The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

The global MABUX bunker indices displayed a consistent downward trajectory by the end of the 22nd week. The 380 HSFO index decreased by 9.38 USD, falling from 487.89 USD/MT in the previous week to 478.51 USD/MT, and remaining consistently below the 500 USD mark. Similarly, the VLSFO index dropped by 14.30 USD, reaching 590.26 USD/MT compared to 604.56 USD/MT last week, descending below the 600 USD threshold. The MGO index declined by 24.23 USD, from 800.68 USD/MT in the previous week to 776.45 USD/MT, ultimately falling below the 800 USD mark. At the time of writing, the downward trend in bunker indices has persisted.

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - experienced a moderate decline of $4.92, standing at $111.75 compared to $116.67 in the previous week, inching closer to the psychologically significant $100 threshold. At the same time, the weekly average decreased by a lesser amount: minus $2.13. In Rotterdam, the SS Spread, on the other hand, advanced $5.00 to $97.00, still below $100. The weekly average of the SS Spread in Rotterdam added $1.50. In Singapore, the price difference of 380 HSFO/VLSFO also increased by $1.00 ($132 vs. $131.00 last week), while the weekly average increased by $13.84. Overall, SS Spread values remain stable and fluctuate around the $100 mark. More information is available in the "Differentials" section of www.mabux.com.

The combination of ample inventories at the end of a mild winter, steady imports of LNG, and weak demand has led to eight consecutive weeks of weekly losses in European benchmark natural gas prices, the longest weekly losing streak in more than six years. Besides, currently, gas inventories are comfortably high for this time of the year. As of May 24, natural gas storage sites in the EU were 66.71% full. The level of gas in storage is the highest for this time of the year in at least a decade.

The price of LNG as bunker fuel showed a significant decline in week 22. In the port of Rotterdam (Netherlands), the price of LNG on May 31 reached 548 USD/MT (minus 83 USD compared to a week earlier). Thus, LNG in Rotterdam is currently priced 116 USD lower than conventional fuel MGO LS (664 USD/MT as of May 31).

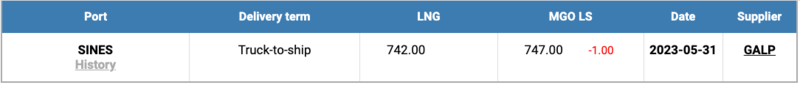

In the port of Sines (Portugal), the price of LNG as bunker fuel remained steady at 742 USD/MT, making it 5 USD cheaper than MGO LS (747 USD/MT as of May 31). The availability of cheaper LNG as an alternative bunker fuel is once again capturing the attention of market participants, making it an attractive choice. More information is available in the LNG Bunkering section of www.mabux.com.

During week 22, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the digital bunker benchmark MABUX (MABUX DBP Index)) maintained an undervaluation of 380 HSFO fuel in all four selected ports. Weekly average of the undercharge rose in Rotterdam, Singapore and Fujairah in the range from 1 to 16 points. In Houston, the MDI remained unchanged at minus $39.

In the VLSFO segment, Singapore remained the only port where overcharge was observed according to the MDI. The overprice average decreased there by 4 points. The remaining three ports were undervalued, with average levels up 7 points in Fujairah and 3 points in Houston, and down 1 point in Rotterdam.

In the MGO LS segment, three ports remain undervalued: Rotterdam, Singapore and Houston. The average weekly undervaluation level rose in Rotterdam (plus 5 points), but decreased in Singapore and Houston: minus 3 and minus 11 points, respectively. Fujairah remained the only overvalued port, where the revaluation level saw another reduction of minus $16.

For more detailed information on the correlation between market prices and the MABUX digital bunker benchmark, please refer to the "Digital Bunker Prices" section at www.mabux.com.

A report published by Climate Analytics and Solutions for Our Climate says that the ‘uptake shipping capacity far exceeds global forecasts of LNG trade as the world transitions away from fossil fuels’ – and consequently many of the LNG carriers now being built could become ‘stranded assets’. The findings of the report were ‘especially relevant’ to South Korea, which dominates the global LNG shipbuilding industry. According to Dongjae Oh, the oil and gas finance program lead at Solutions for Our Climate: ‘The risk is imminent for Korean shipbuilders who are highly reliant on building hundreds of LNG carriers that a net-zero world will not need, and that they may not even be paid for.’ The report says that the current ‘surge’ in orders for LNG carriers has been ‘largely driven by the oil and gas industry’s dash for LNG following conflict in Ukraine’. But it added that: ‘Under growing pressure to decarbonise, governments around the world have announced pledges and adopted policies that would render much of the new LNG vessels useless.’

We expect there are no uptrend drivers in the global market so far. Bunker indices may show a moderate decline in the upcoming week.

By Sergey Ivanov, Director, MABUX

All news