The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

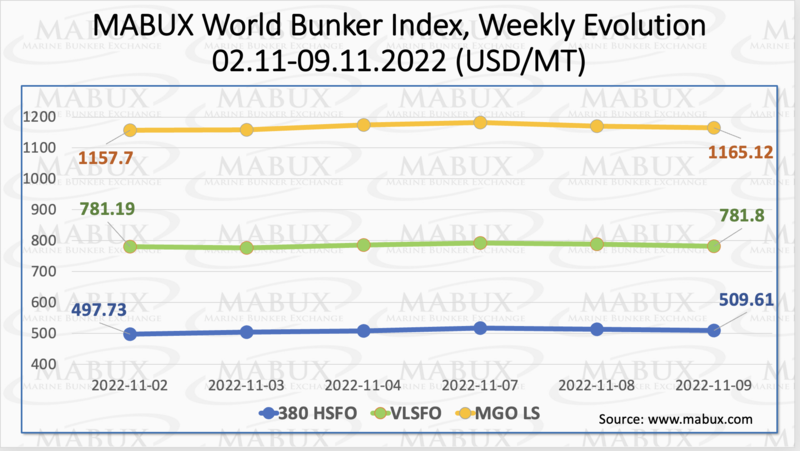

Over the Week 45, MABUX world bunker indices showed signs of possible uptrend. The 380 HSFO index rose by 11.88 USD: from 497.73 USD/MT last week to 509.61 USD/MT, breaking through 500 USD-mark. The VLSFO index, in turn, remained almost unchanged: plus 0.61 USD (781.80 USD/MT versus 781.19 USD/MT last week). The MGO index added 7.42 USD (from 1157.70 USD/MT to 1165.19 USD/MT). All index changes were still insignificant.

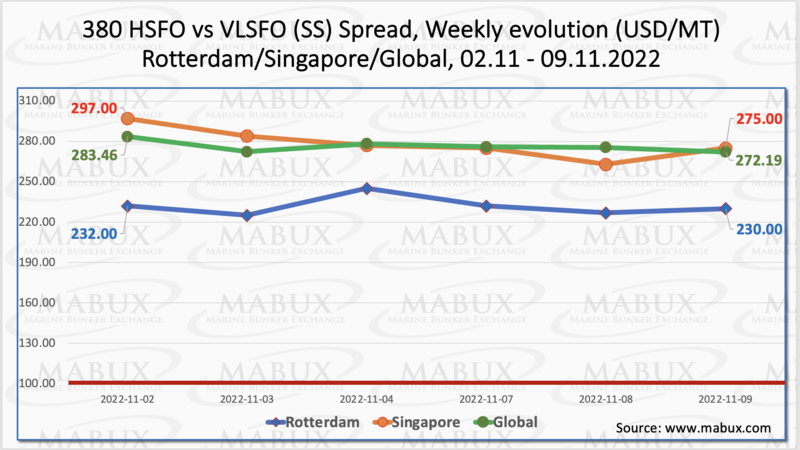

The Global Scrubber Spread (SS) weekly average - the price differential between 380 HSFO and VLSFO - continued its firm decline over the week 45 - minus $ 20.02 ($ 276.19 vs. $ 296.21 last week), gradually moving down from the $ 300 mark. The Rotterdam SS Spread average also dropped by $20.67 to $231.83 from $252.50 last week. In Singapore, the average weekly difference in the price of 380 HSFO/VLSFO decreased more significantly: by $42.67 ($278.50 vs. $321.17 last week). We expect the moderate downtrend in SS Spread to continue next week. More information is available in the Differentials section at mabux.com.

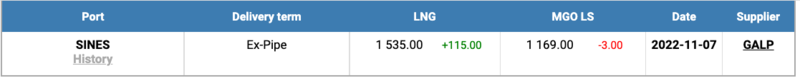

Gas prices in Europe have begun to rise again. As a result, the price of LNG as bunker fuel at the port of Sines (Portugal) on November 07 reached 1535 USD/MT (plus 115 USD compared to the previous week). Thus, the price of LNG exceeds the cost of the most expensive traditional bunker fuel by 369 USD: on November 07, the price of MGO LS in the port of Sines was quoted at 1169 USD/MT.

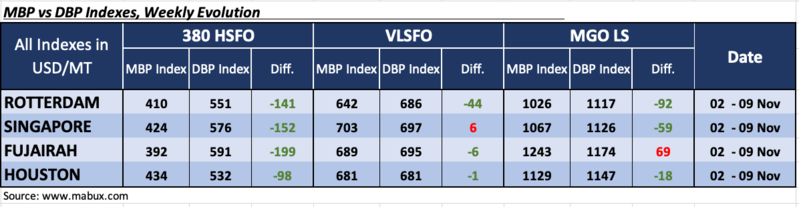

Over the week 45, the MDI Index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index) continued to underestimate 380 HSFO fuel in all four selected ports. Undervaluation margins changed irregular, decreasing in Rotterdam - minus $141, Singapore - minus $152 and Fujairah - minus $199, but rising in Houston - minus $98. In Fujairah, the underprice premium fell below $ 200 for the first time in the last 5 weeks.

In the VLSFO segment, MDI registered two ports at once: Fujairah and Houston, moving into the underestimation zone and joining Rotterdam. The undercharge ratio was minus $6, minus $1 and minus $44, respectively. Singapore remains the only overpriced port - plus $ 6.

In the MGO LS segment, MDI registered fuel underpricing in three out of four selected ports: Rotterdam - minus $92, Singapore - minus $59 and Houston - minus $18. Fujairah remained the only overpriced port in this fuel segment - plus $69. The underpricing decreased slightly while the overpricing rose.

According to statistics provided by DNV, the car carrier segment led the growth in LNG-fuelled vessels orders in October but, for the first time, monthly orders for methanol-fuelled ships overtook LNG bookings. The methanol-fuelled vessel order book was given a fillip by Maersk, COSCO Shipping Lines and OOCL with a combined order total of 18 containerships. There are now a total of 47 methanol-fuelled container ships on order and in operation, and 25 oil/chemical tankers. Looking at vessels in operation, not surprisingly conventional-fuelled vessels still account for the vast majority of the fleet – some 99.59%. Of the alternative fuelled ships in operation, LNG-fuelled vessels account for 0.34% of the fleet, LPG, 0.04%, and methanol 0.02%. As for the order book, conventional-fuelled vessels still account for 86.4% of the fleet. In terms of alternative-fuelled vessels, LNG is the chosen fuel for 9.96% of the fleet, LPG, 2.01%, methanol, 1.23% and hydrogen 0.41%. Looking at contracts placed in 2022, then the growth spurt in the number of alternative fuelled vessels in the fleet can more clearly be seen. These vessels account for 20.84% of this year’s orders, with LNG taking the lead with 14.94%, followed by methanol at 2.82%, LPG, 1.88% and hydrogen, 1.20%.

We expect the main bunker indices to head upwards next week.

By Sergey Ivanov, Director, MABUX

All news