The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

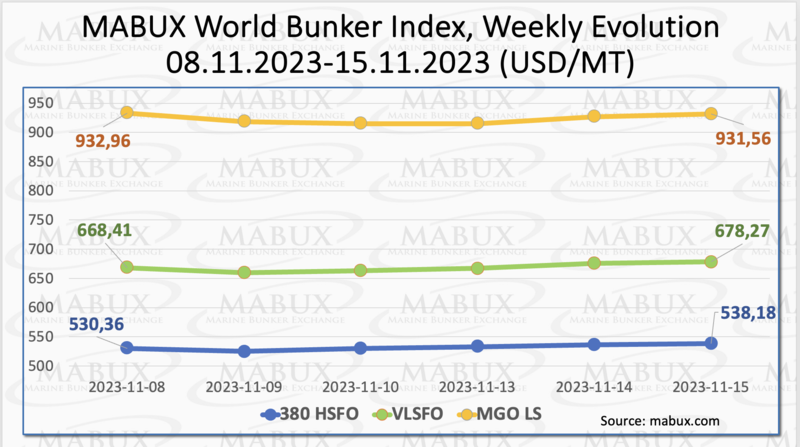

Over the Week 46, the MABUX global bunker indices did not have any firm dynamics and showed mixed movements. The 380 HSFO index rose by 7.82 USD: from 530.36 USD/MT last week to 538.18 USD/MT. The VLSFO index, in turn, added 9.86 USD (678.27 USD/MT versus 668.41 USD/MT last week). The MGO index, on the contrary, fell by 1.40 USD (from 932.96 USD/MT last week to 931.56 USD/MT). At the time of writing, the market was experiencing a moderate upward trend.

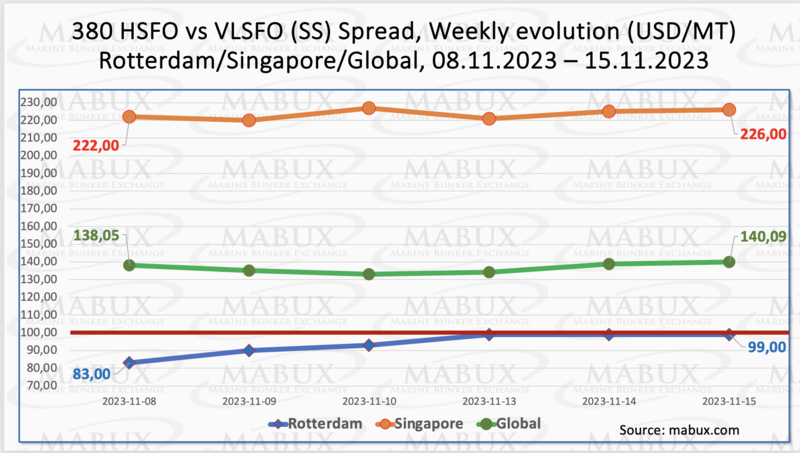

Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed upward dynamics: plus $2.04 ($140.09 versus $138.05 last week), still remaining above the $100.00 mark (SS breakeven). At the same time, the weekly average decreased by $3.95. In Rotterdam, SS Spread rose by another $16.00 (from $83.00 last week to $99.00), approaching the $100 mark. The weekly average also increased by $9.66. In Singapore, the 380 HSFO/VLSFO price difference widened by $4.00, remaining above the $200.00 mark ($226.00 vs. $222.00 last week), with the weekly average showing an increase of $5.17. The renewed growth of SS Spread in major hubs suggests increased profitability of the HSFO + scrubber combination over conventional VLSFO bunker fuels. More information is available in the “Differentials” section of www.mabux.com.

This winter, Europe's natural gas demand is anticipated to increase due to higher electricity consumption in major markets and a gradual easing of industrial demand destruction in the Eurozone. This upswing in European demand has the potential to tighten global LNG and gas markets. While gas inventories in the European Union are nearing full capacity, uncertainties from recent strikes at Australian LNG export facilities and the Hamas-Israel war have kept the European market on edge, resulting in highly volatile prices. According to a Bloomberg survey, experts anticipate that the decline in industrial gas demand could ease early next year, with power consumption returning to pre-energy crisis levels in some key European markets.

