The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX)

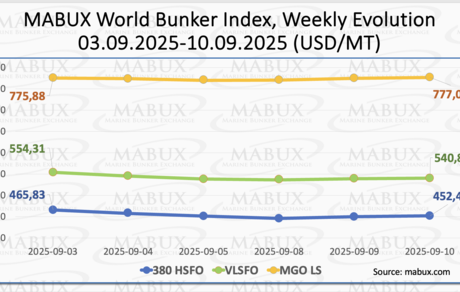

At the close of the 37th week, the global bunker indices MABUX showed mixed dynamics without a clear overall trend. The 380 HSFO index fell by USD 13.43, sliding from USD 465.83/MT last week to USD 452.40/MT, once again approaching the USD 450 mark. The VLSFO index also declined by USD 13.45, moving from USD 554.31/MT to USD 540.86/MT, breaking below the USD 550 threshold. In contrast, the MGO index recorded a modest gain of USD 1.17, rising from USD 775.88/MT to USD 777.05/MT. At the time of writing, the global bunker indices were showing signs of moderate growth.

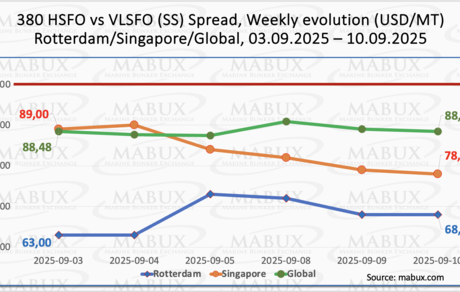

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—remained practically unchanged over the week, edging down by a symbolic $0.02 from $88.48 to $88.46, and continuing to hold steadily below the psychological breakeven mark of $100. The weekly average of the index also showed a slight decline of $0.37. In Rotterdam, the SS Spread rose by $5.00, reaching $68.00 compared with $63.00 a week earlier, while the weekly average in the port remained unchanged at $67.83. In Singapore, by contrast, the 380 HSFO/VLSFO differential narrowed by $11.00, falling from $89.00 to $78.00, with the weekly average down by $6.66. Overall, the SS Spread indices show no clear trend and continue to fluctuate in different directions within the previously established range. The current pattern is expected to persist next week, with conventional VLSFO fuel likely to maintain its higher profitability compared with the HSFO plus scrubber option. More detailed information is available in the "Differentials" section of mabux.com.

The United States exported more liquefied natural gas in August than in any previous month. Exports reached 9.33 million tons, surpassing the April record of 9.25 million tons. Europe remains the main destination for US LNG, accounting for 6.16 million tons, or two-thirds of the total — an increase of 0.91 million tons compared with July. Shipments to Asia declined slightly in August, to 1.47 million tons from 1.8 million tons in July. There is, however, a risk of oversupply in the LNG market, which could drive prices lower. According to Bloomberg, while the market is expected to remain balanced over the next two years, supply is projected to outpace demand from 2027 onward. With new liquefaction terminals coming online, the baseline scenario suggests that by 2030 supply will exceed demand by 63 million tons.

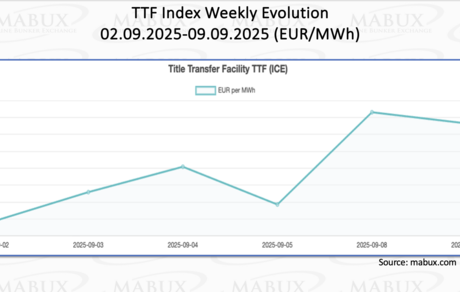

As of September 9, European regional gas storage facilities were 79.63% full, up by 1.55% compared with the previous week. The current level is 8.30% higher than at the start of the year, when storage stood at 71.33%, although the pace of injections has continued to slow moderately. By the end of the 37th week, the European gas benchmark TTF recorded a modest increase of 1.159 euros/MWh, moving from 31.772 euros/MWh the previous week to 32.931 euros/MWh.

