Low consumption impacting refiners in Europe

Nigerian gasoline demand has halved since President Bola Tinubu scrapped the country's costly fuel subsidy late May, impacting European refiners who typically sell into the country, S&P Global Commodities at Sea said.

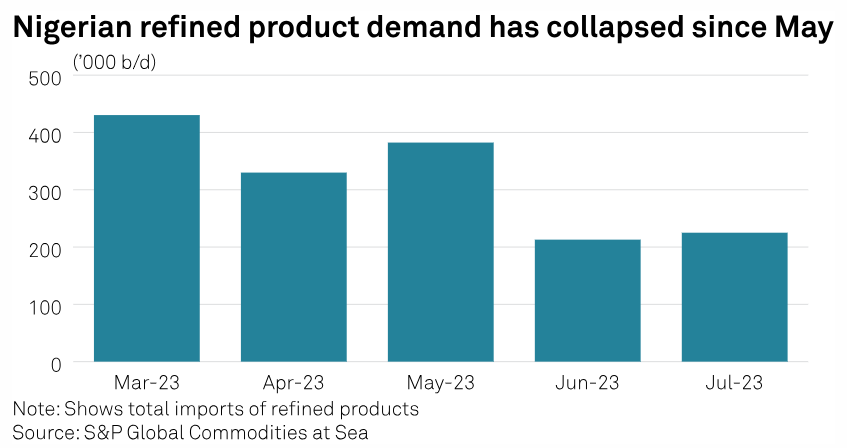

Imports of gasoline to Nigeria plummeted to 106,000 b/d in July from 205,200 b/d in May, according to data from S&P Global Commodities at Sea, after local gasoline prices skyrocketed following Tinubu's announcement. Total refined product demand has fallen 41% in the same period, the data showed.

Depressed demand

Sinking Nigerian demand, driven by high fuel prices, has also led to a drop-off in demand for European exports, whose refiners had relied on thirsty West African markets.

"There is zero demand [in West Africa] at the moment," a source in the region said.

Another European market source said: "Considering the [Nigerian] subsidy removal ... demand is indeed depressed."

The 91 RON FOB AR WAF discount to FOB AR gasoline cargoes was $89/mt on Aug. 10, down sharply from before the subsidy was taken away. On May 22, the spread was at a premium of $50.25/mt, but by the end of the month had fallen to a discount.

The subsidy removal has shaken up longstanding arbitrage for European refiners.

While Nigerian demand in particular has diminished, other destinations have picked up the slack. The US Atlantic Coast made up 28% of total gasoline exported from the Amsterdam-Rotterdam-Antwerp region in July amid persistently low stocks, according to Kpler shipping data, increasing its share from the low teens almost in tandem with the shrinking Nigerian demand.

As a result, European refiners have been unfazed by sinking demand in West Africa. "The arb is strong. Octanes are tight, so gasoline remains well supported" a trader in Europe said.

European traders already faced being crowded out by Russian refined products that have flooded into Africa -- including Nigeria -- since the onset of the war in Ukraine saw European countries boycott Russian oil products. Yet even Russian exports to Nigeria have fallen sharply since the fuel subsidy was scrapped.

Dangote delays

Nigeria is Africa's largest oil producer, with an output of 1.32 million b/d last month according to the Platts OPEC Survey from S&P Global, but a lack of refining capacity means the country is forced to import refined products.

One potential solution is the long-awaited Dangote refinery inaugurated by former president Muhammadu Buhari in April. The mega project, built by Africa's richest man Aliku Dangote, is designed to make Nigeria self-sufficient in fuels, soften the gasoline market, and even to supply countries across Africa and beyond.

According to estimates from S&P Global, Nigerian gasoline production could overtake imports in 2025 and exceed them until the 2040s, if the refinery can get up and running.