The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

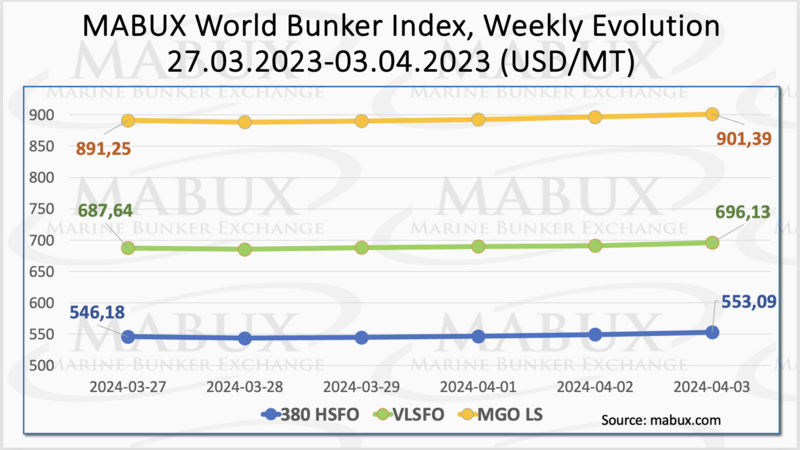

During the 14th week, the MABUX global bunker indices showed a moderate upward trajectory. The 380 HSFO index climbed 6.91 USD, moving from 546.18 USD/MT to 553.09 USD/MT. The VLSFO index rose by 8.49 USD (696.13 USD/MT versus 687.64 USD/MT last week), inching closer to the 700 USD threshold. The MGO index increased by 10.14 USD (from 891.25 USD/MT last week to 901.39 USD/MT), surpassing the 900 USD mark. At the time of writing, the upward trend in the global bunker market continued.

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed a moderate increase of $1.58 ($143.04 vs. $141.46 last week). Conversely, the weekly average witnessed a minor dip of $0.17. In Rotterdam, SS Spread widened by $3.00 (from $110.00 last week to 113.00), lingering close to the $100 mark (SS Breakeven). The average weekly value at the port, on the contrary, narrowed by $5.00. In Singapore, the 380 HSFO/VLSFO price differential rose by $6.00 ($154.00 vs. $158.00 last week), with a marginal weekly average rise of $0.50. The upcoming week might see fluctuating trends in the SS Spread dynamics. More information is available in the “Differentials” section of www.mabux.com.

Europe is poised to conclude the winter heating season with a record-high volume of natural gas inventories. This surplus could shield the EU from price surges and potential energy crises next winter. As of March 25, just one week before the major gas withdrawal season ends on March 31, EU gas storage facilities were 59% full. While storage sites at full capacity represent only about a quarter of the EU's winter consumption, the substantial stock levels at the onset of the refill season in April should facilitate Europe's goal to reach 90% capacity by November 1. However, this year may mark the final stretch for Russian pipeline supply via Ukraine, as the multi-year transit deal is set to expire on December 31. Both Ukraine and the EU have indicated that they will not extend this transit deal. This development places certain central European EU members, such as Austria and Slovakia, at heightened risk concerning their gas supply.

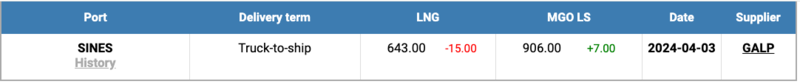

On April 03, the price of LNG as bunker fuel in the port of Sines, Portugal, dropped to 643 USD/MT, which is a decrease of 15 USD compared to the previous week. Concurrently, the price differential between LNG and conventional fuel on April 3rd expanded to 263 USD in favor of LNG, compared to 242 USD the previous week. On that same day, MGO LS was priced at 906 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

During Week 14, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four selected ports positioned in the undercharge zone. Weekly average margins increased by 7 points in Rotterdam, 10 points in Singapore, 1 point in Fujairah and 14 points in Houston. The MDI index in Fujairah hovered slightly above $100.

For the VLSFO segment, based on MDI, all ports transitioned into the underprice zone, with the average weekly ratio climbing by 15 points in Rotterdam, 13 points in Singapore, 16 points in Fujairah, and 21 points in Houston.

In the MGO LS segment, the only overvalued port was Houston, witnessing a 2-point weekly average ratio decline. The other three ports remained undervalued. Weekly average margins grew by 4 points in Rotterdam, 1 point in Singapore, and 5 points in Fujairah. MDI indices in Rotterdam and Singapore continue to exceed the $100 threshold.

The VLSFO segment saw a notable shift towards underpricing over the week. Meanwhile, the balance between undervalued and overvalued ports in the 380 HSFO and MGO LS categories remained stable.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

A consortium of 11 global industry stakeholders recently announced the establishment of the Nuclear Energy Maritime Organization (NEMO), a pioneering industry association dedicated to championing nuclear power within the maritime sector. Based in London, NEMO is set to commence its operations in the second quarter of 2024. In its inaugural press release, NEMO outlined its objectives to support nuclear and maritime regulators in formulating relevant standards and regulations for the deployment, operation, and decommissioning of floating nuclear power platforms. Additionally, the organization aims to offer expert counsel and advocate for the highest levels of safety, security, and environmental standards within this emerging industrial domain. NEMO is committed to facilitating collaboration, sharing knowledge, and promoting advocacy among its members and broader stakeholders. The emergence of NEMO coincides with an increasing consensus on the pivotal role that nuclear power must play in shaping the future energy landscape of the commercial maritime fleet. Advanced nuclear technologies deployed at sea have the potential to significantly mitigate environmental impact, bolster social responsibility, and enhance economic competitiveness.

We expect that the global bunker market will maintain its potential for moderate growth in the forthcoming week.

By Sergey Ivanov, Director, MABUX