Russia was still the source of 31.5% of the EU’s total coal imports this year, and remains as the top supplier of the commodity to Europe, banchero costa report shows. The European Union is now the fifth largest global importer of seaborne coal, after India, China, Japan and South Korea. In 1H 2022, the EU accounted for 10.4% of global seaborne coal shipments.

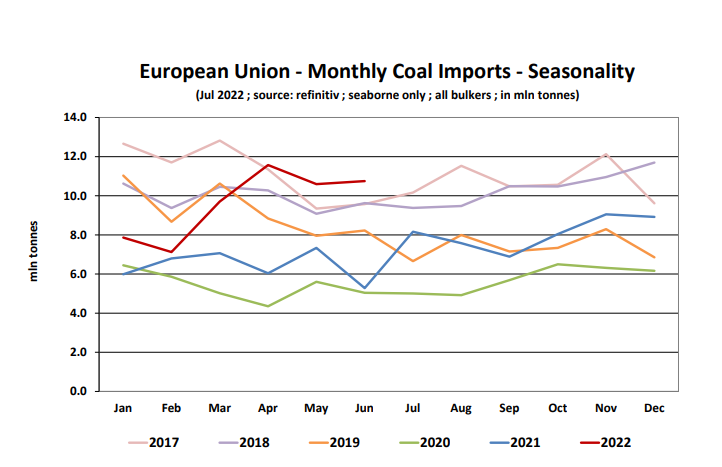

In the first six months of 2022, coal imports into the EU further increased by +49.6% y-o-y to 57.6 mln tonnes. Europe accelerated its coal imports as a direct reaction to the threat of a reduction in gas supply from Russia. This compensated for the sharp drop in demand from Mainland China. In 1H 2022, China’s seaborne coal imports declined by -26.0% y-o-y to 87.8 mln t, from 118.6 mln t in the same period of 2021.

In 1H 2022, coal imports to the EU from Russia increased by +0.2% y-o-y to 18.2 mln tonnes. Of this, 9.1 mln tonnes were imported in the first quarter of 2022 (-1.6% y-oy), and 9.0 mln tonnes were imported in the second quarter (+2.1% y-o-y).

In the whole of 2021, as much as 44% of the EU’s seaborne coal imports were sourced from Russia.

The second most important supplier to Europe is now the USA, accounting for 19.4% of Europe’s imports in 1H 2022. In 1H 2022, imports from the USA surged by +91.6% y-o-y to 11.2 mln t. The third largest supplier to Europe is Australia, accounting for 17.6% of the EU’s seaborne imports in 1H 2022 (10.2 mln t). In fourth place was Colombia, with a 12.7% share of Europe’s coal imports (7.3 mln tonnes). In fifth place was South Africa, with a 5.6% share of Europe’s coal imports (3.2 mln tonnes ).

The main coal import terminals in the European Union (27) are: Rotterdam in the Netherlands (14.6 mln tonnes discharged in 1H 2022), Amsterdam Netherlands (6.8 mln tonnes), Hamburg Germany (3.0 mln tonnes), Gdansk Poland (3.0), Gijon Spain (2.8), Dunkirk France (1.9), Fos France (1.9), Ljmuiden Netherlands (1.6), Ghent Belgium (1.2), Vlissingen Netherlands (1.2), Plonce Croatia (1.2), Taranto Italy (1.1), Wilhelmshaven Germany (1.1), Koper Slovenia (1.0), Antwerp (1.0), Algeciras Spain (0.8).

In the first half of 2022, global coal trade was a bit of a mixed picture. In the January to June period of 2022, global coal loadings increased by +1.5% y-o-y to 572.7 mln t, from 564.1 mln t in the first half of 2021, but still well below the 637.9 mln t in 1H 2019. However, the worst was at start of the year, and the trend in recent months has been very positive. In 1Q 2022, global coal loadings were down -5.1% y-o-y to just 258.5 mln t. In 2Q 2022, coal loadings were a strong +7.7% y-o-y at 314.2 mln t. The month of June 2022 was actually a record 111.6 mln t, +12.3% y-o-y.