The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

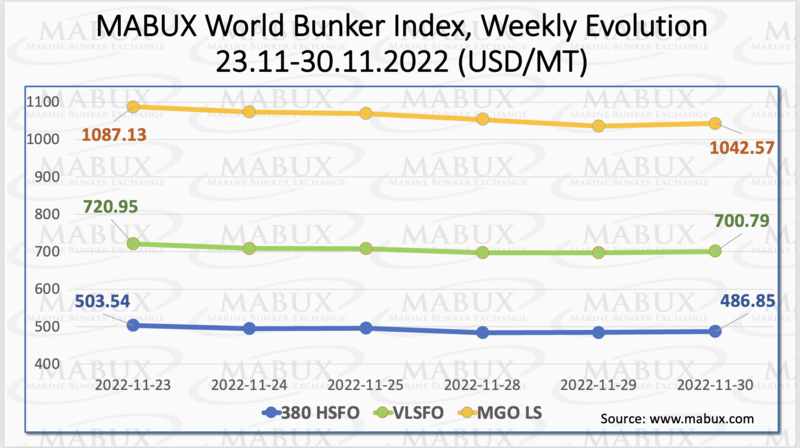

Over the Week 48, MABUX global bunker indices, as expected, continued their firm decline. The 380 HSFO index fell by 16.69 USD: from 503.54 USD/MT last week to 486.85 USD/MT, breaking through the psychological mark of 500 USD. The VLSFO index, in turn, fell by 20.16 USD (700.79 USD/MT versus 720.95 USD/MT last week), coming close to the 700 USD mark. The MGO index also lost 44.56 USD (from 1087.13 USD/MT last week to 1042.57 USD/MT).

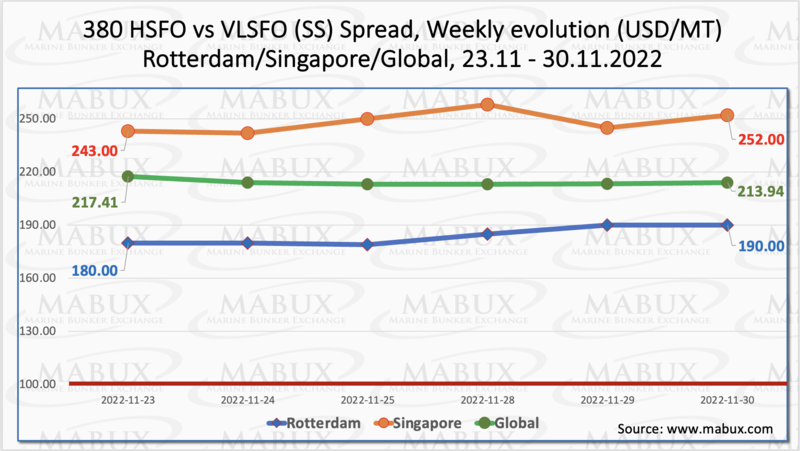

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – did not change significantly over the week 48 – minus $3.47 ($213.94 vs. $217.41 last week), still staying at the $200 mark. The Rotterdam SS Spread, on the contrary, showed a moderate increase for the first time in four weeks – plus $10.00 to $190.00 from $180.00 last week. In Singapore, the price differential of 380 HSFO/VLSFO also increased by $9.00 ($252.00 vs. $243.00 last week). We expect SS Spread does not have any sustainable direction next week. More information is available in the Differentials section at www.mabux.com.

The EU and the UK are expected to raise their combined LNG import capacity by 34%, or by 6.8 billion cubic feet per day (Bcf/d), by 2024 compared with 2021. Floating storage regasification units (FSRUs) are being set up in Germany, the Netherlands, and Finland. Eemshaven in the Netherlands and Wilhelmshaven and Brunsbüttel in Germany are expected to be operational by the end of this year.

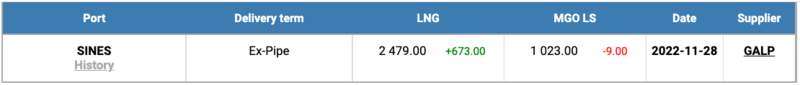

Meantime, natural gas prices in Europe continue a firm uptrend. The price of LNG as bunker fuel at the port of Sines (Portugal) rose to 2479 USD/MT on November 28 (plus 673 USD compared to last week). Thus, the price of LNG exceeds the cost of the most expensive traditional bunker fuel by 1456 USD: on November 28, the price of MGO LS at the port of Sines was quoted at 1023 USD/MT.

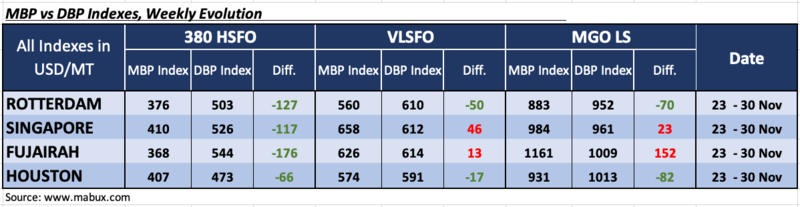

Over the week 48, the MDI (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) continued to show an underestimation of 380 HSFO fuel grade in all four selected ports. The underprice margins did not have a sustainable trend and showed: in Rotterdam – minus $127, Singapore minus $117, Fujairah minus $176 and Houston minus $66.

In the VLSFO segment, according to MDI, Houston returned to the overpricing zone again, joining Singapore: plus $13 and plus $46, respectively. In Rotterdam and Houston, VLSFO fuel grade remained undervalued by minus $50 and minus $17. Underpricing premium decreased and overpricing increased.

In the MGO LS segment, MDI continued to register fuel underpricing in two out of four ports selected: Rotterdam – minus $70 and Houston – minus $82. Singapore and Fujairah remained in the overpricing zone: plus $23 and plus $152, respectively. Undercharge ratio, according to MDI, did not have a sustainable direction, while overcharge narrowed slightly.

According to DNV, monthly orders for methanol-fuelled ships overtook LNG bookings for the first time in October. The methanol-fuelled vessel order book was boosted by Maersk, COSCO Shipping Lines and OOCL with a combined order total of 18 containerships, bringing the total of methanol-fuelled container ships on order and in operation to 47. There are also 25 methanol-fuelled oil/chemical tankers on order and in operation. As for scrubber-equipped vessels, the total number of ships with exhaust gas cleaning systems in operation and on order by 2025 is 4,984. DNV reports, there are owners who have moved from the plans of ordering dual fuel LNG-fuelled newbuilding vessels to ordering regular fuelled vessels with scrubbers recently. It is also expected to see interest in carbon, capture and storage (CCS) – ‘a key technology not only for shipping but for industry in general’ – continue to increase.

There are many uncertainties surrounding the price cap on Russian oil but further volatility in oil and fuel prices continues: the exact price of the cap – EU governments are still split on the level at which to cap Russian oil prices, how many vessels Russia would need to place its oil to buyers, whether Russia will go through with its promise to stop supplying oil to anyone joining the price cap etc. All of these factors could change fuel prices from one direction to the other very significantly. The price cap is due to come into effect on Dec. 05 when an EU ban on Russian crude kicks off. We expect extreme volatility in Global bunker markets next week with wide range of price fluctuations.

By Sergey Ivanov, Director, MABUX

All news