The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

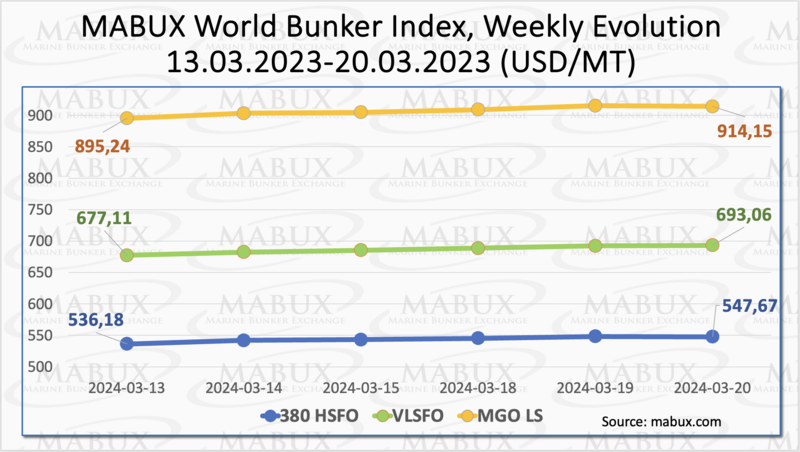

Over the 12th week, the MABUX global bunker indices showed a sustained uptrend. The 380 HSFO index rose by 11.49 USD: from 536.18 USD/MT last week to 547.67 USD/MT. Similarly, the VLSFO index increased by 15.95 USD (693.06 USD/MT versus 677.11 USD/MT last week), nearing the 700 USD mark. Meanwhile, the MGO index added 18.91 USD (from 895.24 USD/MT last week to 914.15 USD/MT), breaking through the 900 USD mark. At the time of writing, there was no clear trend in the market.

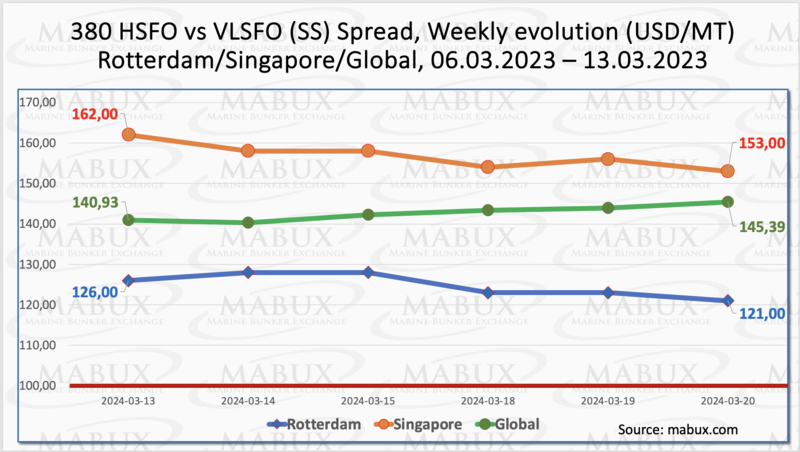

Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO – demonstrated moderate growth, increasing by $4.46 ($145.39 vs. $140.93 last week). At the same time, the weekly average saw a $2.08 increase. Conversely, in Rotterdam, the SS Spread decreased by $5.00 (from $126.00 last week to 121.00), but the weekly average increased by $4.16. In Singapore, the 380 HSFO/VLSFO price differential dropped by $9.00 ($153.00 versus last week's $162.00) with the weekly average falling by $10.67. Overall, SS Spread still does not have a firm trend, and we expect similar dynamics to persist next week. More information is available in the “Differentials” section of www.mabux.com.

Wood Mackenzie reported that gas prices in Europe could plunge as low as $6.70 per million British thermal units (MMBtu) this summer, thanks to a mild winter and ample gas inventories. The report highlights a bullish start to the year, with colder weather sweeping through Europe and industrial demand maintaining its recovering trend, increasing 12% year-on-year in January and around 6% in February. As the European gas withdrawal season nears its end, inventories stood at 70.78 bcm on March 10th, marking a y/y increase of 5.61 bcm and surpassing the five-year average by 21.41 bcm. It is predicted that the end-season inventory level will exceed 68 bcm. Gas prices in Europe continue to be depressed, with the front-month Dutch Title Transfer Facility (TTF) falling by EUR 1.955 per megawatt hour (MWh) to settle at EUR 24.93/MWh on March 11th. This represents a 53% decrease year-on-year and an 81% drop compared to two years ago, in the immediate aftermath of the Russia-Ukraine conflict.

