The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

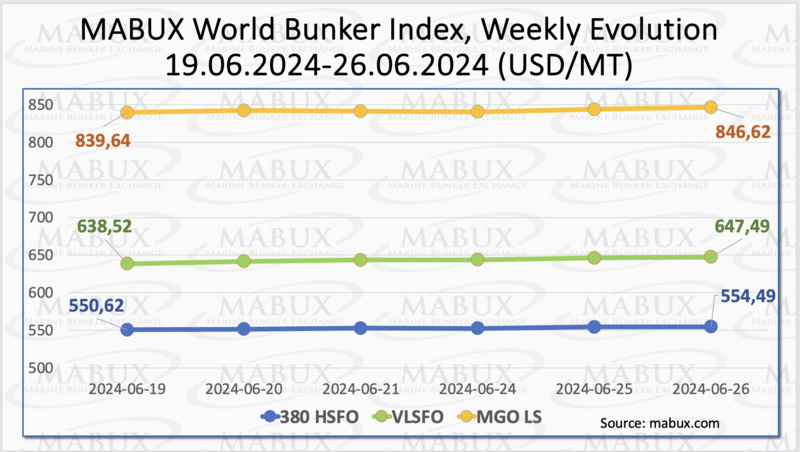

Over the Week 26, the MABUX global bunker indices continued moderate upward movement. The 380 HSFO index rose by 3.87 USD: from 550.62 USD/MT last week to 554.49 USD/MT. The VLSFO index increased by 8.97 USD (647.49 USD/MT versus 638.52 USD/MT last week). The MGO index added 6.98 USD (from 839.64 USD/MT last week to 846.62 USD/MT). At the time of writing, a slight upward trajectory continued in the global bunker market.

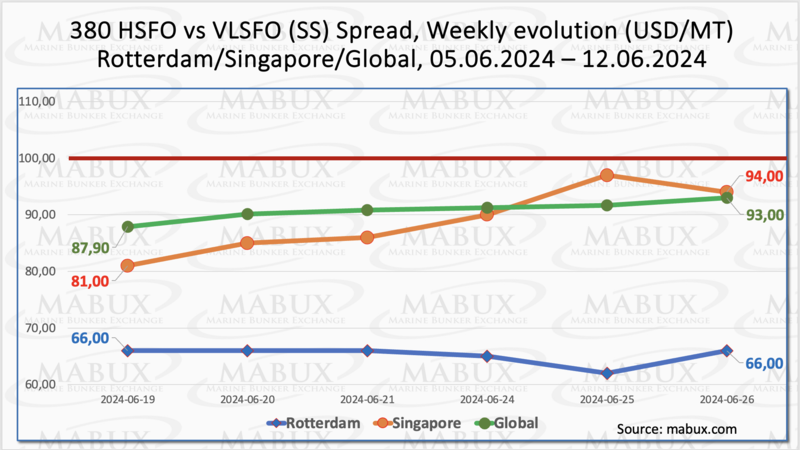

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - resumed moderate growth: plus $5.10 ($93.00 versus $87.90 last week), nearing again the $100.00 mark (SS Breakeven). Meantime, the weekly average increased by a symbolic $0.52. In Rotterdam, SS Spread values remained unchanged at $66.00, though the weekly average widened by 3.17 USD. In Singapore, the price difference 380 HSFO/VLSFO continued to grow: plus $13.00 ($94.00 versus $81.00 last week), also approaching the $100.00 mark, with the weekly average at the port adding 8.00 USD. Overall, SS Spread continues its moderate upward correction. We anticipate the SS Spread Global Index as well as the SS Spread Singapore Index will surpass the $100.00 mark next week. More information is available in the “Differentials” section of www.mabux.com.