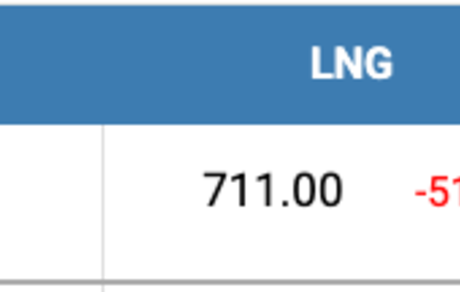

Over the past week, LNG bunker fuel prices at the Port of Sines (Portugal) recorded a significant decline of USD 51.00, falling to USD 711.00/MT from USD 762.00/MT in the previous week. The price differential between LNG and conventional bunker fuel also shifted in favor of LNG. As of the latest assessment, LNG was priced USD 51 below conventional fuel, compared with the prior week when conventional fuel held a USD 32 advantage. On the reporting date, MGO LS was quoted at USD 755.00/MT at the Port of Sines. Further details and extended analytics are available in the “LNG Bunkering” section on mabux.com.

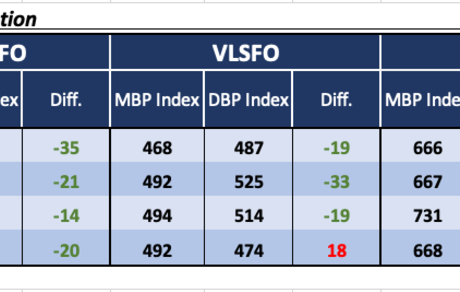

At the end of the 37th week, the updated MABUX Benchmark Market Differential Index (MDI)—the ratio of market bunker prices (MBP) to the MABUX digital bunker benchmark (DBP)—showed the following trends across the world’s major hubs: Rotterdam, Singapore, Fujairah and Houston:

• 380 HSFO segment: All ports remained in the undervalued zone. The average weekly MDI increased by 2 points in Rotterdam but fell by 15 points in Singapore, 55 points in Fujairah, and 22 points in Houston. Overall, MDI values in this fuel segment remain close to the 100% correlation level between MBP and DBP.

• VLSFO segment: Houston moved into the overvalued zone, becoming the only port in this category, with its MDI rising by 62 points. The other ports stayed undervalued, with weekly MDI undervaluation levels edging up by 1 point in Rotterdam and 2 points in Singapore, while Fujairah registered a 17-point decline.

• MGO LS segment: All ports remained undervalued. The MDI rose by 6 points in Rotterdam but fell sharply in the other hubs, decreasing by 34 points in Singapore, 125 points in Fujairah, and 32 points in Houston. Across all ports, MDI values remain well below the $100 mark.

In terms of overall structure, the indices reflected a gradual move toward 100% correlation between MBP and DBP, with the VLSFO segment showing the appearance of one overvalued port (Houston). Nevertheless, the undervaluation trend continues to dominate across all bunker fuel segments. Looking ahead, MDI indices are expected to continue moving toward restoring balance between MBP and DBP.

More detailed information on the correlation between MABUX market prices and the digital benchmark is available in the Digital Bunker Prices section of mabux.com.

According to DNV, the high cost of ammonia remains the most significant barrier to its adoption as a marine fuel. Since 2021, wholesale prices for green ammonia in Northwest Europe have held steady at around $2,900 per tonne of MGO equivalent (tMGOe)—nearly five times higher than current MGO prices. Importantly, this figure excludes bunkering and distribution costs, meaning the actual shipping price of green ammonia could be even higher. Blue ammonia, by contrast, has only entered production this year in very limited volumes and is not yet available for large-scale supply. Small-scale production and distribution further raise unit costs, while scaling up requires substantial investment. For instance, an ammonia bunkering barge can cost around $30 million, depending on size. Looking ahead, DNV forecasts that the cost of both green and blue ammonia could fall to $1,000–1,900/tMGOe by 2050, driven by advancements in technology. Regulatory measures such as the EU ETS, FuelEU Maritime, and the IMO Emissions Pricing Mechanism (set to take effect in 2028) may also accelerate adoption. Until then, however, ammonia will remain a niche transition fuel, viable only for a limited number of shipowners.

We expect the global bunker market will retain the potential for moderate growth next week, with prevailing trends pointing toward a gradual alignment of market and benchmark values.

By Sergey Ivanov, Director, MABUX