MABUX expects slight downward trend to continue in global bunker market next week

The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

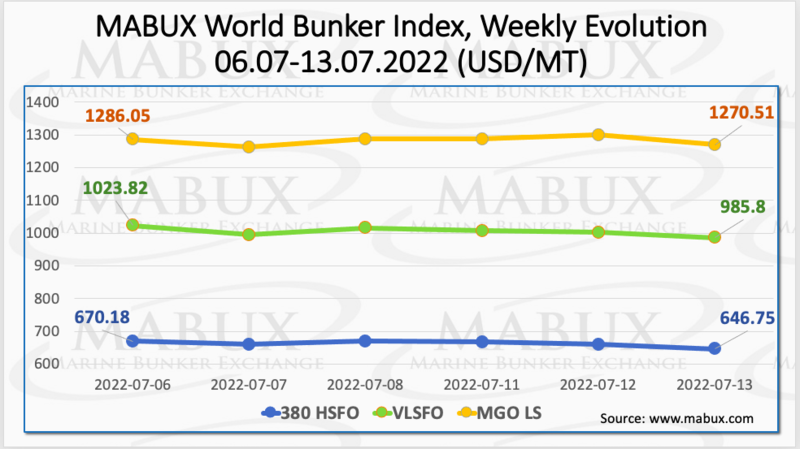

Despite expectations of upward correction after a sharp drop in bunker indices a week earlier, world bunker prices continued their downtrend over the Week 28. The 380 HSFO index fell by another 23.43 USD: from 670.18 USD/MT to 646.75 USD/MT. The VLSFO index, in turn, fell by 38.02 USD well below 1000 USD: from 1023.82 USD/MT to 985.80 USD/MT. The MGO index also lost 15.54 USD (from 1286.05 USD/MT to 1270.51 USD/MT).

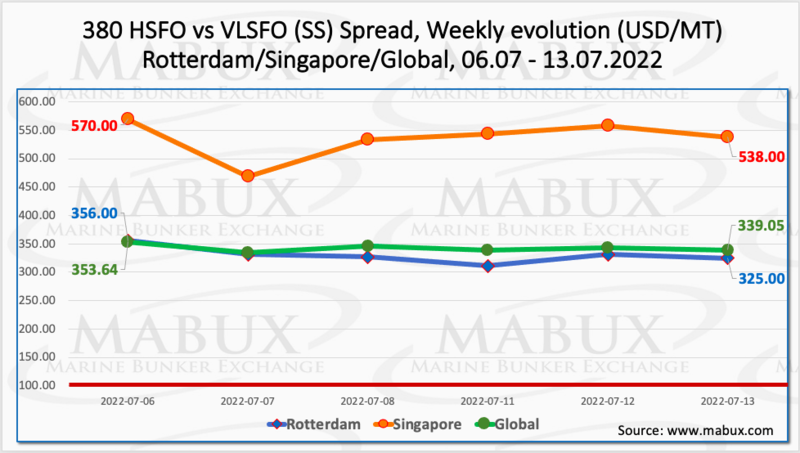

Following further decline of fuel prices, the Global Scrubber Spread (SS) weekly average - the difference in price between 380 HSFO and VLSFO - also turned into a moderate downtrend over the week - minus $ 6.38 ($ 342.52 vs. $ 348.90 last week). In Rotterdam, the average SS Spread, however, continued to rise: $330.17 vs. $324.50 (up $5.67 vs. last week). In Singapore, the average weekly price difference of 380 HSFO/VLSFO has finally begun to decline: minus $6.00 ($535.50 vs. $541.50 last week). For more information, please visit the Price Difference section on mabux.com.

Gazprom suspended the flow of gas along the Nord Stream 1 pipeline for regularly scheduled maintenance on Jul.11, which will last ten days. As a result, gas prices in Europe continued to grow. The price of LNG as bunker fuel in the port of Sines (Portugal) rose on July 11 by another 224 USD and reached 3380 USD/MT (versus 3156 USD/MT a week earlier). LNG prices are still significantly higher than those of traditional bunker fuels: the price of MGO LS in the port of Sines was quoted on July 11 at 1371 USD/MT.

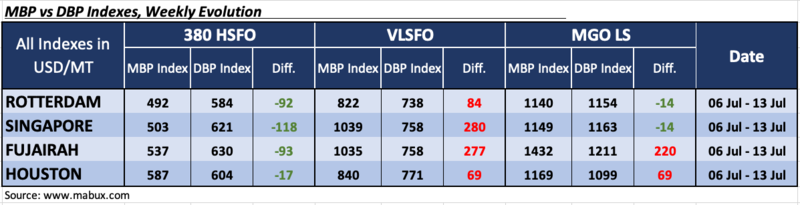

Over the Week 28, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) registered an underestimation of 380 HSFO fuel in all four major ports selected: Rotterdam - minus $ 92, Singapore - minus $ 118, Fujairah - minus $93. Houston also went over the underprice zone: minus $17. Fuel underprice premium continues to widen in all ports.

VLSFO fuel grade, according to MDI, remained, on the contrary, overpriced in all four selected ports: plus $84 in Rotterdam, plus $280 in Singapore, plus $277 in Fujairah and plus $69 in Houston. Here, the MDI index still does not have any firm trend: the overprice premium rose in Rotterdam, Singapore and Houston, but fell in Fujairah. VLSFO fuel is still the most overvalued segment in the global bunker market.

As for MGO LS grade, MDI registered an overestimation of this fuel only in two out of four selected ports: in Fujairah - plus $ 220 and in Houston - plus $ 69. Rotterdam and Singapore went into the underestimation zone: minus $ 14 in both ports. MDI recorded a trend towards a gradual increase of the underprice premium and a reduction of the overpricing. The most significant change was Houston 43 points overcharge down and Singapore 43 points undercharge up.

Singapore has secured the top spot once again in the Xinhua-Baltic International Shipping Centre Development Index Report. It is the ninth consecutive year that the report has ranked Singapore as the global leading maritime centre. The city state scored 94.88 out of a possible 100 points, whilst second on the list was London, with 83.04 points. Meanwhile, Shanghai, home to the world’s largest port, takes third place with 82.79 points. Singapore has earned its longstanding spot at the top of this index due to its wide and established ecosystem of professional global maritime services, good governance, ease of doing business and large and strategically situated port. Further down the top ten, there was little movement as Hong Kong, Dubai, Rotterdam and Hamburg take fourth, fifth, sixth and seventh place respectively. This year, however, New York/ New Jersey overtook Athens/ Piraeus to take the eighth place on the list, due to its port’s exceptionally strong TEU uptick in 2021, as logistics companies moved goods through the US east coast port to avoid congestion on the US west coast. Like last year, the Chinese port of Ningbo-Zhoushan comes in tenth. Its place in this list is almost entirely due to it being the third busiest port in the world in terms of cargo handling, following Singapore and Shanghai.

We expect slight downward trend to continue in global bunker market next week.

By Sergey Ivanov, Director, MABUX