The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

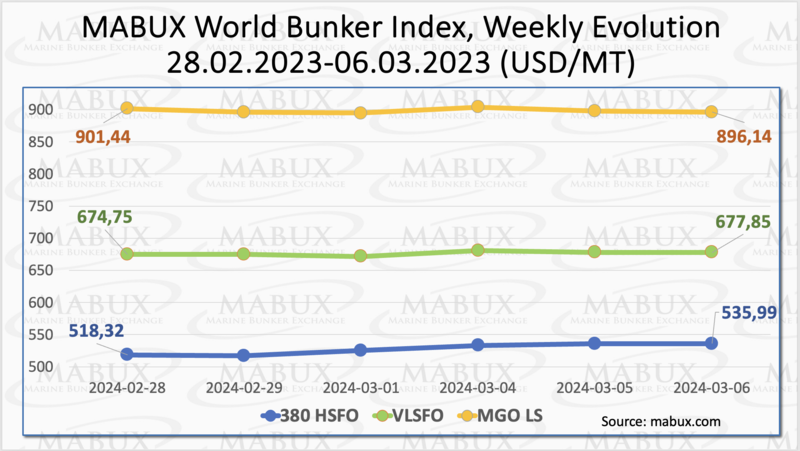

Over the Week 10, the MABUX global bunker indices still did not have a firm trend and changed sideways. The 380 HSFO index rose by 17.67 USD: from 518.32 USD/MT last week to 535.99 USD/MT. The VLSFO index, in turn, added 3.10 USD (677.85 USD/MT versus 674.75 USD/MT last week). In contrast, the MGO index, fell by 5.30 USD (from 901.44 USD/MT last week to 896.14 USD/MT), breaking the 900 USD mark. At the time of writing, the market appeared to be in the process of establishing a stable trend.

The MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed a reduction: minus $14.57 ($141.86 versus $156.43 last week). At the same time, the weekly average also decreased by $4.88. In Rotterdam, SS Spread narrowed by $3.00 (from $120.00 last week to 117.00), although the weekly average widened by $5.50. In Singapore, the 380 HSFO/VLSFO price differential dropped by $7.00 ($187.00 vs. $194.00 last week) with the weekly average rosing by $1.33. Overall, SS Spread still does not have a sustained trend, changing slightly and in different directions. More information is available in the “Differentials” section of www.mabux.com.

According to Avenir LNG's estimates, the global demand for LNG bunkering is projected to increase to approximately 5.7 million metric tons this year, marking a significant rise from the 3.8 million metric tons recorded last year. Avenir LNG's forecast surpasses the approximately 5 million metric tons predicted by the prominent oil and gas company, Shell, for this year. The company maintains a high level of optimism regarding the maritime sector's interest in LNG, anticipating a growth in LNG consumption to 8.3 million metric tons next year and a substantial surge to 36.9 million metric tons per year by 2033. This growth is supported by the gradual deployment of LNG-powered ships. At the beginning of 2023, there were 389 LNG-fueled ships in operation, signifying an almost tenfold increase over the past decade. Avenir LNG foresees LNG bunker demand surpassing the sector's LNG bunkering capacity starting next year. The company predicts a necessity for 31 additional LNG bunker vessels by the end of the upcoming year and another 31 by 2026 to meet the escalating LNG bunker demand in the shipping industry.

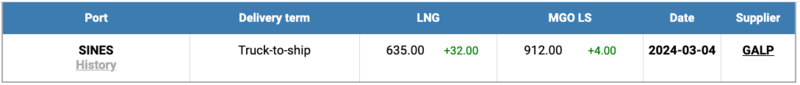

The price of LNG as bunker fuel in the port of Sines (Portugal) experienced a rise, reaching 635 USD/MT on March 04, marking a 32 USD increase compared to the previous week. Concurrently, the price gap between LNG and conventional fuel on March 04 narrowed to 277 USD in favor of LNG, compared to 305 USD the previous week. On that same day, MGO LS was quoted at 912 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

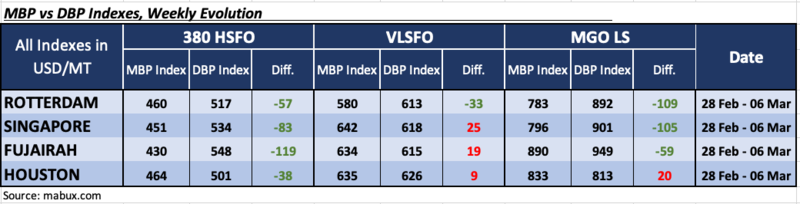

Throughout Week 10, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four selected ports were in the undercharge zone. The average weekly underprising increased by 3 points in Rotterdam, 1 point in Fujairah, and 6 points in Houston. The MDI index in Singapore remained unchanged, while in Fujairah, it still remained above the $100 mark.

In the VLSFO segment, according to MDI, Rotterdam was the only undercharged port, with the weekly average decreasing by 3 points. The other three selected ports were overcharged. Average weekly premium rose by 2 points in Singapore and 3 points in Fujairah but fell by 7 points in Houston.

As for the MGO LS segment, Houston remained the only overpriced port, with the average weekly margin increasing by 11 points. The other three ports were in the undercharge zone. The average weekly premium rose by 12 points in Rotterdam and 7 points in Singapore but fell by 6 points in Fujairah. The MDI index in Rotterdam and Singapore exceeded the $100 mark again.

According to the MDI index, the overall proportion of underpriced and overpriced ports in the 380 HSFO, VLSFO and MGO LS segments did not change during the week.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

The European Commission (EC) has initiated a call for proposals within the Connecting Europe Facility – Alternative Fuels Infrastructure Facility (AFIF), allocating €1 billion to facilitate the expansion of alternative fuels supply infrastructure for maritime, inland waterway, and air transport along the trans-European transport network (TEN-T). The funding earmarked for ports will specifically bolster the development of electricity and hydrogen supply, marking a significant milestone as it includes support for ammonia and methanol bunkering facilities for the first time. This phase of AFIF, spanning 2024-2025, is designed to enhance the accessibility of electric recharging points and hydrogen refuelling stations along the European Union's primary transport corridors and hubs. Notably, these efforts are in alignment with the goals outlined in the newly established Regulation for the deployment of alternative fuels infrastructure (AFIR).

We anticipate that the global bunker market is currently in a state of temporary stabilization, and no drastic changes in bunker indices are expected in the upcoming week.

By Sergey Ivanov, Director, MABUX

All news