The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

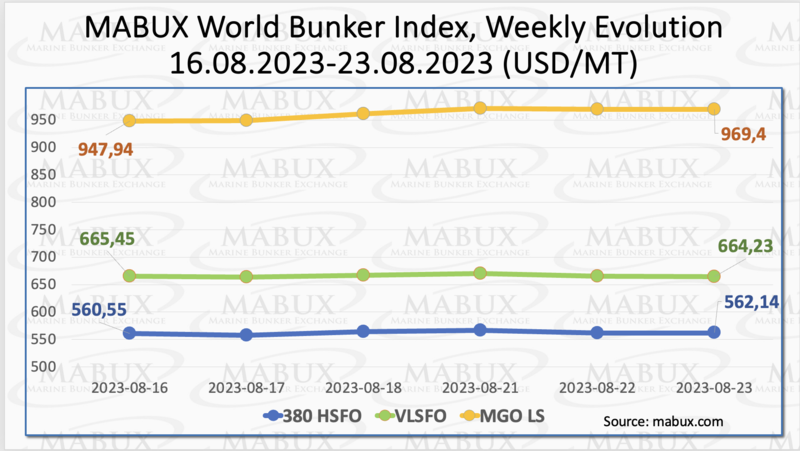

During the Week 34, the MABUX global bunker indices did not show a sustainable trend, changing irregular. The 380 HSFO index rose by 1.59 USD from 560.55 USD/MT last week to 562.01 USD/MT. Conversely, the VLSFO index fell by 1.22 USD (664.23 USD/MT versus 665.45 USD/MT last week). The MGO index recorded a significant rise by 21.46 USD (surging from 947.94 USD/MT last week to 969.40 USD/MT). As of the time of writing, the market was showing a moderate downtrend.

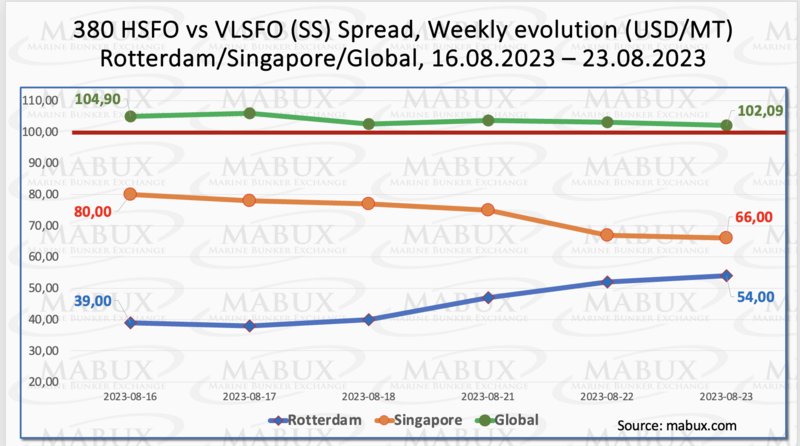

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed a slight decline: minus $2.81 ($102.09 vs. $104.90 last week), while remaining close to the $100.00 mark (SS breakeven point). The weekly average, on the contrary, increased by $2.40. Rotterdam experienced a noteworthy upswing in the SS Spread, adding $15.00 in a single week, widening from $39.00 to $54.00. The weekly average of the SS Spread in Rotterdam also climbed by $8.83. Only in Singapore, the difference in the price of 380 HSFO/VLSFO decreased: minus $14.00 ($66.00 vs. $80.00 last week). The weekly average also showed a decline of $3.50. The current market conditions suggest the potential for a moderate upward correction of the SS Spread. More information is available in the "Differentials" section of www.mabux.com.

