The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

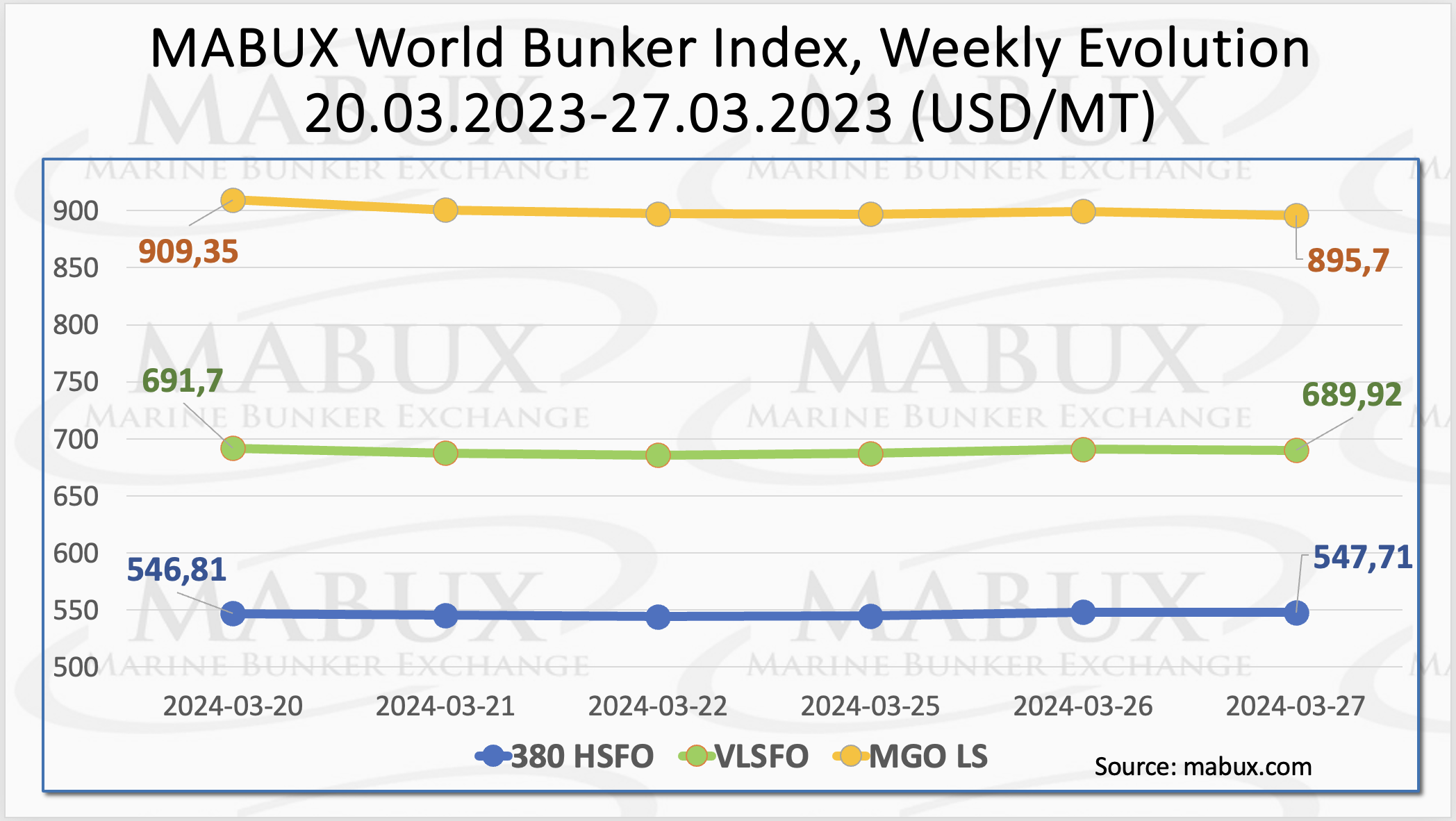

Over the 13th week, the MABUX global bunker indices generally indicated a moderate decline. HSFO index saw a marginal increase of 0.9 USD, rising from 546.81 USD/MT to 547.71 USD/MT. Conversely, the VLSFO index decreased by 1.78 USD, settling at 689.92 USD/MT compared to 691.70 USD/MT the previous week, remaining below the 700 USD threshold. The MGO index experienced a more pronounced decline of 13.65 USD, dropping from 909.35 USD/MT to 895.70 USD/MT, breaching the 900 USD mark. As of the report's writing, this downward trend in the global bunker market persisted.

