The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

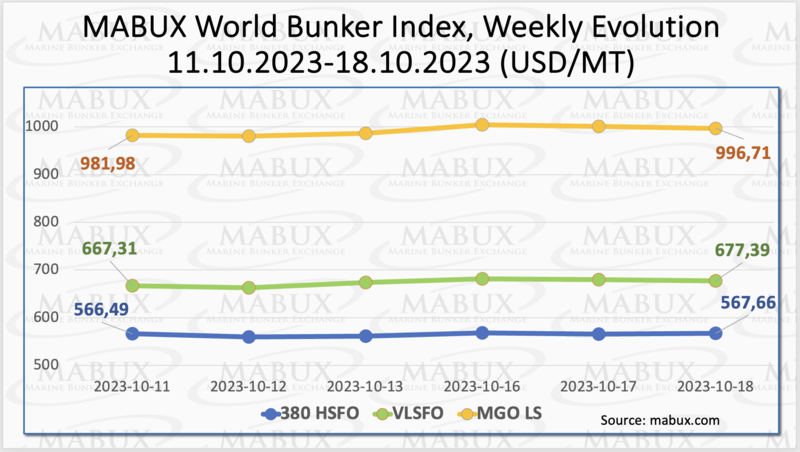

Over the Week 42, the MABUX global bunker indices turned into an upward trend, primarily driven by the escalating conflict in the Middle East.The 380 HSFO index rose by 1.17 USD: from 566.49 USD/MT last week to 567.66 USD/MT. The VLSFO index, in turn, added 10.08 USD (677.39 USD/MT versus 667.31 USD/MT last week). The MGO index increased by 14.73 USD (from 981.98 USD/MT last week to 996.71 USD/MT, being at the 1000 USD mark. At the time of writing, the upward trend in the market continued.

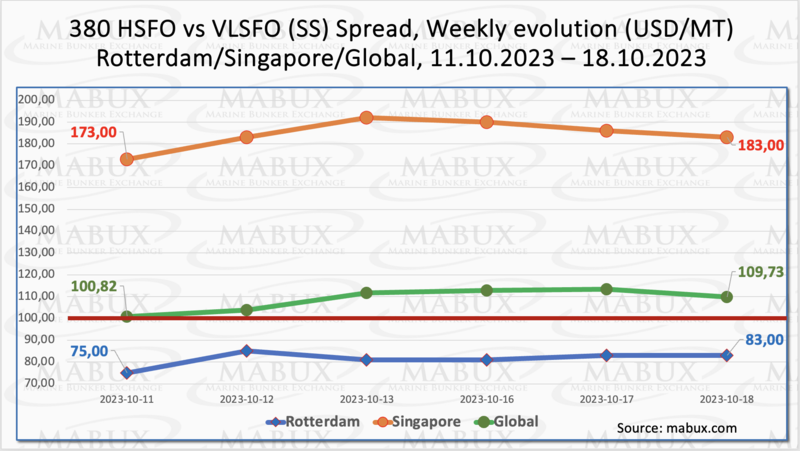

Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - continued to widen: plus $8.91 ($109.73 versus $100.82 last week) . It remained consistently above the $100.00 mark, which is the SS breakeven point. The weekly average also surged by $10.69. In Rotterdam, SS Spread saw a growth of $8.00 (from $75.00 last week to $83.00) and the average rose by $6.00. Singapore observed a $10.00 increase in the price difference of 380 HSFO/VLSFO, with the weekly average widening by $14.00. Due to high volatility in the fuel market, we expect that the SS Spread may continue to grow moderately in the upcoming week. More information can be found in the “Differentials” section of www.mabux.com.

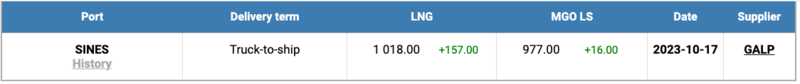

Gas prices have soared over recent days, with geopolitical volatility rattling spot markets and escalating fears of supply shortages this winter. Hamas’ attack on Israel has introduced fresh uncertainty into markets, with the country closing its Tamar gas field in the Mediterranean. There are also fears of sabotage in Europe, after a leak was identified on a 77km-long Baltic Sea gas pipeline between Finland and Estonia.

