The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX)

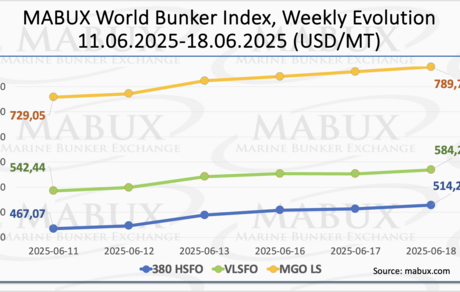

At the close of the 25th week, the global bunker indices published by MABUX recorded a sharp increase, driven by the escalating conflict in the Middle East. The 380 HSFO index surged by USD 47.17, rising from USD 467.07/MT to USD 514.24/MT, surpassing the USD 500.00 threshold. The VLSFO index climbed by USD 41.82, reaching USD 584.26/MT from USD 542.44/MT the previous week. Meanwhile, the MGO index posted a gain of USD 60.65, increasing from USD 729.05/MT to USD 789.70/MT. As of this writing, the upward trend continues to dominate the global bunker market.

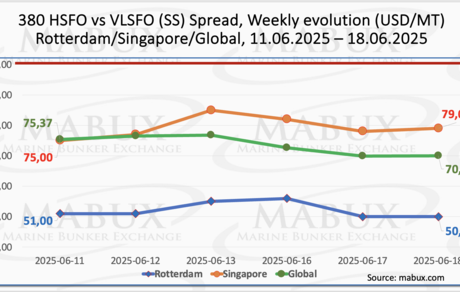

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—narrowed by $5.35, declining from $75.37 last week to $70.02. The weekly average also fell slightly, down $1.64. In Rotterdam, the SS Spread decreased by $1.00, from $51.00 to $50.00, although the weekly average at the port rose by $4.67. Conversely, in Singapore, the SS Spread widened by $4.00, increasing from $75.00 to $79.00, with the weekly average gaining $9.83. Minor and multidirectional fluctuations—without a clear upward or downward trend—continue to define the global and port-level SS Spread dynamics. At current levels, conventional VLSFO remains the most cost-effective option compared to 380 HSFO combined with a scrubber, with SS Spread values consistently below the breakeven threshold of $100.00. No significant changes in SS Spread dynamics are expected in the coming week. Additional details can be found in the Differentials section of www.mabux.com.

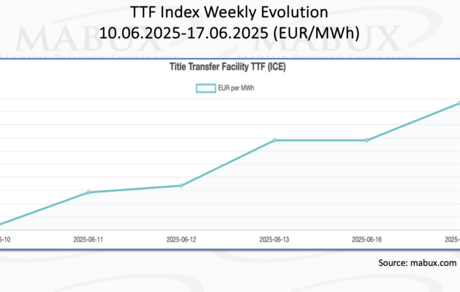

The European Parliament and EU member states have tentatively agreed to ease natural gas storage requirements, permitting a 10-percentage point deviation from the 90% fill target. The move addresses concerns from several major gas-consuming countries, which warned they may need to subsidise storage in unfavourable market conditions or miss the targets altogether. Additionally, EU countries are proposing to make the mandatory 90% storage target applicable at any point between 1 October and 1 December, rather than by the current 1 November deadline.

As of June 17, European regional gas storage facilities were 54.05% full—an increase of 2.26% compared to the previous week but 17.28% lower than at the start of the year (71.33%). The gradual refilling of storage sites continues. By the end of Week 25, the European gas benchmark TTF showed a clear upward movement, rising by €4.671/MWh to €39.309/MWh, compared to €34.638/MWh the previous week.

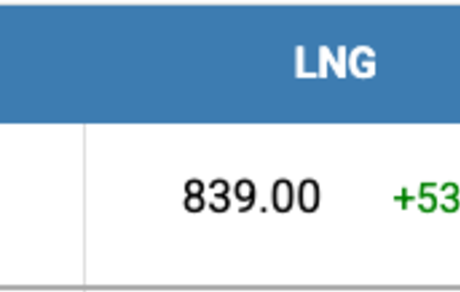

The price of LNG as a bunker fuel at the port of Sines (Portugal) resumed its upward trend by the end of the week, increasing by 53 USD to reach 839 USD/MT, compared to 786 USD/MT the previous week. At the same time, the price gap between LNG and conventional fuel narrowed to 83 USD in favor of conventional fuel, down from 91 USD the week before. On June 16, MGO LS was quoted at 756 USD/MT at the port of Sines. More detailed information is available in the LNG Bunkering section on the www.mabux.com website.

At the end of Week 25, the MABUX Market Differential Index (MDI)—which reflects the correlation between market bunker prices (MBP) and the MABUX Digital Bunker Benchmark (DBP)—showed the following trends across the 380 HSFO, VLSFO, and MGO LS segments:

• 380 HSFO segment: Rotterdam and Singapore moved into the undervalued zone, resulting in all four key ports—Rotterdam, Singapore, Fujairah, and Houston—being assessed as undervalued. Weekly average MDI values rose by 9 points in Rotterdam, 12 points in Singapore, and 3 points in Houston, while decreasing by 1 point in Fujairah. The MDI readings for Rotterdam and Singapore remained close to the 100% correlation level between MBP and DBP.

• VLSFO segment: All four ports—Rotterdam, Singapore, Fujairah, and Houston—continued to be undervalued. Weekly average MDI values increased by 8 points in Rotterdam, 10 in Singapore, 9 in Fujairah, and 10 in Houston. Notably, Rotterdam reached a 100% correlation between MBP and DBP.

• MGO LS segment: Rotterdam returned to the overvalued zone, becoming the only overvalued port in this segment. Its average MDI rose by 7 points. The other three ports remained undervalued, with weekly average MDI increases of 11 points in Singapore, 26 in Fujairah, and 1 in Houston. Rotterdam's MDI held at 100% correlation, while Fujairah continued to record an MDI value consistently above $100.00.

Overall Market Trend: The balance continues to tilt toward undervaluation. In the 380 HSFO segment, both Rotterdam and Singapore shifted into the undervalued zone, while in the MGO LS segment, Rotterdam re-entered the overvalued category. Despite this, the overall trend of undervaluation remains dominant in the global bunker market and is expected to persist into the following week.

Further details on the correlation between market prices and the MABUX Digital Benchmark can be found in the Digital Bunker Prices section of mabux.com.

A new report from classification society DNV predicts that carbon capture and storage (CCS) will account for 15% of all maritime COŌéé emissions by 2050. The report anticipates that onboard CCS technologies will become scalable across most of the global shipping fleet starting around 2040. Given the high projected costs of green fuels, CCS could emerge as a competitive alternative, despite the added CAPEX, OPEX, and offloading costs. However, the lack of infrastructure for COŌéé offloading at ports, as well as for its transport and storage, remains a significant challenge. DNV forecasts that maritime transport will represent 9% of all COŌéé captured via CCS by 2050. Globally, CCS capacity is expected to quadruple by 2030, with average costs decreasing by 40% by 2050 as the technology matures and scales. While natural gas processing currently dominates CCS applications, DNV projects that post-2030 growth will be driven largely by hard-to-abate sectors such as steel and cement.

We expect the steady uptrend in the global bunker market to persist, driven by continued volatility stemming from the escalating conflict in the Middle East.

By Sergey Ivanov, Director, MABUX