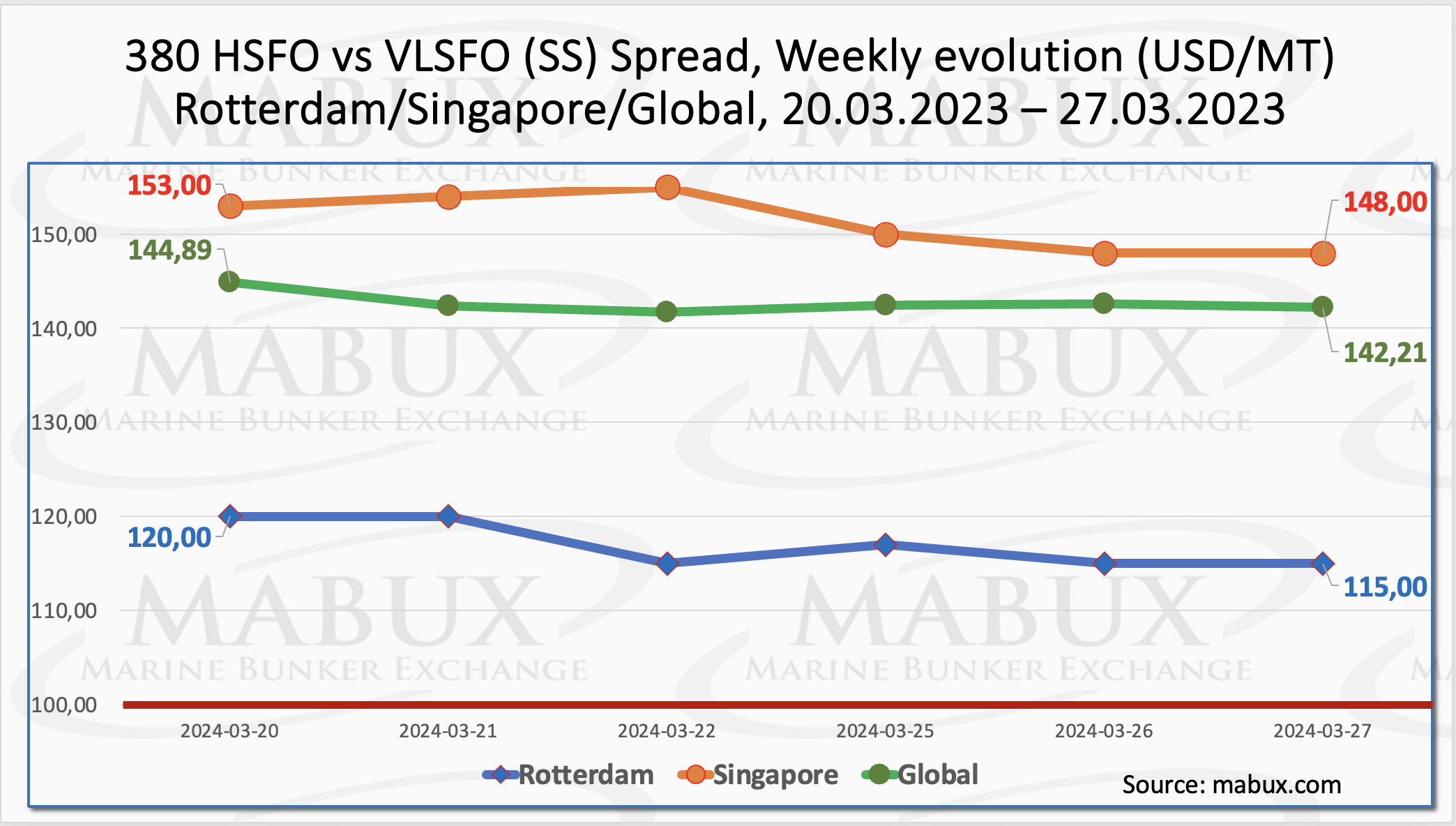

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO – showed a moderate reduction of $2.68 ($142.21 compared to $144.89 last week). The average weekly value saw a negligible decrease of $0.01. Rotterdam witnessed a $5.00 decrease in the SS Spread, falling from $120.00 to $115.00, nearing the $100 benchmark (SS Breakeven). The average weekly value in the port also declined by $7.83. In Singapore, the price difference between 380 HSFO/VLSFO narrowed by $5.00 ($148.00 versus $153.00 last week), with the average weekly value decreasing by $5.50. We expect this moderate decline in the SS Spread to persist in the upcoming week. More detailed information is available in the "Differentials" section on www.mabux.com.

