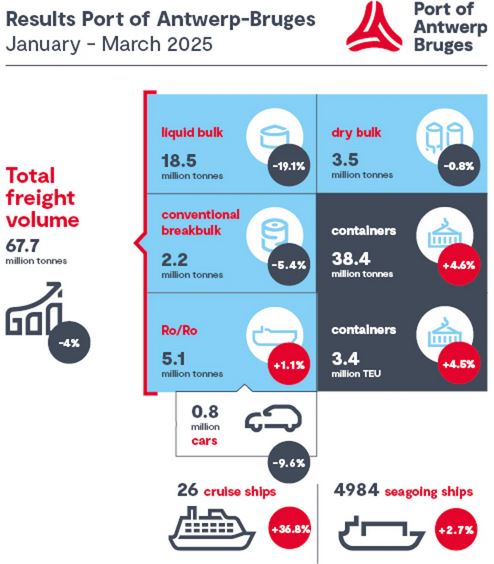

In the first quarter of 2025, Port of Antwerp-Bruges handled 67.7 million tonnes of cargo, a 4.0% decrease compared to the same period in 2024, according to the company's release.

In the first quarter of 2025, Port of Antwerp-Bruges handled 67.7 million tonnes of cargo, a 4.0% decrease compared to the same period in 2024, according to the company's release.

The decline was primarily due to a significant drop in bulk volumes, though container throughput increased. As the United States remains its second-largest trading partner, the port is monitoring the evolving trade environment for potential tariff impacts.

Container throughput rose by 4.6% in tonnage and 4.5% in TEUs compared to Q1 2024, despite geopolitical uncertainties and container alliance restructuring. However, transitions to new alliances and strikes at other ports led to longer container dwell times, increasing pressure on terminal capacity.

The port’s market share in the Hamburg-Le Havre Range grew to 30.5% in 2024, and globally, it advanced from 15th to 14th among the largest container ports.

Liquid bulk throughput fell by 19.1%, driven by declines in gasoline, naphtha, and LNG due to changed market conditions in Africa, reduced petrochemical demand, and EU sanctions on Russian LNG transshipment.

Chemical throughput increased by 10.9%, largely due to a 128% rise in biofuels, though without this, the segment would have declined by 1.7%.

Conventional general cargo decreased by 5.4%, with iron and steel throughput dropping 14.3% due to a weak economic climate and import quotas.

Roll-on/roll-off (RoRo) throughput grew by 1.1%, despite an 11.3% decline in new car throughput, offset by increases in unaccompanied freight.

Dry bulk remained nearly stable, with a 0.8% decline.

The impact of U.S. import tariffs on port traffic remains limited. Container exports to the U.S. increased by 3.2%, steel exports peaked temporarily in January, and car exports to the U.S. fell by 20%, aligning with an overall decline in car exports.

Jacques Vandermeiren, CEO of Port of Antwerp-Bruges, stated: "We are in particularly uncertain times, which makes it difficult to predict what 2025 will bring next. But as in previous crises, our port is showing resilience and operational reliability. That stability is critical, both for our customers and for the broader economy. At the same time, the protectionist measures taken by the United States make it clear that Europe needs to make a stronger commitment to robust economic policies in order to strengthen our industry and anchor its strategic position."

Formed in 2022 through the merger of the ports of Antwerp and Zeebrugge, Port of Antwerp-Bruges is a major European port handling 278 million tonnes of cargo annually. It serves as a critical hub for containers, breakbulk, vehicles, and chemicals, hosting 1,400 companies, including Europe’s largest integrated chemical cluster.