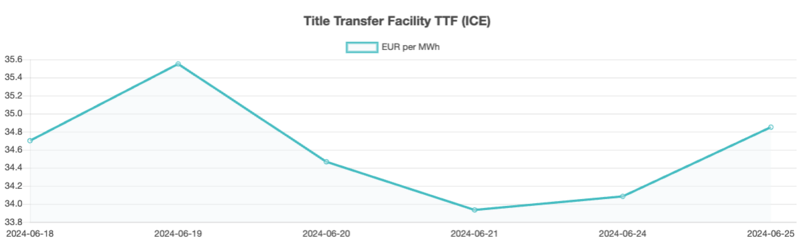

The European gas market remains dominated by slow inventory builds and high sensitivity to supply disruptions. Sudden outages and planned maintenance in Norway, along with potential further reductions in Russian pipeline supply, have kept Dutch TTF Natural Gas Futures around €35 per megawatt-hour. StanChart forecasts that while Europe’s gas supply interruptions may be brief, prices are likely to stay elevated due to slower-than-normal inventory accumulation. During week 26, the European gas benchmark TTF continued to rise moderately, adding another 0.153 EUR/MWh (34.853 EUR/MWh versus 34.700 EUR/MWh last week.

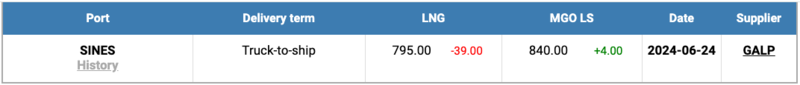

On June 24, the price of LNG as bunker fuel in the port of Sines (Portugal) decreased to 795 USD/MT, marking a drop of 39 USD compared to the previous week. This price shift highlights a 45 USD advantage for LNG over conventional fuel, contrasting with a 20 USD advantage for MGO LS observed a week earlier. On the same day, MGO LS was priced at 840 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

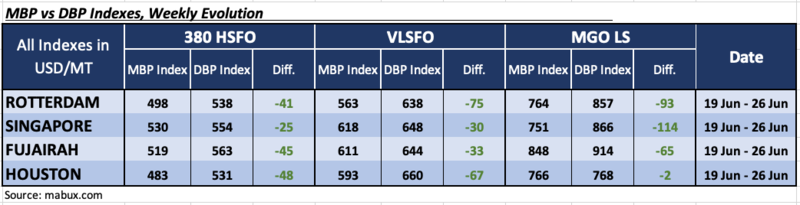

In Week 26, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) continued to record undervaluation across all fuel segments in the world's four largest hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, weekly underprice averages rose further by 2 points in Rotterdam, 4 points in Singapore, 5 points in Fujairah, and 7 points in Houston.

In the VLSFO segment, average weekly undervaluation levels increased by 1 point in Fujairah, but decreased by 1 point in Singapore and 3 points in Houston. In Rotterdam the MDI index has not changed.

In the MGO LS segment, weekly averages increased by 7 points in Rotterdam, 4 points in Singapore, and 23 points in Fujairah, but fell by 13 points in Houston. The MDI index in Houston approached the 100% correlation mark between the market price and the MABUX digital benchmark, while in Singapore, it remained consistently above the $100 mark.

Over the week, the balance of overvalued/undervalued ports did not change: all segments of bunker fuel remained undervalued in all selected ports. We expect this trend of fuel underestimation to continue next week.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on www.mabux.com.

A joint report from Lloyd’s Register (LR) and the World Liquefied Gas Association (WLGA) indicates that the market for dual-fuel LPG engines is poised for significant growth. LPG is highlighted as a ‘cleaner, lower carbon emission marine energy source than many alternatives currently available.' Despite this potential, the report notes that advancements in technology are crucial for LPG to become a practical option for shipowners and operators aiming to transition their fleets to low and zero-carbon vessels. To support the widespread adoption of LPG, the report emphasizes the need for a broader range of engine technologies. At present, there are no four-stroke marine engines capable of utilizing LPG, necessitating the decarbonization of auxiliary engines through alternative fuels. Additionally, the development of a robust and safe bunkering framework is essential to promote the uptake of LPG. Regulatory support for LPG is still in its infancy, with the International Maritime Organization (IMO) having recently published interim guidelines. The report underscores the importance of expanding these regulations to facilitate the transition to LPG as a viable marine fuel.

We expect the steady upward trend in the global bunker market to continue next week.

By Sergey Ivanov, Director, MABUX

All news