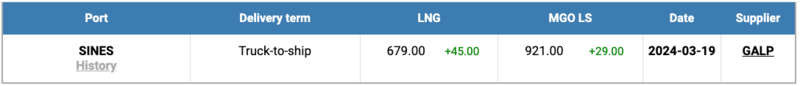

The price of LNG as bunker fuel at the port of Sines (Portugal) increased moderately, reaching 679 USD/MT on March 19 (plus 45 USD compared to the previous week). Meanwhile, the price gap between LNG and traditional fossil fuel widened on March 19, with LNG holding an advantage of 242 USD compared to 221 USD the previous week. On the same day, MGO LS was quoted at 921 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

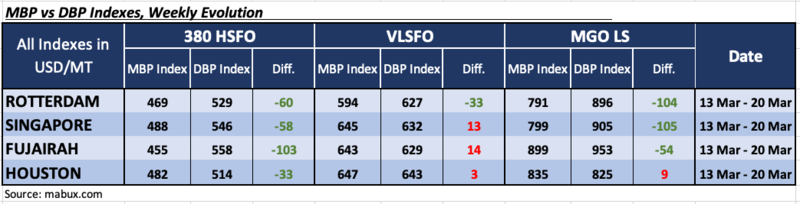

In Week 12, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four selected ports were in the undercharge zone. The average weekly underpricing widened by 8 points in Rotterdam but narrowed by 3 points in Singapore, 4 points in Fujairah, and 2 points in Houston. The MDI index in Fujairah remained above the $100 mark.

Regarding the VLSFO segment, according to MDI, Rotterdam remained the only undervalued port. The average weekly ratio increased by 7 points. The other three selected ports were in the overcharge zone. Average weekly margins fell by 12 points in Singapore, 13 points in Fujairah and 7 points in Houston. The MDI index in Houston approached the 100% correlation mark between market price and the MABUX digital benchmark.

As for the MGO LS segment, Houston remained the only overpriced port, with the average weekly margin decreasing by 8 points. The other three ports were underpriced, with the average weekly premium decreasing by 13 points in Rotterdam, 7 points in Singapore and 2 points in Fujairah. The MDI index in Rotterdam and Singapore approached the $100 mark, slightly above it.

The overall ratio of undervalued and overvalued ports in the 380 HSFO, VLSFO and MGO LS segments remained unchanged during the week. The MDI index does not yet show a sustained trend.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

In Singapore, marine fuel sales surged to a total of 4,509,330 metric tonnes (mt) last month, marking an 18.8% increase from the 3,796,920 mt recorded in February 2023. However, this figure represented an 8.1% decline from January's sales of 4,906,100 mt. Notably, very low sulphur fuel oil (VLSFO) sales hit 2,554,600 mt, the lowest monthly total in three months. Similarly, high sulphur fuel oil (HSFO) sales reached 1,601,000 mt, the lowest figure since November. Sales of low sulphur marine gasoil slipped slightly to 296,800 mt, down 0.1% year-on-year (y-o-y) and 6.4% month-on-month (m-o-m). Bio-blended VLSFO sales plummeted to 15,600 mt in February, marking a 65.6% decrease from January and the lowest monthly total in 2023 for this fuel grade. Notably, VLSFO was the sole fuel grade to register bio-blended sales last month. Singapore witnessed a robust month for marine LNG volumes, with sales reaching 26,900 mt in February, a staggering 158.7% increase from January. This figure accounted for nearly a quarter of the total marine LNG sales (110,900 mt) registered in 2023. Overall, during the initial two months of the year, global bunker hub sales, including non-conventional fuels, amounted to 9,415,430 mt, marking a 15.2% increase from the 8,175,250 mt recorded in the same period in 2023.

We expect global bunker indices to continue trending upward next week.

By Sergey Ivanov, Director, MABUX

All news