Steam turbine carriers are facing increasing risks due to environmental scrutiny and market unpredictability, according to industry analysts. The combination of low charter rates, regulatory pressures, and the rise of modern, more efficient carriers has led to a sharp decline in the economic viability of steam carriers.

Drewry Maritime Research projects that more than 50% of the current steam carrier fleet will be demolished by the end of 2030.

In 2024, spot rates for steam carriers averaged 23,000 per day but plummeted to23,000 per day but plummeted to 5,000 per day by the end of the year, marking a historic low.

This decline was driven by subdued demand in Europe, weak competition between Europe and Asia, and an oversupply of vessels. Despite the re-routing of LNG carriers via the Cape of Good Hope, which increased tonne-mile demand, steam carriers failed to benefit from longer voyages. This trend is expected to continue in 2025-26, with rates remaining low throughout the year.

The economic feasibility of steam carriers is increasingly questioned as they struggle to cover operating costs. The cost differential between 10-year and 15-year-old steam carriers is substantial, at about 16-17%, and continues to grow. Some shipowners are considering laying up their vessels, hoping for a demand surge from new liquefaction capacity expected later in the decade. However, even if demand increases, steam carriers may only secure short-term employment, leaving owners to bear the costs of lay-ups. Environmental regulations are also impacting the LNG shipping industry.

The average speed of LNG carriers has been reducing to comply with maritime regulations such as the Carbon Intensity Indicator (CII) and the Energy Efficiency Existing Ship Index (EEXI). Steam carriers, however, face significant challenges in meeting these regulations. Speed reduction, a common strategy to comply with environmental standards, becomes uneconomical for steam carriers due to higher boil-off gas rates.

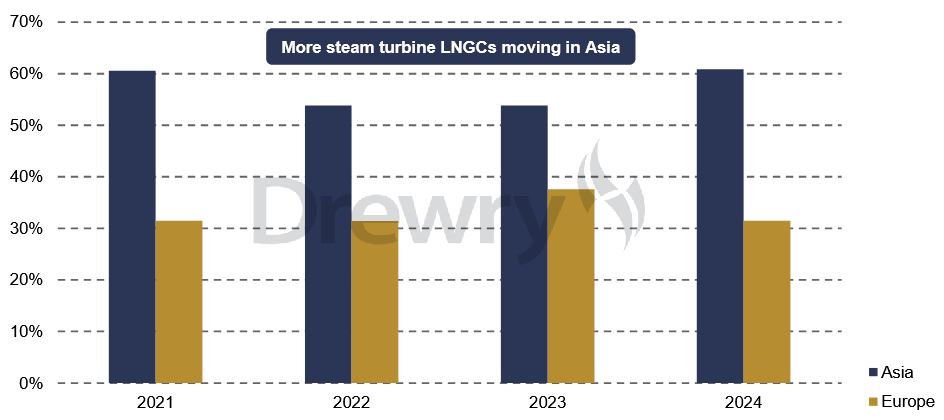

Market fragmentation is already underway, with steam carriers increasingly routed towards Asia, where they can cater to short-haul trade requirements.

However, even in Asia, steam carriers are expected to struggle as environmental regulations tighten and shipping costs rise. The demolition age for steam carriers has decreased from 38 years in 2023 to 28 years in 2024, accelerating scrapping activities.

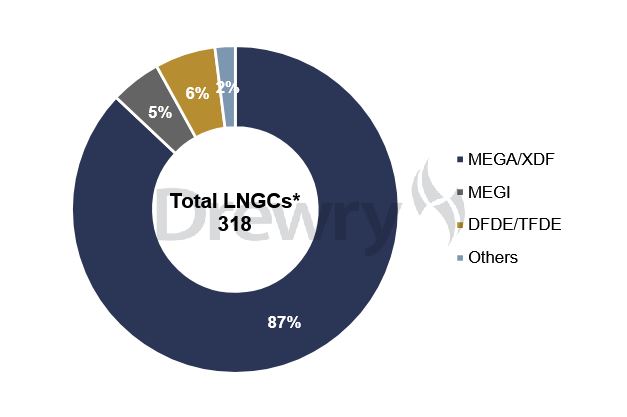

Modern carriers equipped with XDF/MEGA engines, which are more efficient and environmentally compliant, are replacing steam carriers. About 95% of newly ordered carriers are equipped with these advanced engines. While methane slip remains a concern, technological advancements are expected to improve engine efficiency, ensuring these carriers remain viable until at least 2035.

Drewry projects that more than 100 steam carriers will be scrapped by 2030, with some finding conversion opportunities into Floating Storage and Regasification Units (FSRUs) or Floating Storage Units (FSUs). However, only a limited number of steam carriers will qualify for conversion due to technical and economic constraints.

The scrapping of steam carriers is expected to help rebalance the oversupplied market, with rates stabilizing and beginning to rise from 2027 onwards.

Drewry Maritime Research is a leading provider of maritime research and consulting services, offering insights into shipping markets, including LNG and container shipping.

Clarksons Research is a global shipping research firm that provides data and analysis on the shipping industry, including fleet statistics and market trends.