High uncertainties about COVID-19 and the economic recovery continue to weigh on the fuel market and bunker prices. It is clear now that 2020 would not be the year of oil market balance as the world still has a lot of excess crude and oil product stocks to process.

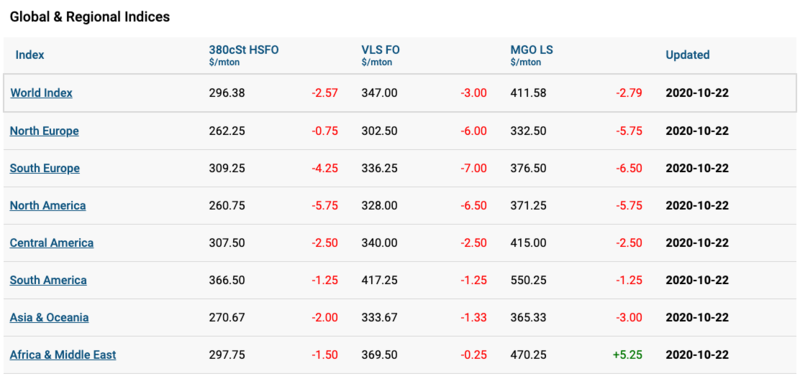

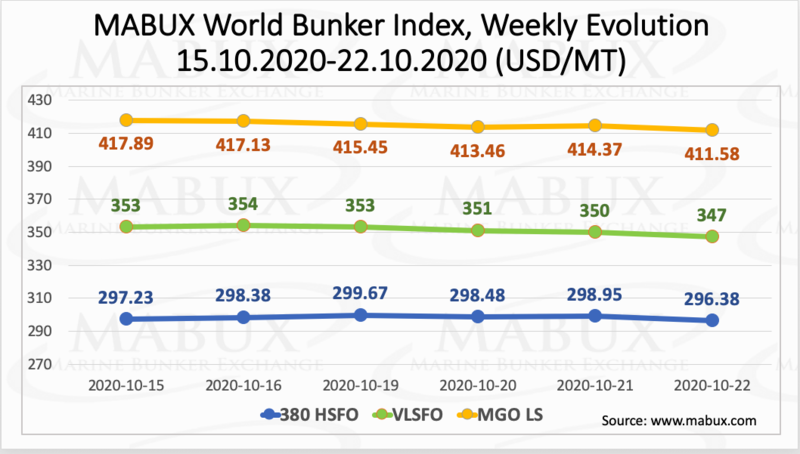

The World Bunker Index MABUX turned into slight downward trend for a week. The 380 HSFO index fell from 297.23 to 296.38 USD/ MT (-0.85 USD), VLSFO lost 6.00 USD globally: from 353 to 347 USD / MT while MGO declined by 6.31 USD: from 417.89 down to 411.58 USD/MT. The Global Scrubber Spread (SS) (price difference between 380 HSFOs and VLSFOs) has narrowed by 3.69 USD and averaged USD 53.15 (56.84 USD a week ago).

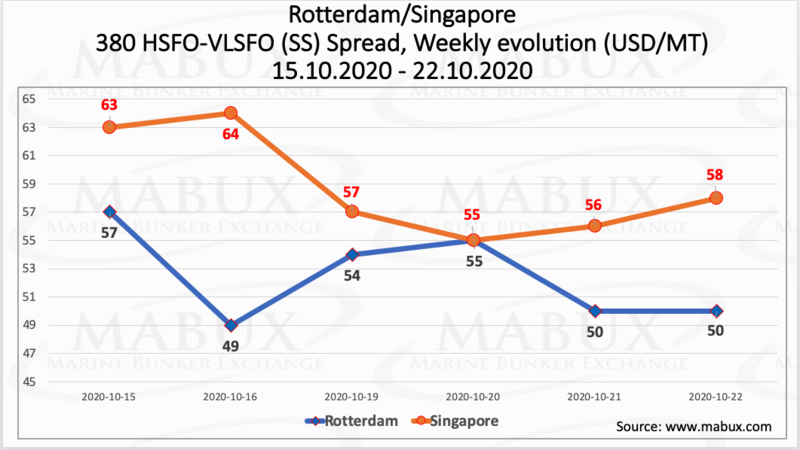

The SS Spreads in Rotterdam and Singapore have largely converged, and on October 20 they were even equal (55 USD). SS Spread in Rotterdam has ranged during the week from 57.00 USD (15.10) down to 50.00 USD (21-22.10). Average value of SS spread for the week has decreased by 6.33 USD from 58.83 USD to 52.50 USD.

In Singapore SS Spread has also changed downward during the week and fell by 5 USD: from 63 USD to 58 USD. Average weekly SS Spread has lost 11.50 USD: from 70.33 USD a week ago to 58.83 USD today.

European Commission has presented methane emission reduction strategy. The strategy, which sets out measures to cut methane emissions in Europe and internationally, presents legislative and non-legislative actions in the energy, agriculture and waste sectors. One of the priorities under the strategy is to improve measurement and reporting of methane emissions. The level of monitoring currently varies between sectors and Member States and across the international community.

Scrubber manufacturer Yara Marine Technologies has forecast that the market for exhaust gas cleaning systems (EGCS) will bounce back when the COVID-19 pandemic is brought under control. Yara also argues that there are not only commercial but also environmental benefits to using scrubbers rather than VLSFO, as the equipment helps to reduce other pollutants besides dealing with Sulphur and there has been no scientific evidence that scrubbers could damage the environment.

Bunker-One – America estimates a net fall in bunker demand of 9.3% in Q2 2020 versus Q2 2019, but there have been sharp regional differences in the severity of the decline. The US Gulf Coast has taken a knock, with bunker demand down by 30%. The Panama and Long Beach/Los Angeles markets have each witnessed a 15% slump, the Fujairah and South African markets have fallen by 20%, and Hong Kong has experienced a 25% decline in demand.

All news