All major shipping lines have recorded sharp Y/Y revenue drops in 2023-Q3

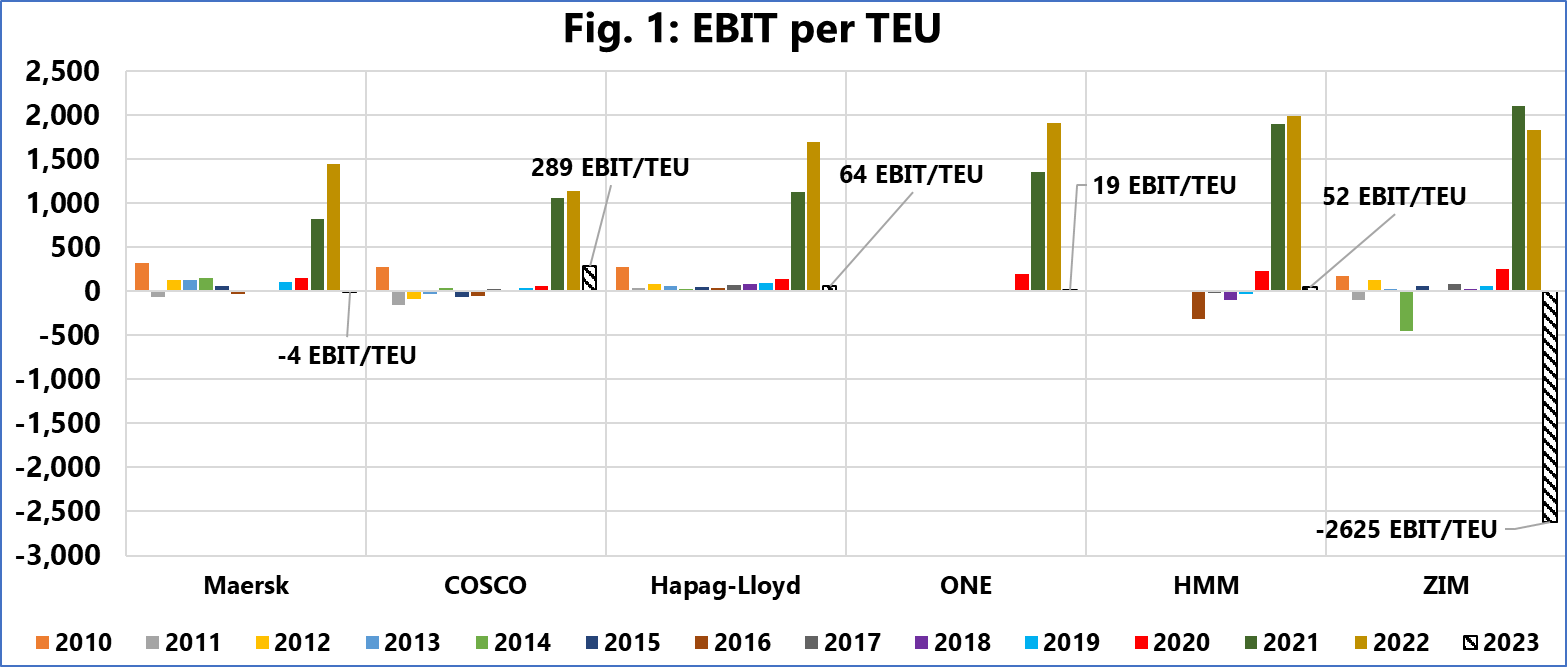

All major shipping lines that report on their financial figures have recorded sharp Y/Y revenue drops in 2023-Q3. In fact, the smallest contraction was of -51.8%. While this does sound alarming, we have to remember that the Y/Y comparison is against a period of high rates. To counter this volatility, we instead compare 2023-Q3 against 2019 on an annualised basis and see that the contraction in 2023-Q3 is an artefact of the abnormal growth in 2021-2022, and the revenues are now really only dropping down to the pre-pandemic levels.