The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX)

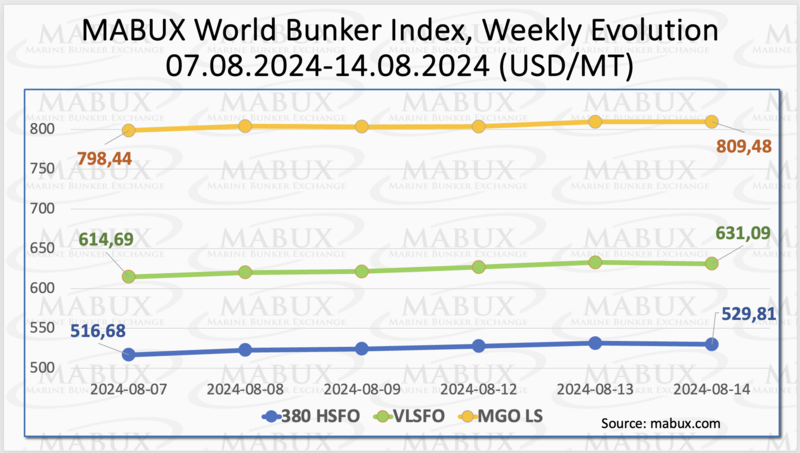

During Week 33, the MABUX global bunker indices resumed a moderate upward trend, marking the first increase in four weeks. The 380 HSFO index rose by USD 13.13: from USD 516.68/MT last week to USD 529.81/MT, once again surpassing the USD 500 mark. The VLSFO index increased by USD 16.40 (USD 631.09/MT versus USD 614.69/MT last week). The MGO index also added USD 11.04 (from USD 798.44/MT last week to USD 809.48/MT), exceeding the USD 800 threshold. As of the time of writing, the global bunker market continued to trend moderately upward.

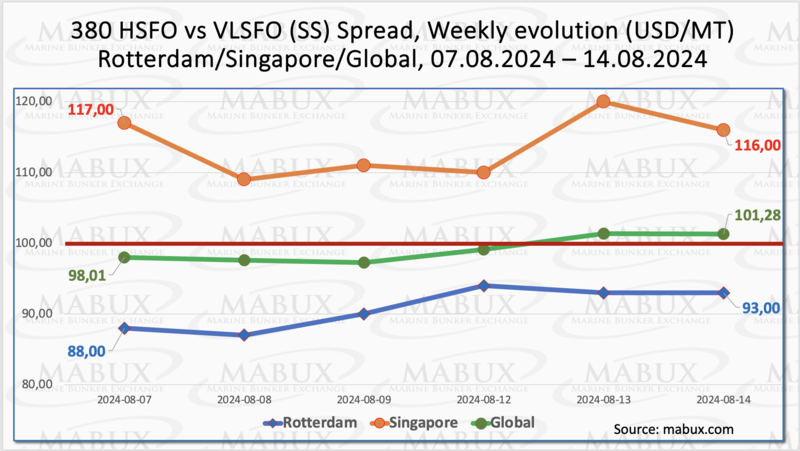

The MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed a moderate increase for the first time in six weeks: plus $3.27 (101.28 versus $98.01 last week), once again exceeding the $100.00 SS Breakeven mark. However, the weekly average declined by a symbolic $0.56. In Rotterdam, the SS Spread widened by $5.00 to $93.00 vs. $88.00 last week, approaching the $100.00 mark. The average weekly value in the port also added $14.33. In Singapore, the 380 HSFO/VLSFO spread narrowed by $1.00 from $117.00 last week to $116.00, though it remains comfortably above the $100.00 mark. The weekly average in Singapore showed a marginal decline of $0.34. Overall, the Global SS Spread and SS port indices indicate an upward trend that is likely to continue into the next week. More details are available in the “Differentials” section of www.mabux.com.

