Global fertiliser trade is undergoing a structural shift as India cuts reliance on imports from China, China tightens export restrictions, and producers in Russia and MENA boost exports into more distant markets, according to Drewry Maritime Research.

Global fertiliser trade is undergoing a structural shift as India cuts reliance on imports from China, China tightens export restrictions, and producers in Russia and MENA boost exports into more distant markets, according to Drewry Maritime Research.

Total fertiliser trade exceeded 190‚ÄØmillion tonnes in 2024, underscoring the scale of these developments.

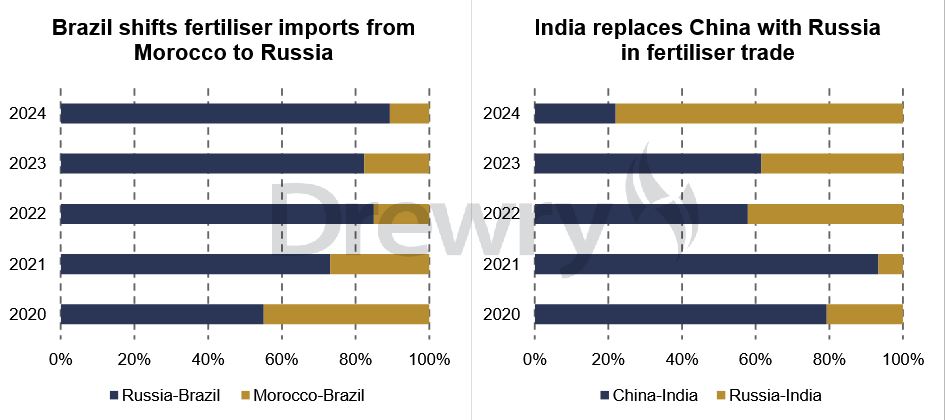

The China–India urea trade has nearly ceased, as India—historically the world’s largest urea importer—has diversified its imports and targeted self‚Äëreliance medium‚Äëterm. China has imposed tighter export restrictions to prioritise domestic availability. These changes opened market space for Russia and other suppliers to gain share.

At the same time, producers in Russia and MENA, formerly focused on Asian markets, have increasing exports to Latin America and Australia.

Brazil’s imports from Russia and Australia’s imports from MENA have substantially increased tonne‚Äëmile demand as average voyage distances climb. India’s diversification, shifting volumes from China to suppliers in the Gulf and Black Sea, has similarly lengthened route distances.

Between 2024 and 2030, global fertiliser trade is expected to grow at around 2–3‚ÄØ% annually. However, tonne‚Äëmile growth is projected to outpace volume growth due to these longer-haul reconfigured trade patterns.

Russian and MENA exports moved away from closer Asian markets and toward Latin America and Oceania, reinforcing this trend.

Implications for the dry bulk shipping market are significant. While historically fertiliser was shipped on Handysize and Supramax vessels, increasing parcel sizes and upgraded port infrastructure have driven a shift toward larger ships.

The Panamax share rose from 21‚ÄØ% in 2020 to 24‚ÄØ% in 2024, while Handysize share declined from 36‚ÄØ% to 32‚ÄØ%. Supramax use surged on specific routes—for Russian exports rising from 49‚ÄØ% to 76‚ÄØ% between 2020 and 2024, with Handysize declining from 51‚ÄØ% to 24‚ÄØ%. In Brazil, reliance shifted almost entirely to Supramaxes as upgrades at Santos and Paranaguá reduced Handysize share from 51‚ÄØ% to 19‚ÄØ%.

Average haul distances are now structurally longer: Brazil sourcing from Russia increases average distance by over 60‚ÄØ% versus historical imports from Morocco; similarly, India replacing China with Russia and MENA lengthens routes. These shifts sustain tonne‚Äëmile demand even where import volumes stabilize.

Overall, global fertiliser trade between 2024 and 2030 will be shaped more by route reconfiguration and vessel‚Äësize shifts than sheer tonnage increases. Though volumes grow steadily, tonne‚Äëmile demand will benefit disproportionately from longer voyages as nearby suppliers are replaced by distant ones, maintaining strong demand for Supramax and Panamax capacity and sustaining the sector’s role in minor bulk shipping.

Recent reporting confirms that China has suspended specialty fertiliser exports to India—effectively halting supply of products like MAP and calcium nitrate—which forced Indian buyers to turn to Europe, Russia and West Asia, where prices are already 15–20‚ÄØ% higher. In response, India secured a five‚Äëyear supply deal with Saudi state‚Äëowned mining company Ma’aden, for 3.1‚ÄØmillion tonnes per year of diammonium phosphate (DAP), with firms such as Indian Potash Ltd, KRIBHCO and Coal India Ltd as Indian offtakers. Analysts interpret these shifts as India countering China’s export weaponisation through diversification toward Russia, EU and West Asian suppliers. Russian fertiliser producers such as PhosAgro, EuroChem, Uralchem and Acron have capitalised on this relocation, targeting expanded exports to India and Brazil, with production expected to reach 65‚ÄØmillion tonnes in 2025.

Indian Potash Ltd (IPL) Indian Potash Limited is a central‚Äëpublic sector undertaking incorporated under the Indian Companies Act, wholly owned by the Government of India, with responsibilities in importing and distributing potash and phosphate fertilisers in India.

KRIBHCO (Krishak Bharati Cooperative Ltd) is a central government cooperative under the Ministry of Cooperation of India, organised as a multi‚Äëstate cooperative society, engaged in the procurement, production and distribution of fertilizers, including involvement in long‚Äëterm supply contracts with international partners.

Coal India Limited, incorporated under the Companies Act and majority‚Äëowned by the Government of India, specialises in coal mining and has diversified operations, including participation in the newly signed DAP supply agreements, as one of the Indian consortium buyers.

The Saudi Arabian Mining Company—known as Ma’aden—is a Saudi joint stock company majority‚Äëowned by the government of Saudi Arabia, engaged in mining and minerals extraction and processing, including phosphate.