The Bunker Outlook was contributed by Marine Bunker Exchange (MABUX)

Global Bunker Market faced some historically significant challenges last year, it started with IMO2020, the greatest change in fuel regulation in this century, with lot of expectations and contradictory predictions. However, the appearance of the so called “Joker factor” - COVID-19 - drastically changed the situation on the market.

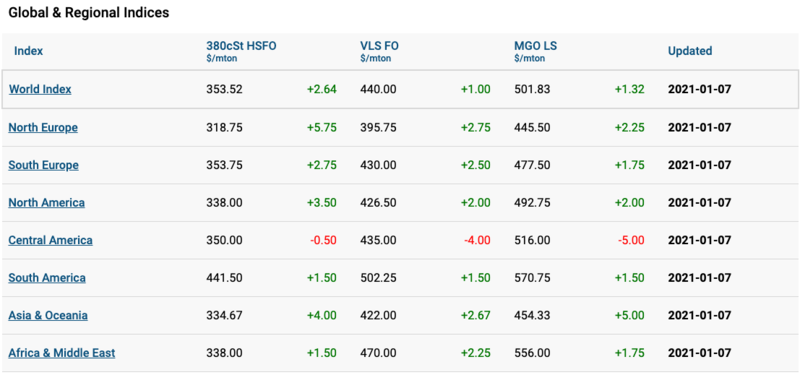

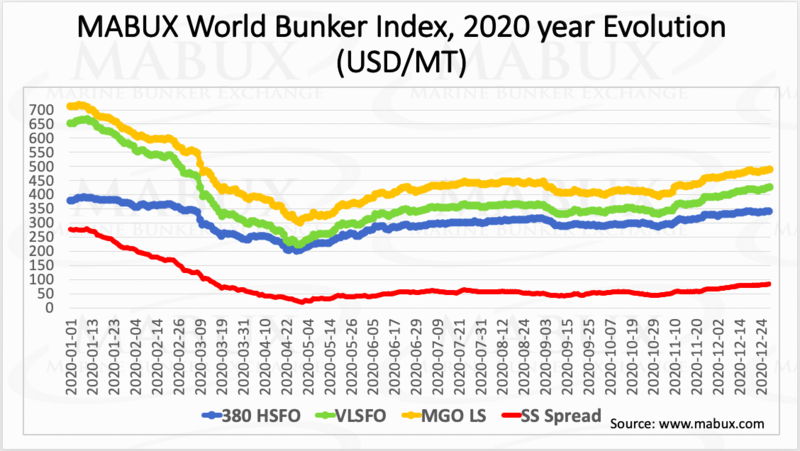

MABUX MGO LS Global Bunker Index and VLSFO Global Bunker Index fell from January to May 2020 by 57.4% (from 714 USD/MT in January to 304 USD/MT in May) and by 64.7% (from 654 USD/MT to 231 USD/MT), respectively.

Despite fears that prices for traditional high-sulfur fuel (380 HSFO) would also drop sharply amid limited demand, in reality, 380 HSFO Global Bunker Index in the first half of 2020 remained more stable and decreased only by 45.7% (from 387 USD/MT in January to 210 USD/MT in May).

However, the main surprise was the sharp reduction in the price difference between VLSFO and 380 HSFO - the so-called scrubber spread Index (SS), which is an indicator of economic attractiveness for one of the main ways to comply with IMO2020 regulations: the use of scrubbers in combination with cheap high-sulphur fuel oil. The 90% drop of SS Index (from 275 USD in January to 25 USD in May) in the first five months of 2020 led to a sharp decline in scrubber orders and to delays and cancellations of the installations of ordered scrubbers.

The second half of 2020 was marked by a gradual recovery in demand in the global bunker market supported by vaccines optimism and reflected in a moderate increase in bunker fuel prices, which continues to these days. MGO LS Index increased by 38% to 490 USD/MT, VLSFO Index - by 46% to 427 USD/MT, 380 HSFO Index - by 38.6% to 342 USD/MT. The revival of the market was reflected in the SS spread Index as well - it widened by 70% to an average of 83 USD, bringing back the relevance of scrubbers’ solution.

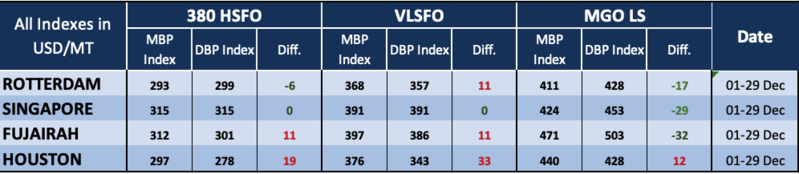

Correlation of MBP (Market Bunker Prices) Index vs DBP (Digital Bunker Prices) Index at four global largest hubs (Rotterdam, Singapore, Fujairah and Houston) in December 2020 showed that 380 HSFO fuel was undervalued in Rotterdam (minus 6 USD/MT). At the same time, in Singapore there was a situation when both MBP and DBP Indices had a 100% correlation on 380 HSFO and VLSFO in December. In Fujairah and Houston, both types of fuel: 380 HSFO and VLSFO, remained overpriced (380 HSFO: plus 11 USD/MT and plus 19 USD/MT, respectively; VLSFO: plus 11 USD/MT and 33 USD/MT, respectively). MGO LS, in turn, was undervalued at all selected ports ranging from minus 17 USD/MT to minus 32 USD/MT, with the exception of Houston (was overvalued by 12 USD/MT).

We anticipate a stronger year ahead as the rollout of coronavirus vaccine programs allows global activity to recover which will led to higher refinery runs and growing demand for all types of fuels, including marine fuels.

All news