The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX) Week 47, 2024

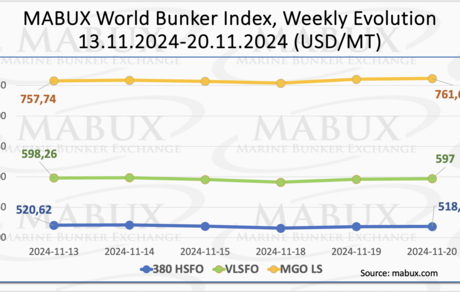

Over Week 47, the MABUX global bunker indices exhibited no clear trend and changed irregularly. The 380 HSFO index fell by another 2.13 USD: from 520.62 USD/MT last week to 518.49 USD/MT. The VLSFO index also decreased by 1.26 USD (597.00 USD/MT versus 598.26 USD/MT last week), breaking the 600 USD mark. Conversely, the MGO index, rose by 3.90 USD (from 757.74 USD/MT last week to 761.64 USD/MT). At the time of writing, the global bunker market remains without a definitive trend.

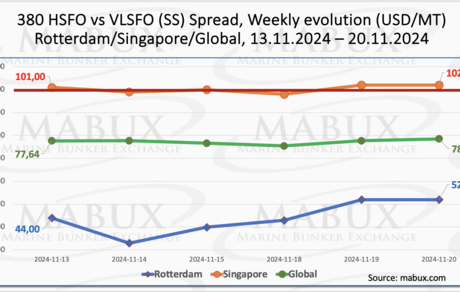

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - increased marginally by $0.87 (from $77.64 last week to $78.51), but staying well below the SS Spread breakeven mark of $100.00. The weekly average, on the contrary, decreased by $2.05. In Rotterdam, SS Spread showed growth: plus $8.00 ($52.00 versus $44.00 last week), with the weekly average up $2.67. In Singapore, the difference in the price of 380 HSFO / VLSFO widened by $1.00: from $101.00 last week to $102.00, with the index twice crossing the $100.00 mark during the week. However, the weekly average fell by $9.17. Overall, the SS Spread trend remains contracting, with values hovering near or below the $100 threshold. No significant changes in the 380 HSFO/VLSFO spread are anticipated next week. For more information, please visit the Differentials section of www.mabux.com.

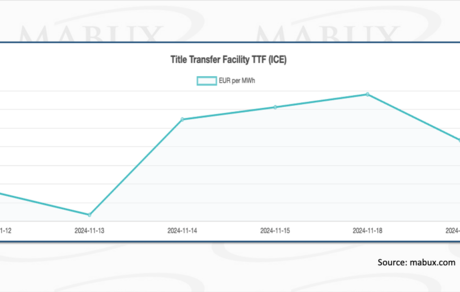

Gas indices in the EU are expected to remain stable through November, as high inventory levels help cushion against price swings. However, a forecasted cold snap may increase gas withdrawals, supporting prices amid strengthening winter demand. The competitiveness of the TTF index in the global LNG market will largely depend on regional price spreads, freight rates, and weather-driven demand shifts. As of November 18, European regional storage facilities were 90.30% full, a 2.74% decrease from the previous week. At the end of the 47th week, the European gas benchmark TTF continued to grow: plus 1.413 euros/MWh (45.668 euros/MWh versus 44.255 euros/MWh last week).

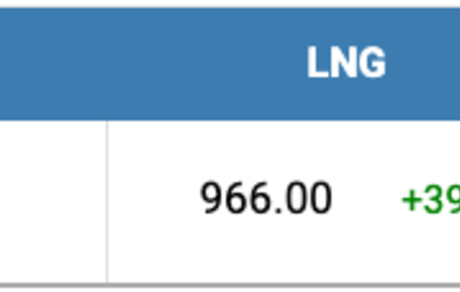

The price of LNG as a bunker fuel in the port of Sines (Portugal) continued to rise by the end of the week, increasing by USD 39 compared to the previous week and reaching USD 966/MT on November 18. Meanwhile, the price gap between LNG and conventional fuel also widened on November 18: USD 235 in favor of MGO LS versus USD 195 a week earlier: On the same day, MGO LS was quoted in the port of Sines at USD 731/MT. More detailed information is available in the LNG Bunkering section on www.mabux.com.

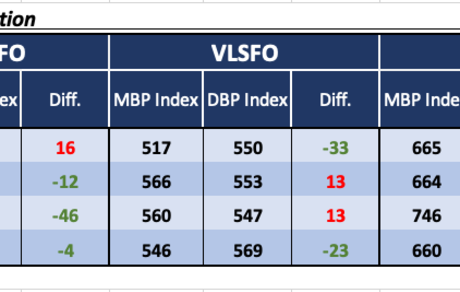

During Week 47, the MABUX Market Differential Index (MDI): the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index)) revealed the following trends across the four largest global hubs: Rotterdam, Singapore, Fujairah and Houston:

• 380 HSFO segment: Rotterdam remained the only overvalued port, with its weekly average increasing by 2 points. The other three ports were in the undervalued zone. Weekly averages decreased by 3 points in Fujairah and 6 points in Houston. The MDI index in Singapore was unchanged, while Houston’s index approached the 100% correlation mark between the market price and the MABUX digital benchmark.

• VLSFO segment: Rotterdam and Houston were in the undervalued zone, where the weekly averages fell by 7 and 15 points, respectively. Singapore and Fujairah continued to be overvalued. The weekly averages declined by 6 points in Singapore and by 3 points in Fujairah.

• MGO LS segment: All four selected ports stayed in the undervalued zone. The weekly averages increased by 5 points in Rotterdam, 14 points in Singapore, and 8 points in Fujairah, but decreased by 3 points in Houston. The MDI index in Singapore exceeded the $100.00 mark.

The balance of overvalued/undervalued ports has not changed at the end of the week. The overall trend suggests continued undervaluation of bunker fuel prices across key ports.

More detailed information on the correlation between market prices and the MABUX digital benchmark is available in the Digital Bunker Prices section of www.mabux.com.

A new report from UCL and UMAS reveals that emissions reductions in international shipping have stagnated since 2018, underscoring the need for intensified efforts to improve fleet efficiency and cut carbon intensity. The report highlights that while international shipping emissions fell between 2008 and 2014, they returned to 2008 levels by 2018 and have since remained largely unchanged through 2022. This trend starkly contrasts with the International Maritime Organization’s (IMO) goal of reducing absolute emissions by 20-30% by 2030 from 2008 levels. The report also suggests that better alignment of shipping demand with fleet capacity in various segments could unlock substantial carbon intensity reductions. Higher fleet utilization, combined with larger average ship sizes, could offset the slight declines in individual ship technical efficiency and maintain slower average speeds seen in 2022.

The global bunker market is expected to continue showing mixed fluctuations with no clear trend in the coming week. Geopolitical tensions could lead to momentary price surges.

By Sergey Ivanov, Director, MABUX