By 2030, it is projected that new liquefaction projects will amplify LNG production to approximately 50% more than today's global LNG trade. This expansion is expected to alleviate market constraints and foster price stability. LNG supply is anticipated to offer the greatest flexibility in adjusting to fluctuations in European gas demand. As of February 2024, global LNG imports remained relatively stagnant compared to the previous year, registering at 33.74 Mt. Nevertheless, the Asia Pacific, LAC, and MENA regions experienced upticks in LNG imports, counterbalancing the subdued imports observed in Europe and North America. From January to February 2024, global LNG imports increased by 3.7% (equivalent to 2.61 Mt year-on-year), reaching a total of 72.79 Mt, with Asia Pacific being the primary driver of this growth.

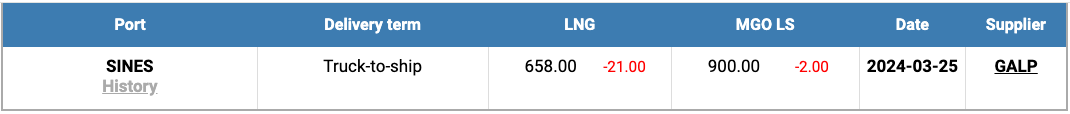

On March 25, the price of LNG as bunker fuel in the port of Sines, Portugal, dropped to 658 USD/MT, marking a decrease of 21 USD compared to the previous week. Concurrently, the price gap between LNG and conventional fuel remained consistent, with LNG holding a 242 USD advantage. On that same day, MGO LS was priced at 900 USD/MT in the port of Sines. For further details, refer to the LNG Bunkering section on www.mabux.com.

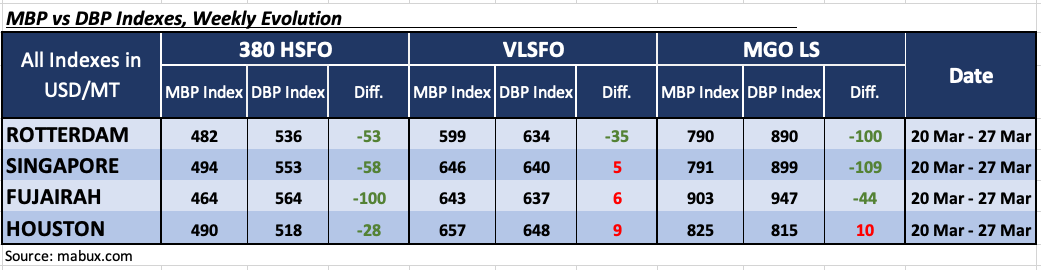

During Week 13, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four selected ports remained undervalued. The average weekly undercharge margins decreased by 7 points in Rotterdam, 3 points in Fujairah, and 5 points in Houston. Fujairah's MDI index remained above the $100 mark throughout the week.

As for the VLSFO segment, according to MDI, Rotterdam remained the only undervalued port, with the average weekly ratio increasing by 2 points. The remaining ports were overpriced, with Singapore and Fujairah seeing an 8-point decrease and Houston a 6-point increase in average weekly margins.

In the MGO LS segment, Houston stood as the only overpriced port, with a 1-point weekly margin increase. The other three ports were underpriced, with Rotterdam and Fujairah experiencing a decrease of 4 and 10 points, respectively, while Singapore saw a 4-point increase. Rotterdam and Singapore's MDI indices remained slightly above the $100 mark.

The overall balance between undervalued and overvalued ports across the 380 HSFO, VLSFO, and MGO LS segments remained steady throughout the week. The MDI index trends for 380 HSFO and VLSFO segments are gradually tilting towards the undervaluation zone.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of www.mabux.com.

A recent report by Wärtsilä suggests that the cost of sustainable marine fuels could reach parity with conventional bunkers by 2035, contingent upon the implementation of robust emissions policies such as carbon taxes and emissions limits. According to the report, initiatives like the EU Emissions Trading Scheme (ETS) and the FuelEU Maritime Initiative (FEUM) are projected to more than double the cost of using fossil fuels by 2030. By 2035, these policies are expected to narrow the price differential between fossil fuels and sustainable alternatives for the first time. The shipping industry currently grapples with a 'chicken and egg' dilemma concerning the adoption of alternative fuels. Wärtsilä emphasizes that without clear demand signals, suppliers find it challenging to ramp up production effectively. To address this issue, Wärtsilä has developed new models predicting the availability and cost of various fuels on a global scale over time. The report underscores the need for decisive policy implementation, industry collaboration, and proactive measures by individual operators to expedite the transition to sustainable marine fuels. By aligning these efforts, the shipping industry can accelerate the production and adoption of eco-friendly fuels, ultimately contributing to a more sustainable future.

We foresee a continued moderate downward trend in the global bunker market in the upcoming week.

By Sergey Ivanov, Director, MABUX