The bunker market review was contributed by Marine Bunker Exchange (MABUX)

The Global Fuel market continues to focus on the bearish signs - rising U.S. inventories, increased oil supply from Libya, and the second COVID-19 wave in major developed economies threatening the economic and put more pressure on fuel prices in recent weeks.

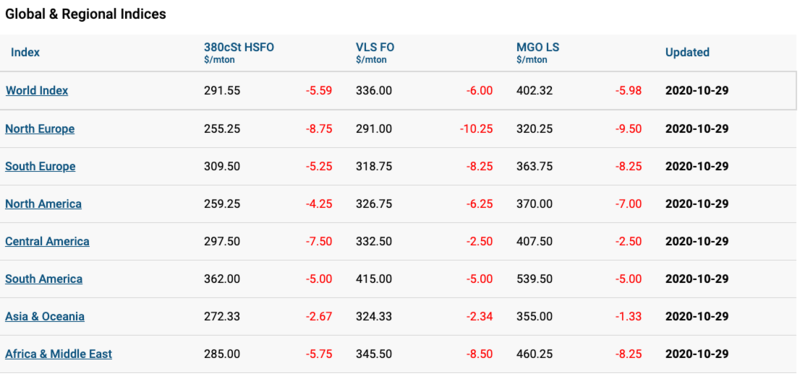

The World Bunker Index MABUX did not have any firm trend in October, having reached its peak in the middle of the month (Oct.12-18) but turned into a moderate downward movement by the end of the month.

As a result, the 380 HSFO Monthly index fell from 292.76 (29.09) to 291.55 USD/ MT (-1.21 USD) on Oct.29, VLSFO Monthly index lost 10.00 USD globally: from 346 to 336 USD / MT, while MGO Monthly index dropped by 7.89 USD: from 410.07 down to 402.18 USD / MT.

Monthly Global Scrubber Spread (SS) (price difference between 380 HSFOs and VLSFOs) increased slightly in October by 5.25 USD and averaged 52.46 USD (47.21 USD in September).

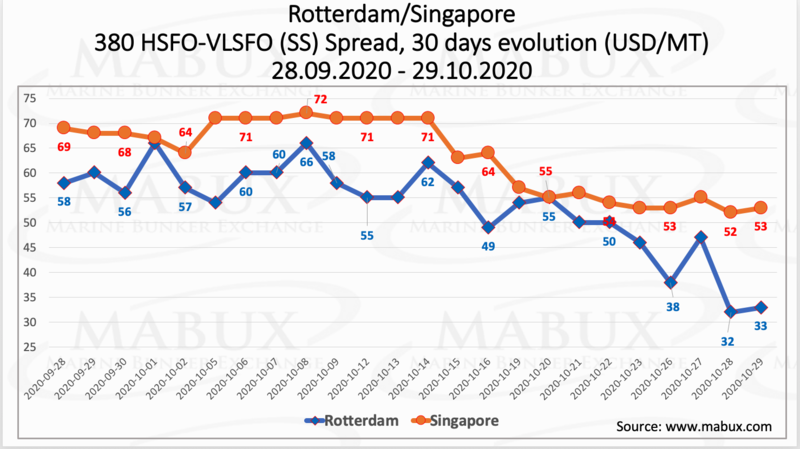

Meantime, Monthly SS Spread in both: Rotterdam and Singapore narrowed significantly in the end of October. Monthly SS in Rotterdam decreased from 58 USD in the beginning of the month down to 33 USD on Oct.29 (-25 USD). Average value of SS spread for the month is 53.25 USD (41.63 USD in September).

In Singapore Monthly SS Spread narrowed from 69 USD on Sep.29 down to 53 USD on Oct.29 (-16 USD). Average Monthly SS has changed slightly: from 61.29 USD to 63.33 USD.

U.S. regulators are rolling out on Oct.26 the first of a two-part regime imposing new pollution control standards on ships. The regime will have long-term implications for how shipowners manage vessel discharges. The most anticipated discharge standards were those relating to exhaust gas cleaning systems (EGCS or “scrubbers”), and ballast water.

As per some analysis, the International Maritime Organization’s (IMO) proposed Arctic heavy fuel oil (HFO) ban contains so many waivers and exemptions that 84% of HFO use would still be allowed to continue until 2029. The ban would start to take effect in July 2024, but waivers and exemptions included in the draft text would allow some vessels to continue using and carrying HFO until July 2029. It is expected that 84% of HFO consumptions would be permitted until 2029, 70% of fuel oil carriage, and black carbon emissions would be at 95% of current levels.

All news