Global bunker prices may experience a slight decline in the upcoming week

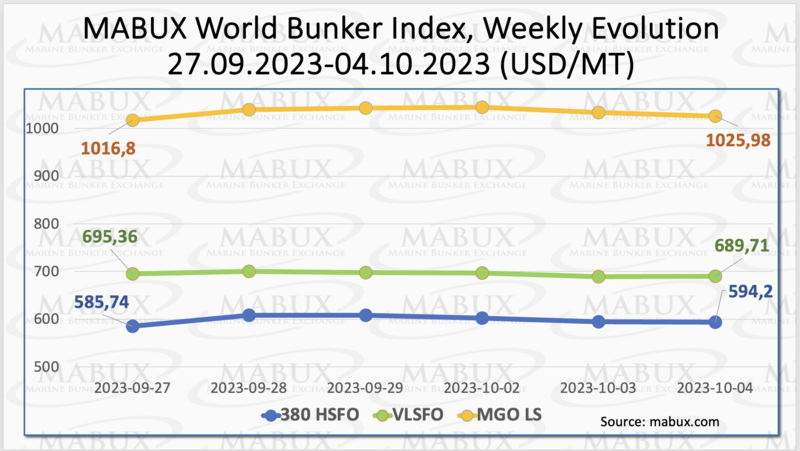

As of the Week 40, the MABUX global bunker indices experienced some minor fluctuations. The 380 HSFO index rose by 8.46 USD: from 585.74 USD/MT last week to 594.20 USD/MT. Conversely, the VLSFO index lost 5.65 USD (689.71 USD/MT versus 695.36 USD/MT last week). On the other hand, the MGO index, increased by 9.18 USD (from 1016.80 USD/MT last week to 1025.98 USD/MT. At the time of writing, the market was generally following a slight downward trend.

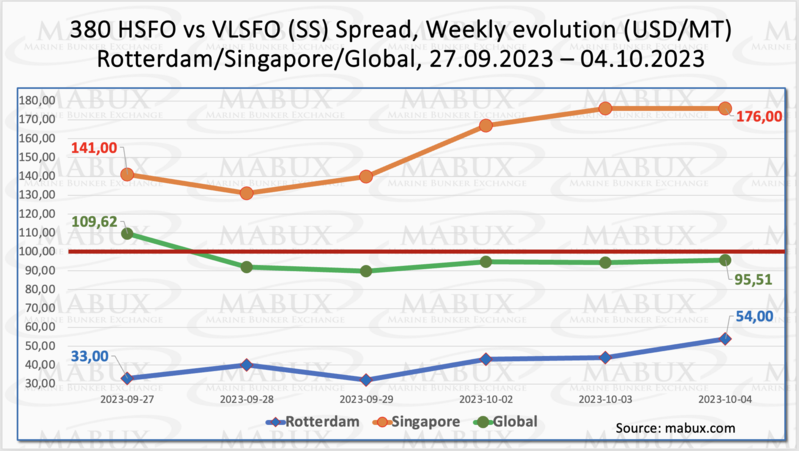

Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - continued to decline: minus $14.11 ($95.96 versus $109.62 last week), falling below $100.00 (SS breakeven) for the first time since September 07 of this year. At the same time, the weekly average also decreased by $11.88. In Rotterdam, SS Spread began to gradually increase again: plus $21.00 (up from $33.00 last week to $54.00). The weekly average SS Spread in Rotterdam also widened by $8.83. In Singapore, the price difference between 380 HSFO and VLSFO increased more significantly: plus $35.00 ($176.00 versus $141.00 last week). The weekly average increased by $20.50. Based on the dynamics of SS Spread in the major hubs, it is possible that global SS index values may show an uptrend in the coming week. Further details are available in the "Differentials" section of www.mabux.com.

