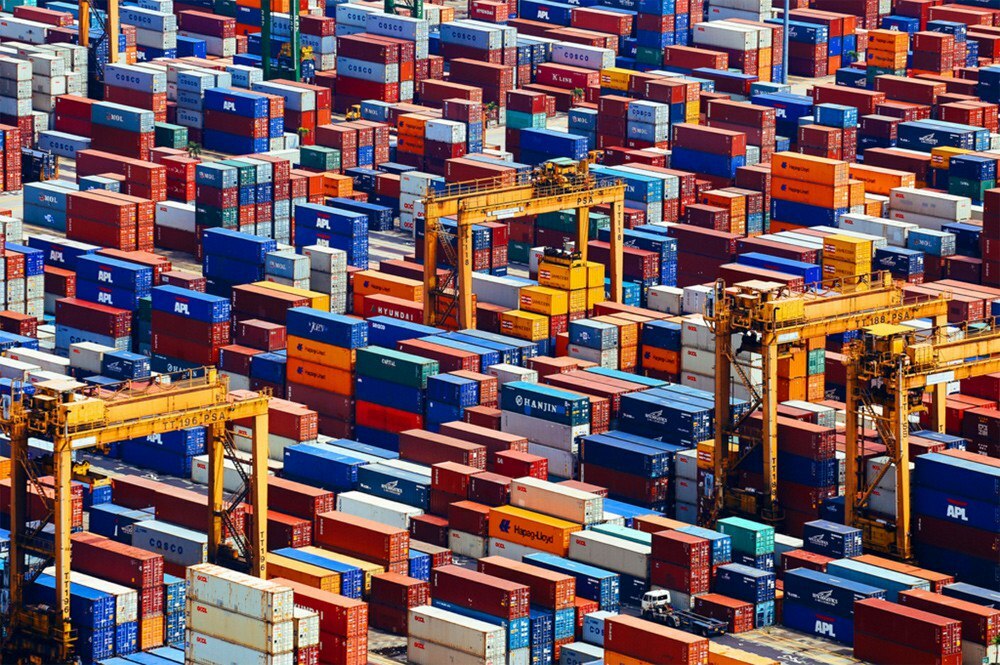

This indicator can completely replace the expected shortage of containers due to withdrawal of international lines from Russian market

The total volume of container orders amid the abolition of import duties is estimated at 90,000 units, with a maximum expected deficit of 77,000, Sergey Avseykov, Executive Director, the Eurasian Union of Rail Freight Traffic Participants (ESP) was quoted as saying by the ESP press office. Sergey Avskekov took part in the plenary session of the Siberian Transport Forum.

Thanks to government support measures initiated by ESP, the market of rail container traffic is coping with the pressure caused by the post-sanctions transformation of international logistics. Private investments will make it possible to make up for the lack of containers in the Russian Federation, caused by the withdrawal of several western shipping lines. And the need for imports of critical goods, exports of Russian high value-added products and increased domestic consumption make it possible to look at the rail traffic trend with optimism.

“Firstly, due to the acceleration of government decisions, we have zeroed the customs duty on containers until September 30th. Introduced multiple use of imported containers. There were subsidies for the credit rate for the purchase of containers. Inspections during import and transit have been reduced,” said Sergey Avseykov said.

He added that due to this, orders for containers have already exceeded the forecast demand for containers after a number of shipping lines left the Russian market.

“We are in direct and constant dialogue with the Russian government. Meetings are held regularly under the chairmanship of First Deputy Prime Minister Andrey Belousov,” said the head of FSP.

Sergey Avseikov noted that containers carry a wide range of high value-added products, more than 3,000 types of cargo: food and consumer goods, equipment, components, lumber, fertilizers and much more. The need for their transportation remains consistently high.

“The forecast of the Ministry of Economic Development at the end of May was quite conservative: we, in our segment, were largely agree with it, but June showed more optimistic growth. The fall in June compared to 2021 is only 3%, and by the end of the year, I think we will even out, transportation (in terms of volume) will approach 2021. In 2023, container traffic will definitely be higher than in 2021. Container transportation retains its position as a leader in terms of growth and development,” Sergey Avseykov said, pointing to 2021 numbers when the growth in container traffic was 12%.

At the same time, the “turn to the east” trend sharply increases the importance of large Siberian and Far Eastern agglomerations. “The departmental project for the development of transport and logistics centers nears completion. It will be approved in the coming weeks. Now it is 3.5 million TEU of capacities of modern TLCs, which are concentrated mainly in the Central Federal District, the Moscow region,” he said.

“Until the end of 2024 with projects already being implemented, this figure will be 8.6 million TEU. It's mostly eastbound. Private investment will amount to about 140 billion rubles. Almost all TLCs are built with private money. Investors believe in them, despite some current instability, continue to invest and ask for only one thing, that decisions on infrastructure development be made promptly,” Sergey Avseykov added.

The Siberian region, including Novosibirsk, is one of the key regions in this concept, the head of ESP highlighted.

“In Novosibirsk, the terminal at the Kleshchikha station will be rehabilitated. The construction of a modern TLC Sibirsky with a capacity of 600,000 TEUs has already begun, with plans of expanding it to 1 million TEU,” he said. At the same time, Sergey Avseykov focused on the fact that one of the topical issues for investors in transport and logistics complexes is the timely construction of road infrastructure for TLCs and production and logistics parks (PLPs).

In this regard, the head of the association called for speeding up state highway projects. In addition, Sergey Avseykov touched upon the technological issues of rail transportation. “In conditions of limited infrastructure, solutions such as double trains are a very important solution. Container trains are very light, and one engine can haul two trains. Now this is being actively discussed with RZD, although they are already double trains. But we are talking about running these trains from a modern TLC to a modern TLC. By reducing the number of technical operations, we will get twice as much transported cargo for almost the same money. This will significantly increase productivity,” said the head of ESP.

“Summarizing, I would like to emphasize that developed infrastructure is always followed by general economic development,” said Sergey Avseykov, adding that he was “very pleased to hear that the word “containers” is “mentioned most often” at the forum.

The Eurasian Union of Rail Freight Traffic Participants (ESP) was created by the largest container operators in Russia, owners of port and terminal facilities. The companies that are members of ESP control about 90% of the market. Among the members of the ESP are TransContainer, RZD Business Active, FESCO, UTLC ERA.