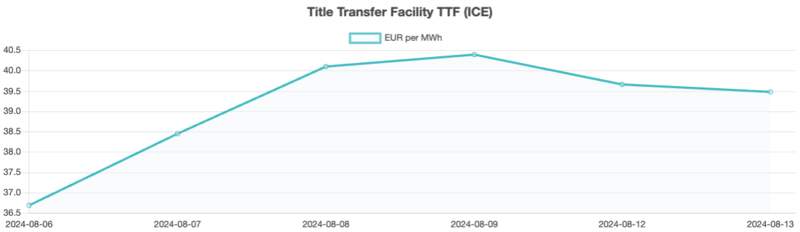

Gas prices in Europe surged last week amid concerns about supply from the Mediterranean due to escalating tensions between Israel and Iran. Increased demand for liquefied natural gas (LNG) in Asia is diverting more supply to the Asian continent, resulting in lower volumes for Europe, where prices are at a discount compared to spot prices in Asia. As of August 14, European gas storage facilities were 87.85% full. By the end of Week 33, the European gas benchmark TTF saw an increase of 2,804 EUR/MWh, rising from 36,676 EUR/MWh to 39,480 EUR/MWh, although a moderate decline began on August 12.

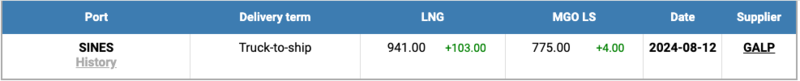

The price of LNG as bunker fuel in the port of Sines (Portugal) increased by USD 103 by the end of the week, reaching USD 941/MT on August 12, compared to the previous week. Meanwhile, the price differential between LNG and conventional fuel widened significantly on August 12, with MGO LS being USD 166 cheaper than LNG, a sharp increase from the USD 60 difference observed the week before. On the same day, MGO LS was quoted at USD 778/MT in the port of Sines. More detailed information is available in the LNG Bunkering section on www.mabux.com.

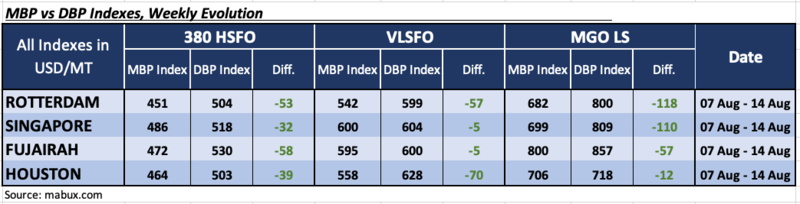

In Week 33, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) indicated underpricing of all types of bunker fuel across the world's four largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: The average weekly underpricing premium increased by 19 points in Rotterdam, 12 points in Singapore, 9 points in Fujairah, and 12 points in Houston.

• VLSFO segment: Singapore and Fujairah returned to the undercharge zone, resulting in all four ports being undervalued. The average weekly margins increased by 6 points in Rotterdam, 15 points in Singapore, 7 points in Fujairah, and 15 points in Houston. MDI indices in Singapore and Fujairah remain close to a 100% correlation mark between the market price and the MABUX digital benchmark.

• MGO LS segment: The weekly underpricing ratio rose by 14 points in Rotterdam, 6 points in Singapore, 16 points in Fujairah, and 7 points in Houston. MDI indices in Rotterdam and Singapore remained above the $100 mark.

Throughout the week, the balance of overvalued versus undervalued ports shifted toward underpricing. We expect this trend to continue into the next week.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on mabux.com.

Gibson Shipbrokers highlights the growing popularity of scrubbers for VLCCs, primarily due to the long distances these vessels travel and their high fuel consumption. The firm reports that the scrubber premium on a TD3C voyage has averaged $6,750 per day since the start of 2020, though it currently sits around $5,000 per day. Scrubbers are more commonly installed on newer vessels, with 74% of VLCCs under 10 years old equipped with the technology, compared to 47% of those built between 2005 and 2014. In other vessel segments, Gibson notes that approximately 29% of the existing Suezmax fleet and 23% of the Aframax/LR2 fleet are fitted with scrubbers. Adoption rates are lower for smaller vessels: 8% of the LR1/Panamax fleet, 17% of MRs, and just 2% of Handies have scrubbers installed. Gibson also points out that larger tankers, particularly those retrofitted with scrubbers in 2020/2021, have seen their investment pay off. However, for smaller tankers, the benefits are less certain, depending largely on installation dates, annual operating days, and trading patterns.

We anticipate the uptrend to prevail in global and regional bunker indices next week.

By Sergey Ivanov, Director, MABUX

All news