The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

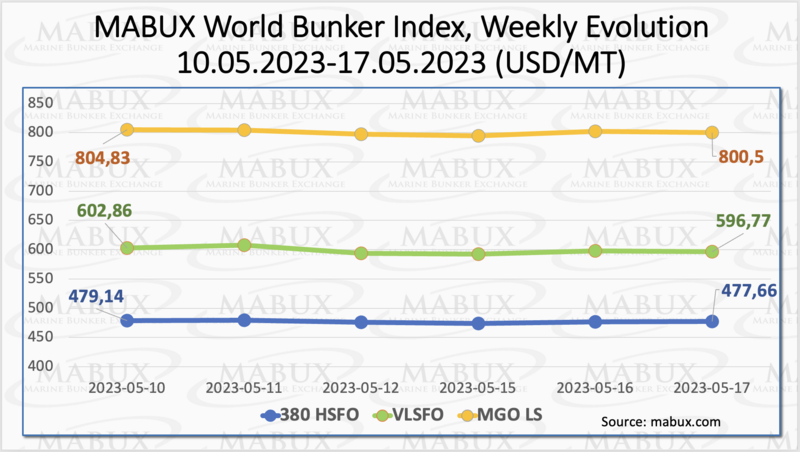

In Week 20, the global MABUX bunker indices declined moderately. The 380 HSFO index dropped by 1.48 USD to 477.66 USD/MT, remaining below 500 USD. The VLSFO index fell by 6.09 USD to 596.77 USD/MT, crossing the 600 USD threshold. The MGO index decreased by 4.33 USD to 800.50 USD/MT. The market downtrend persisted at the time of writing.

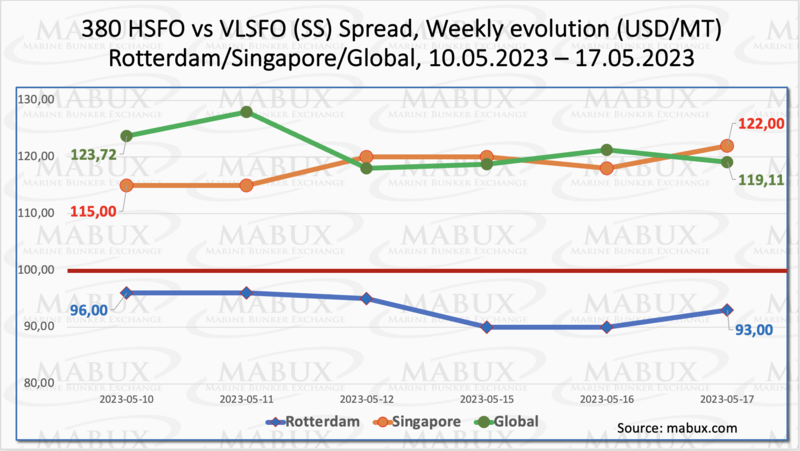

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - decreased by 4.61 USD to 119.11 USD, approaching the psychological mark of 100 USD. The weekly average only decreased by 0.88 USD. In Rotterdam, the SS Spread dropped by 3 USD to 93.00 USD, staying well below 100 USD. The weekly average SS Spread in Rotterdam lost 2.34 USD. In Singapore, the 380 HSFO/VLSFO price difference slightly increased by 7 USD to 122 USD, while the average weekly value decreased by 12.50 USD. Overall, the downward trend in the SS Spread continues. More information is available in the Differentials section of www.mabux.com.

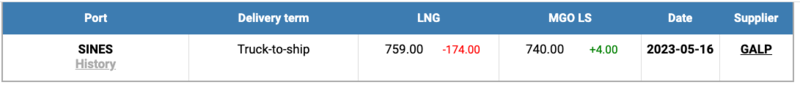

Low demand for natural gas has sent Europe’s benchmark gas prices towards a seventh consecutive weekly loss—the longest run of weekly losses since 2020. Lower power demand amid mild spring weather in most of Europe is depressing gas prices, while comfortable inventories of gas have not yet led to any rush for filling storage sites ahead of the next winter. Spot LNG prices for delivery to North Asia in June have also plunged in recent weeks amid weak demand and high inventories in key Asian importers.

The price of LNG as bunker fuel in the port of Sines, Portugal, has continued its decline and reached 759 USD/MT on May 15, which is a decrease of 174 USD compared to the previous week. Consequently, the price difference between LNG and conventional fuel has significantly narrowed, reaching 19 USD on May 15. On that day, MGO LS in the port of Sines was quoted at 740 USD/MT. This convergence in prices indicates that LNG is once again becoming a competitive fuel option and could be considered as a potential driver for the further development of the LNG fleet. More information is available in the LNG Bunkering section of www.mabux.com.

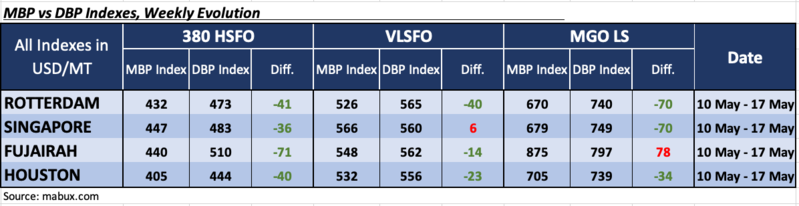

During week 20, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index)) registered an undervaluation of 380 HSFO fuel in all four selected ports. The average weekly underprice levels increased in Rotterdam and Singapore by 2 and 4 points, respectively. Conversely, Fujairah experienced a decrease of 4 points, while Houston's underprice level remained unchanged.

In the VLSFO segment, Singapore entered the overcharge zone with a positive 6-point value according to MDI. The other three ports continued to be undervalued, with the average underprice premium increasing between $4 and $18.

As for the MGO LS segment, three ports: Rotterdam, Singapore, and Houston - were still underestimated. The average weekly undercharge ratio for these three ports increased by 1-5 points. Fujairah remained the only overvalued port, but the overcharge premium significantly reduced by minus $71.

For more detailed information on the correlation between market prices and the MABUX digital bunker benchmark, please refer to the "Digital Bunker Prices" section at www.mabux.com.

Some 4,253 million metric tonnes (mt) of marine fuel were sold in Singapore last month – 13.4% up on the 3,750 million mt registered in April 2022. For the second time this year, sales of VLSFO (2,034 million mt) surpassed the 2 million mt mark. Sales of HSFO 380 cSt (1,164,800 mt) rose 27.4% year-on-year (y-o-y) but slipped 5.7% month-on-month (m-o-m). Similarly, sales of MGO LS (312,100 mt) increased y-o-y but fell on the month. During the first four months of the year a total of 16,600,000 mt of marine fuel has been sold at the world’s biggest bunker hub – 10.3% up on the 15,052,200 mt sold in the corresponding period in 2022. The 3,495 calls for bunkers in April was the highest monthly total of the year to date.

We expect that the global bunker market retains the potential for further declines. Bunker indices may continue the downtrend next week.

By Sergey Ivanov, Director, MABUX

All news