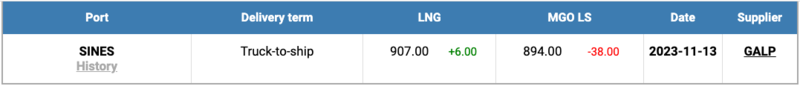

The price of LNG as bunker fuel in the port of Sines (Portugal) increased by a symbolic 6 USD compared to the previous week, reaching 907 USD/MT on November 13. The price gap between LNG and conventional fuel on this date shifted in favor of MGO, with a difference of 13 USD, as opposed to the previous week's 41 USD in favor of LNG. On November 13, MGO LS was quoted at 894 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

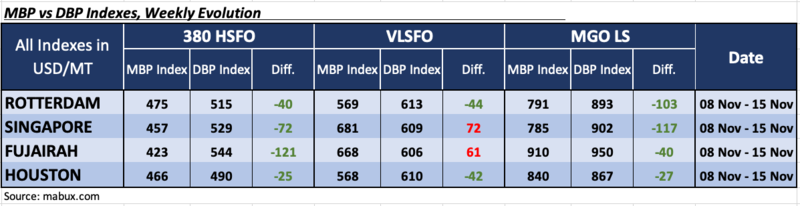

Throughout Week 46, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) indicated the following trends in selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four ports remained undervalued. The weekly average underpricing widened by 12 points in Rotterdam and 3 points in Fujairah, but narrowed by 5 points in Singapore and 8 points in Houston. In Fujairah, the underpricing of this type of fuel continues to exceed the $100 mark.

In the VLSFO segment, according to the MDI, Fujairah and Singapore were in the overcharge zone, with the average premium rising by a further 20 points in Singapore and 19 points in Fujairah. In Rotterdam and Houston, VLSFO remained undervalued. Average underpricing ratio decreased by 1 point in Rotterdam but increased by 3 points in Houston.

In the MGO LS segment, all ports remained undervalued, with the weekly average showing a decrease of 4 points in Rotterdam, 4 points in Singapore and 12 points in Fujairah. Conversely, Houston's average MDI index increased by 3 points.

In general, significant irregular fluctuations in the MDI index persist, indicating high market volatility.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

The marine fuel sales in Singapore reached a new peak last month, totaling 4,401,500 metric tonnes (mt), marking the highest monthly figure since July. This represents a 3.5% increase from the 4,252,800 mt recorded in October 2022. Notably, very low sulphur fuel oil (VLSFO) sales dominated the market, accounting for more than half of all marine fuel sales in the global bunker hub at 2,521,700 mt. Additionally, the 76,800 mt sales of bio-blended VLSFO set a new record for the highest monthly total. High sulphur fuel oil (HSFO) sales experienced a slight month-on-month (m-o-m) decline of 1.5% but demonstrated a substantial 7.6% year-on-year (y-o-y) increase, totaling 1,451,200 mt. Similar to bio-blended VLSFO, the 2,300 mt of bio-blended HSFO sales marked the highest monthly total ever recorded at the Port of Singapore. Sales of low sulphur marine gasoil showed positive growth both y-o-y and m-o-m, reaching 297,800 mt. The monthly total of 35,700 mt in marine gasoil sales marked the highest of the year. In the realm of alternative fuels, marine LNG sales at the Port of Singapore for October totaled 16,100 mt, ranking as the third-highest monthly total of 2023, following figures of 18,300 mt and 17,900 mt in July and June, respectively. For the first 10 months of the year, the cumulative marine fuel sales at the Port of Singapore amounted to 42,507,900 mt, reflecting an 8.2% increase compared to the same period in 2022 when 39,303,500 mt was sold.

The global bunker market has shown some signs of the moderate growth driven by high volatility amid the ongoing conflict in the Middle East. We expect next week the world bunker indices to show slight upward trend.

By Sergey Ivanov, Director, MABUX

All news