The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

During Week 09, the MABUX global bunker indices changed irregular with no clear trend. The 380 HSFO index saw a symbolic decrease of 0.32 USD, slipping from 519.82 USD/MT to 519.50 USD/MT, hovering around the 500 USD mark. Conversely, the VLSFO index added 1.42 USD (674.96 USD/MT versus 673.54 USD/MT last week). The MGO index decreased by 4.84 USD (from 909.38 USD/MT last week to 904.54 USD/MT). At the time of writing, a moderate downward trend prevailed in the market.

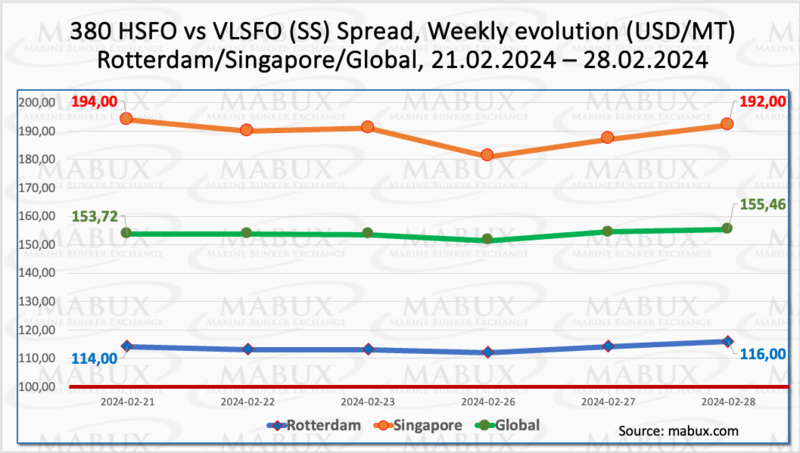

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - moderately increased by $1.74 ($155.46 versus $153.72 last week), with the weekly average experiencing a symbolic decrease of $0.66. In Rotterdam, SS Spread showed a $2.00 increase (from $114.00 last week to 116.00), despite the weekly average decreasing by $4.66. In Singapore, the 380 HSFO/VLSFO price difference narrowed by $2.00 ($194.00 vs. $192.00 last week), still hovering around the $200 mark, with the weekly average also decreasing by $6.66. Overall, changes in SS Spread are minor, and a clear trend is yet to emerge. More information is available in the “Differentials” section of mabux.com.

Woodside Energy anticipates a 50% surge in liquefied natural gas (LNG) demand over the next decade, driven by Asia. This aligns with the projections of leading LNG player Shell, which, earlier this month, also predicted a 50% increase in LNG demand by 2040. Despite certain regions experiencing a plateau in natural gas demand, Shell foresees a global demand peak post-2040, a forecast extending more than a decade beyond the latest estimates by the International Energy Agency (IEA), which predicts a peak in demand for all hydrocarbons before 2040. Woodside, akin to Shell, expresses optimism in its gas demand outlook, emphasizing the essential role of gas in supporting intermittent wind and solar energy sources in the long run. Notably, Germany has recently initiated the construction of four new gas-powered plants, investing a total of $17 billion. These plants are designed to be hydrogen-ready, allowing for a seamless transition if hydrogen emerges as a viable alternative for power generation, further showcasing the evolving landscape of energy solutions.

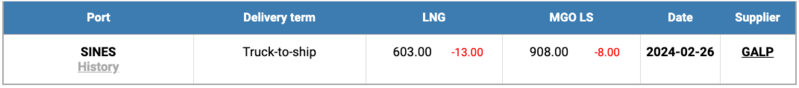

The price of LNG as bunker fuel in the port of Sines (Portugal) showed a moderate decline and reached 603 USD/MT on February 27 (minus 13 USD compared to last week). At the same time, the price gap between LNG and conventional fuel on January 27 narrowed slightly, favoring LNG by 305 USD in contrast to the 316 USD difference a week earlier. On that specific day, MGO LS was priced at 908 USD/MT at the port of Sines. More information is available in the LNG Bunkering section of mabux.com.

During Week 09, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) recorded the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four selected ports were still underpriced. Rotterdam's average weekly undercharging increased by 30 points, Singapore by 2 points, but Houston fell by 6 points. The MDI index in Fujairah remained unchanged and above the $100 mark.

In the VLSFO segment, according to the MDI, Rotterdam returned to the underpriced zone, with the weekly average increasing by 42 points. The other three selected ports were overcharged. Average weekly premium fell by 9 points in Singapore, 1 point in Fujairah and 3 points in Houston.

Concerning the MGO LS segment, Houston remained the only overpriced port, with the average weekly ratio narrowing by 5 points. The other three ports were in the undercharge zone, with Rotterdam showing a 55-point increase and Fujairah a 23-point decrease. The MDI index in Singapore remained unchanged.

Thus, according to the MDI index, 380 HSFO and MGO LS remain undervalued in the world's largest hubs. The VLSFO segment is overpriced in all ports except Rotterdam.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of mabux.com.

According to the United Nations Conference on Trade and Development (UNCTAD) report, rerouting vessels from the Suez Canal to the Cape of Good Hope results in increased speeds, higher bunker consumption, and elevated emissions for voyages. Container ships, for instance, experience a 2.2% rise in fuel consumption with a 1% increase in speed. Accelerating from 14 to 16 knots leads to a 31% increase in fuel use per mile. Consequently, the longer distances caused by rerouting imply a 70% increase in greenhouse gas emissions for a round trip from Singapore to Northern Europe. The attacks by Yemen's Houthi rebels on merchant shipping due to the Israel-Hamas war have prompted shipping companies to divert vessels from the Suez Canal, choosing the Cape of Good Hope route. This trend has been solidifying since major shipping lines announced their intention to divert from mid-December onwards.

No drastic changes in the bunker indices are expected for the upcoming week. The market is likely to be dominated by minor multidirectional fluctuations.

By Sergey Ivanov, Director, MABUX

All news