According to Global Data, there is a projected surge in LNG demand that will lead to a doubling of global capacity by 2027. The United States is poised to maintain its dominant position in the global LNG market, driving substantial capacity growth within the next four years. This growth is expected to contribute to 60% of the total new capacity additions for North America. The current annual global liquefaction capacity of 487.3 million tons is anticipated to expand significantly to 958 million tons. Europe is emerging as a significant catalyst for increased U.S. capacity in the LNG sector. Over the past 18 months, Europe has become one of the primary clientele for U.S. LNG traders. This trend is expected to continue, as the return of Russian pipeline gas supply remains uncertain. Sanctions notwithstanding, Russia is projected to achieve the second-largest growth in LNG capacity over the next four years, adding 67.5 million tons annually. This expansion is ahead of Qatar, which is forecasted to increase its capacity by 48 million tons annually.

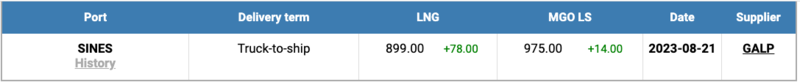

The price of LNG as bunker fuel in the port of Sines (Portugal) has once again experienced a notable increase, reaching 899 USD/MT on August 21. This marks an uptick of 78 USD in comparison to the previous week. Concurrently, the price gap between LNG and traditional fuel as of August 21 has narrowed to 76 USD, favoring LNG. On the same day, MGO LS was priced at 975 USD/MT at the Sines port. More information is available in the LNG Bunkering section of www.mabux.com.

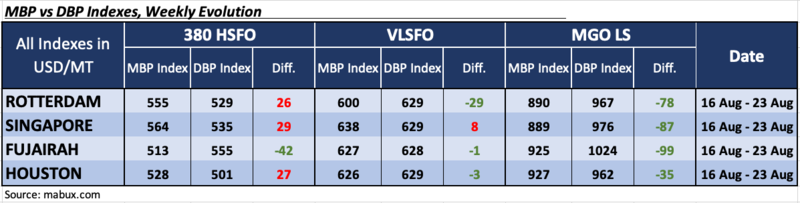

During Week 34, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the digital bunker benchmark MABUX (MABUX DBP Index)) displayed some signs of market stabilization while the undervalued trend continued to dominate.

In the 380 HSFO segment, Fujairah remained the only port with an undervalued status, with the average weekly ratio decreasing by 1 point. In the other three ports, the MDI index registered an overpricing. Weekly average premium decreased in Rotterdam by 9 points but rose in Singapore by 9 points. In Houston, the MDI index remained changed.

Within the VLSFO segment, MDI indicated that only Singapore showed an overcharge, with the weekly average rising by 6 points. The other ports maintained an undervalued status. The weekly average ratio in Rotterdam remained unchanged, but Fujairah and Houston both saw decreases of 9 and 21 points respectively. These two ports are nearly aligned with a 100% correlation between market prices and the digital benchmark.

In the MGO LS segment, all selected ports continued to be undervalued, with the average underpricing down 1 point in Rotterdam and 5 points in Houston, but up 14 points in Singapore and 1 point in Fujairah.

Given the current market stabilization, it is expected that the MDI index will exhibit minimal changes in the coming week. For further information on the correlation between market prices and the MABUX digital benchmark, please refer to the "Digital Bunker Prices" section on www.mabux.com.

VPS reported, that currently 3.8% of all VLSFOs tested have at least one off-specification parameter. This compares favourably with the off-specification rates for HSFO fuels at 11.4% and MGO fuels at 16.9%. However, the VLSFO off-specifications are potentially more concerning than some of those associated with HSFO and MGO. Sulphur, water, cold-flow properties and cat-fines are the most frequent of VLSFO off-specification parameters. Sulphur off-specification is the most common of all VLSFO off-specifications, with over 30% of all off-specifications being attributed to this one parameter. However, recent test results have shown that sulphur off-specification is certainly better today than it was back in 2021, with only 1.6% of VLSFOs tested being >0.50% Sulphur compared to 2.4% >0.50% in 2021. Also, this year suppliers are producing more fuel in the 0.41%-0.46% Sulphur range, than the 0.47%-0.50% range, than over the past two years, which means that there is less chance of the VLSFOs falling outside of the 95%-confidence interval, or being off-specification.

We consider the global bunker market is currently in the mode of forming a sustainable trend. Irregular changes in global bunker indices will prevail next week.

By Sergey Ivanov, Director, MABUX

All news