The European gas market experienced a slight decline at the start of October. Even though European gas storage facilities are currently at around 93% capacity, prices remain volatile due to unfavorable renewable energy production and disruptions in Norwegian gas fields. Many market participants anticipate limited downward pressure on prices as the European Union approaches the heating season. Furthermore, Europe's liquefied natural gas (LNG) imports have decreased by 20% compared to the previous year, primarily due to the ample storage levels throughout Europe.

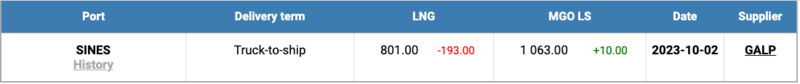

The price of LNG as bunker fuel in the port of Sines (Portugal) began a firm decline, reaching 801 USD/MT on October 02 (minus 193 USD compared to the previous week). Meantime, the differential in price between LNG and traditional fuel on October 02 has once again surged, with LNG holding a strong advantage of 262 USD over conventional fuels, compared to 58 USD just one week earlier: MGO LS was quoted that day in the port of Sines at 1063 USD/MT. More information is available in the LNG Bunkering section of www.mabux.com.

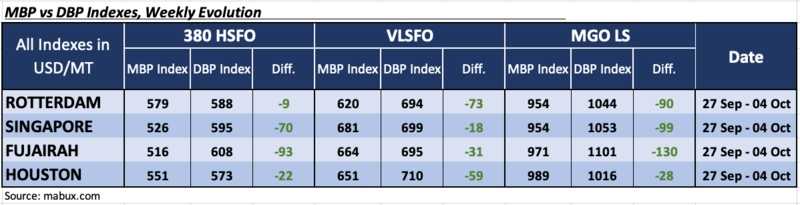

During Week 40, the MDI index (the ratio of market bunker prices (MABUX MBP Index) to the digital bunker benchmark MABUX (MABUX DBP Index)) continued to register underpricing for all types of bunker fuels in all selected ports.

In the 380 HSFO segment, the average weekly underpricing values increased by 6 points in Rotterdam, by 5 points in Singapore and by 18 points in Houston but decreased by 4 points in Fujairah.

In the VLSFO segment, the MDI showed an increased undercharging only in Houston – plus 14 points. In the other three ports, the MDI narrowed: by 2 points in Rotterdam, 17 points in Singapore and 11 points in Fujairah.

In the MGO LS segment, the average underpricing premium increased only in Houston (plus 2 points) and decreased in Rotterdam by 2 points, in Singapore by 10 points and in Fujairah by 3 points.

Overall, all types of bunker fuels remained undervalued in all selected ports. More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

Dubai has been ranked fifth among the 20 most prominent international centres for commercial maritime shipping for the fourth consecutive year, as the emirate seeks to boost its status as a global maritime hub. As per the Xinhua-Baltic international shipping centre development index, Dubai, the only Arab city on the list, is placed ahead of various global centres such as Rotterdam (Netherlands), Hamburg (Germany), Athens/Piraeus (Greece), Ningbo/Zhoushan (China), and New York/New Jersey (the US). Singapore, London, Shanghai and Hong Kong secured the top four ranks on the list. The rankings are based on port inputs (20 per cent), business services inputs (50 per cent) and general environment inputs (30 per cent).

As per DNV, a record 48 methanol-fuelled vessels were ordered in July, however, there were no orders in August and 12 methanol-fuelled vessels were ordered in September. While the container segment ‘continues to be dominant’ for methanol-fuelled orders, the first methanol-fuelled very large crude carrier (VLCC) was ordered as well as ‘a few orders’ for methanol-fuelled bulk carriers. Besides, a total of 21 LNG-fuelled vessels were ordered in August and this was followed by an additional eight in September. Container vessels represented the larger share of LNG-fuelled orders during August and September with car carriers and tankers not far behind.

We anticipate that the global bunker market is currently showing signs of potentially entering a moderate downward trend. Consequently, global bunker prices may experience a slight decline in the upcoming week.

By Sergey Ivanov, Director, MABUX

All news