The price of LNG as bunker fuel in the port of Sines (Portugal) increased sharply and reached 1018 USD/MT on October 17 (plus 157 USD compared to the previous week). The difference in price between LNG and conventional fuel on October 17 was again in favor of MGO for the first time since July 11, 2023: 41 USD versus 112 USD in favor of LNG a week earlier: MGO LS was quoted that day in the port of Sines at 977 USD/MT. More information is available in the LNG Bunkering section of www.mabux.com.

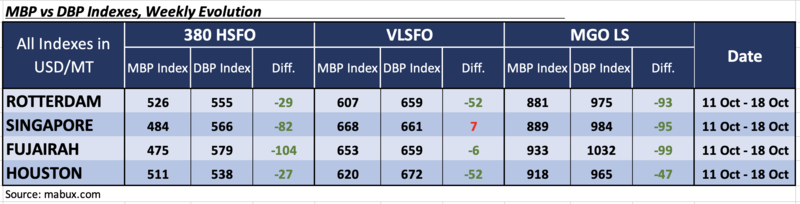

During the 42nd week, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the digital bunker benchmark MABUX (MABUX DBP Index)) recorded the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four ports were undervalued. Average weekly underpricing increased by 4 points in Rotterdam, but decreased by 4 points in Fujairah and 7 points in Houston. The MDI index in Singapore remained unchanged. In Fujairah, fuel underpricing level continued to exceed the $100.00 mark.

In the VLSFO segment, according to the MDI, Singapore shifted into the overcharge zone, with its weekly average increased by 12 points. In the other three ports, VLSFO remained undervalued. Average levels of undervaluation fell by 1 point in Rotterdam, 6 points in Fujairah and 9 points in Houston.

In the MGO LS segment, the average undercharge premium showed an increase in Rotterdam by 11 points and in Houston by 12 points, but decreased in Singapore by 8 points and in Fujairah also by 8 points. In Fujairah, fuel underpricing has dropped below the $100.00 mark.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

In the recent review, the United Nations Conference on Trade and Development (UNCTAD) issued a warning regarding carbon dioxide emissions statistics for 2012 and 2022 within the context of the 33 primary flags of registration. The findings indicate that the majority of flag states have experienced an increase in shipping emissions. According to UNCTAD, the shipping industry's greenhouse gas emissions, which constitute 3% of the global total, have surged by 20% over the past decade. Without proactive measures, emissions could potentially reach 130% of their 2008 levels by 2050. Complicating this situation is the presence of an aging global fleet, with the average age of ships as of early 2023 standing at 22.2 years. Over half of these vessels are now older than 15 years, rendering many of them unsuitable for retrofitting or premature for scrapping. The UN agency underscores that while alternative fuels hold promise, their widespread adoption is still in its nascent stages, as a staggering 98.8% of the current fleet continues to rely on fossil fuels. However, there is a silver lining to this situation, as 21% of vessels on order are set to operate on cleaner alternatives such as liquefied natural gas, methanol, and hybrid technologies.

The ports of Antwerp-Bruges and Rotterdam have jointly announced a new regulation stipulating that fuel supply vessels operating in both ports must install a certified bunker measurement system by January 1, 2026. In late 2022, these ports had already expressed their intention to enforce the compulsory use of mass flow meters (MFMs). At the time, they indicated that the subsequent step would involve identifying suitable MFMs and establishing a specific implementation date during the first half of 2023. Currently, out of the 170 bunker vessels in operation across Rotterdam, Antwerp, and Zeebrugge, only 40 are currently equipped with a bunker measurement system. Recognizing the significant impact this mandate will have on the sector, the ports have emphasized that the 2026 commencement date has been chosen to allow ample time for companies in the bunker supply chain to adapt to this new requirement.

We expect that the upward trend in the bunker market will persist in the week ahead, driven by the escalating conflict in the Middle East.

By Sergey Ivanov, Director, MABUX

All news