Data from VesselsValue reveals that the total value of the Chinese newbuilding orderbook has reached $123 billion, with container vessel orders comprising approximately 38% of the total.

China Merchants Shipping led Chinese companies in new vessel orders last year, contracting for 28 vessels worth USD 4.4 billion. Their investments focused on the tanker and LNG sectors, each accounting for approximately 33% of their orders, with additional orders for bulk carriers and vehicle carriers.

COSCO Shipping Lines ranked second, with orders for 18 New Panamax container vessels (13,400-14,000 TEU) totaling USD 3.06 billion.

Other significant orders came from COSCO Shipping Development (20 bulkers, USD 929 million), COSCO Shipping Bulk (10 vessels including Newcastlemax and ore carriers, USD 822 million), and China Shipbuilding Trading (22 Panamax newbuildings, USD 778 million).

Seacon Shipping Group also placed 26 new orders, primarily for tankers, valued at USD 738 million.

Newbuilding prices have reached their highest point since 2009 due to increased steel prices, limited yard availability, and high demand. The Red Sea crisis contributed to this imbalance, boosting earnings expectations and prompting orders across the container, tanker, and LNG sectors.

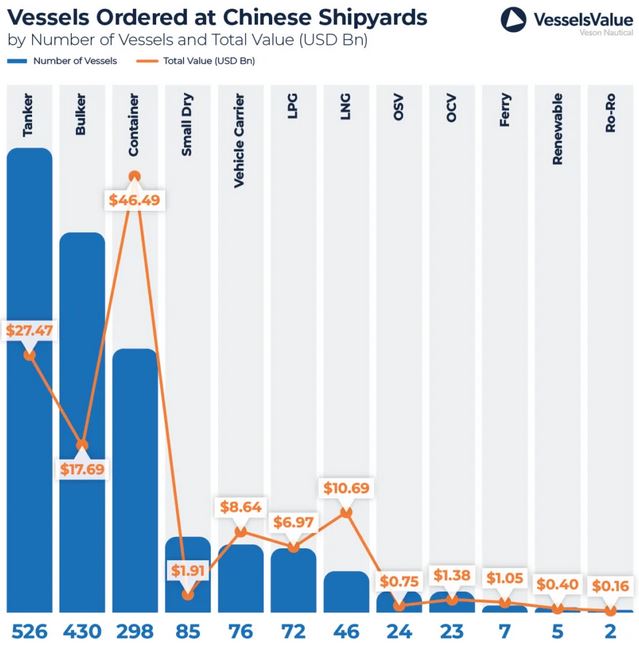

Tankers were the most popular vessel type ordered in 2024 (526 vessels, USD 27.4 billion), followed by bulkers (430 vessels, USD 17.7 billion).

While container orders ranked third in number (298 vessels), their total value (USD 46 billion) surpassed all other sectors due to significant gains in container vessel values.

Container newbuildings saw the smallest value increase, making them attractive investments. For example, the value of 7,000 TEU Post Panamax newbuildings rose by approximately 14.45%, while 20-year-old Post Panamaxes saw an approximately 114.99% increase.