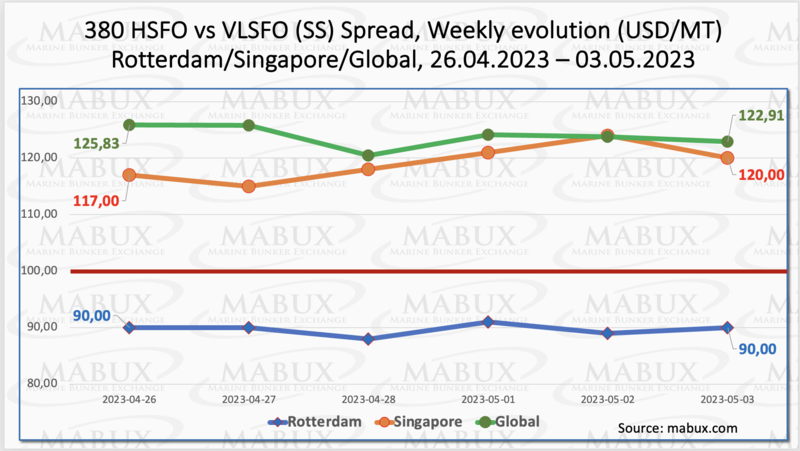

In Week 18, the Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - continued to decrease: minus $2.92 ($122.91 vs. $125.83 last week). The weekly average also declined by $5.63. In Rotterdam, the SS Spread remained constant at $90, which is below $100, and the weekly average decreased by $3.16. In Singapore, the price difference between 380 HSFO and VLSFO increased by $3.00 by the end of the week, reaching $120 compared to $117.00 in the previous week. However, the weekly average remained almost unchanged, with a minor decline of $0.50. It is anticipated that the SS Spread will continue to contract in the following week. For more information, refer to the “Differentials” section at www.mabux.com.

The price of LNG as bunker fuel in the port of Sines (Portugal) rose moderately, reaching 985 USD/MT on May 02 (plus 52 USD compared to the previous week). The price difference between LNG and conventional fuel also widened to 219 USD on May 02ą▒ with MGO LS in the port of Sines at 766 USD/MT on that day. At the moment, LNG prices have stabilized, and we do not expect significant changes in the LNG/conventional fuel price spread next week. More information is available in the LNG Bunkering section on www.mabux.com.

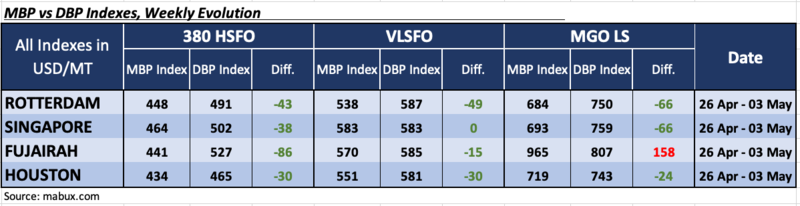

In Week 18, the MDI index, which measures the correlation between MABUX market bunker prices (MBP Index) and MABUX digital bunker benchmark (DBP Index), indicated that the 380 HSFO fuel was undervalued in all four selected ports. The average underestimation experienced a moderate decline across all ports, ranging from minus $2 to minus $15.

In the VLSFO segment, according to MDI, the fuel also remained undervalued in all selected ports. The underprice ratio decreased slightly in Rotterdam and Fujairah by $5 and $8, respectively. In Houston, the MDI increased by $2, while in Singapore, it indicated a 100 percent correlation between the market price and the digital benchmark.

There are still three underpriced ports in the MGO LS segment: Rotterdam, Singapore and Houston. The average weekly undervaluation margin rose in Rotterdam by 9 points, but decreased in Singapore and Houston (11 and 13 points respectively). Fujairah remains the only overvalued port - plus $ 158.

For more detailed information on the correlation between market prices and the MABUX digital bunker benchmark, you can refer to the "Digital Bunker Prices" section at www.mabux.com.

As per DNV, an increase in tanker and bulk carrier orders could see the overall share of alternative fuels in the newbuilding orderbook dwindle. A total of 19 vessels with alternative fuel propulsion were ordered last month. As newbuild orders are now turning more towards tankers and bulkers, it is likely that that the overall share of alternative fuels in the orderbook decreases. So far this year the total order figure for alternative fuel vessels stands at 63. As previously reported, during the first four months of 2022, a total of 121 such vessels had been ordered.

The Port of Rotterdam has reported a bunker sales total (excluding LNG) of 2,632,738 metric tonnes (mt) for the first quarter of this year, which was up 5% on the 2,507,146 mt sold in Q1 2022. LNG bunker sales for Q1 2023 were 86,088 cubic metres (cbm) – down on the 102,579 cbm reported for the same period last year but up significantly on the 58,599 cbm sold in the fourth quarter. Very low sulphur fuel oil (VLSFO) continues to be best-selling fuel grade – but the gap between VLSFO and high sulphur fuel oil (HSFO) has narrowed. In Q1 2023, sales of VLSFO were 984,034 mt and HSFO sales were 809,871 mt. This compares to 930,481 mt of VLSFO and 707,312 mt of HSFO in Q1 2022. Besides, there were big quarter-on-quarter drops in the sales of both VLSFO and HSFO bio-blended fuels.

There are still no drivers in the global bunker market that are able to form an upward evolution. We expect the downtrend to continue next week.

By Sergey Ivanov, Director, MABUX

All news