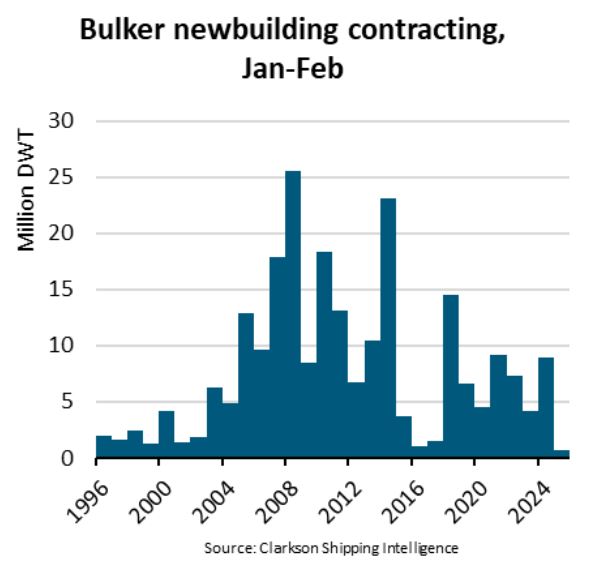

Bulker newbuilding contracting fell by 92% year-on-year in the first two months of 2025, reaching the lowest level in at least 30 years, according to BIMCO’s Shipping Number of the Week.

Bulker newbuilding contracting fell by 92% year-on-year in the first two months of 2025, reaching the lowest level in at least 30 years, according to BIMCO’s Shipping Number of the Week.

Filipe Gouveia, Shipping Analysis Manager at BIMCO, stated, “During the first two months of 2025, bulker newbuilding contracting dropped 92% y/y to the lowest level in at least 30 years. While contracting in January was low, no new ships were ordered in February. Weak freight rates, high newbuilding prices, long lead times and uncertainty are likely discouraging contracting.”

Dry bulk contracting has been declining since the second half of 2024, with second-hand prices for five-year-old ships dropping by 12% due to weakening freight rates, while newbuilding prices fell by 1%. As of February 2025, a five-year-old ship sold for 86% of the value of a newbuilt.

Competition from container and tanker sectors has kept newbuilding prices elevated, as they vie for limited shipyard slots, resulting in delivery timelines extending to 2027 for smaller bulkers and 2028 for larger ships.

Gouveia noted, “The dry bulk medium-term market outlook is currently very uncertain, which could be affecting contracting. The outlook for iron ore and coal seems weak, while a potential return to normal Red Sea routings and burgeoning trade wars may further weaken demand.”

The dry bulk orderbook is at 10% of the fleet, sufficient for replacing older ships in a stable market, with the fleet’s average age nearing 13 years.

The panamax segment, comprising 34% of the orderbook capacity, has the largest orderbook-to-fleet ratio at 14%, though its contracting dropped by 83% year-on-year, impacted by freight rates worsening over the past eight months.

The capesize segment, accounting for 29% of the orderbook, has the lowest orderbook-to-fleet ratio at 8%, with no capesize ships ordered in 2025 after a stronger 2024.

Gouveia added, “Looking ahead, fleet renewal and decarbonisation are likely to be the key drivers for contracting, as demand growth is expected to remain low. Older bulkers are already less competitive, as climate regulations limit their sailing speeds. As regulations increasingly tighten in the medium to long term, recycling of older ships could be further incentivised.”

BIMCO, founded in 1905 and headquartered in Copenhagen, Denmark, is the world’s largest international shipping association, representing over 2,100 members and providing market analysis and standardized contracts for the maritime industry.