The Bunker Weekly Overview was contributed by Marine Bunker Exchange (MABUX)

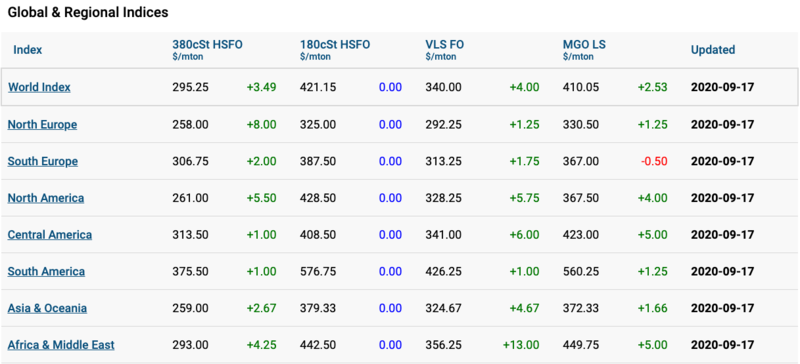

The persistent worry that world economies are not recovering from the coronavirus lockdowns robustly enough to absorb a new increase in oil production is still the downward driver on global fuel market. The World Bunker Index MABUX has demonstrated slight upward evolution for a week. The 380 HSFO index rose from 291 to 295 USD/ MT (+4.00 USD), VLSFO added 8.00 USD globally: from 332 to 340 USD / MT while MGO gained only 0.25 USD: 410 USD / MT. There are no any significant changes in the Global Scrubber Spread (SS) (price difference between 380 HSFOs and VLSFOs) as well: it has narrowed by 1.42 USD and averaged USD 43.31 (44.73 USD a week ago).

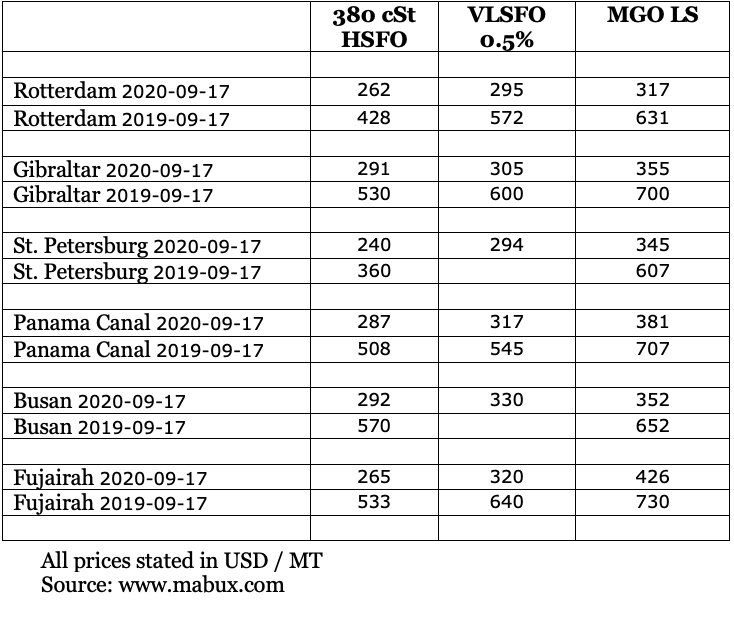

Meantime, SS Spread in Rotterdam has fluctuated during the week from 29.00 USD (10.09) up to 38 USD (14-16.09) and down to 33.00 USD today, Sep.17. Average value of SS spread for the week has increased by 1.00 USD from 33.50 USD to 34.50 USD.

In Singapore SS Spread has changed slightly upward during the week and added 10 USD: from 54 USD to 64 USD. Average weekly SS Spread has gained 4.00 USD: from 54.83 USD to 58.83 USD.

CE Delft reported, the use of scrubbers results in an increase of CO2 emissions between 1.5% and 3% for a range of representative ships. Another option to comply with limits for the sulphur content of fuel oil - using fuel oil with a sulphur content of 0.50% (VLSFO), respectively 0.10% or less (ULSFO) - leads to an improvement of the fuel quality in terms of aromatics content and viscosity. The increase of emissions associated with desulphurisation in a refinery are higher than 1% and in many cases multiple times higher, depending on the quality improvement of the fuel, the refinery layout and the crude used. As per CE Delft, in many cases, the carbon footprint of using a scrubber is lower than low-sulphur fuels.

The European Parliament on Sep.15-16 voted in favour of including greenhouse gas emissions from the maritime sector in the European Union’s carbon market from 2022. This would force shipowners to buy EU carbon permits to cover these emissions. The plan is to expand the scheme to include emissions from voyages within Europe, as well as international trips which start or finish in an EU port, through a package of market reforms the EU Commission will propose by June 2021. It is expected that the expansion of the scheme may take until 2023 to implement. That would coincide with a deadline for the UN shipping agency (IMO) to publish a plan on global emissions-cutting efforts for the sector.

All news