The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

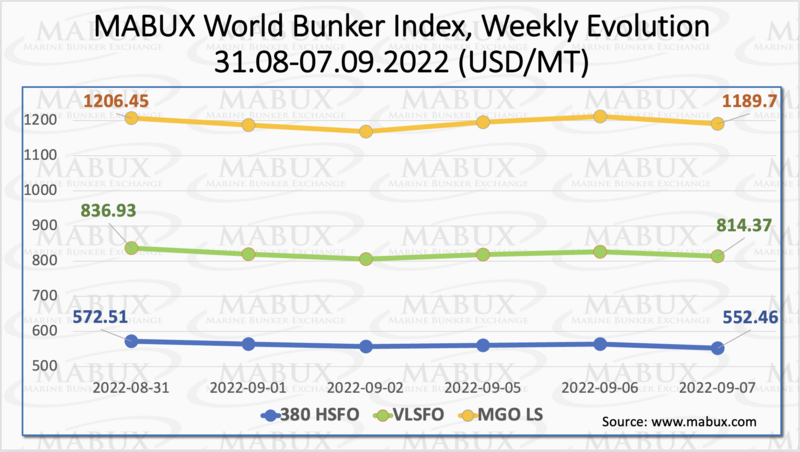

Over the Week 36 MABUX global bunker indices showed a moderate decline. The 380 HSFO index fell by 20.05 USD from 572.51 USD/MT last week to 552.46 USD/MT, still below the 600 USD mark. The VLSFO index, in turn, fell by 22.56 USD: from 836.93 USD/MT to 814.37 USD/MT. The MGO index lost 16.75 USD (from 1206.45 USD/MT to 1189.70 USD/MT), dropping below 1200 USD again.

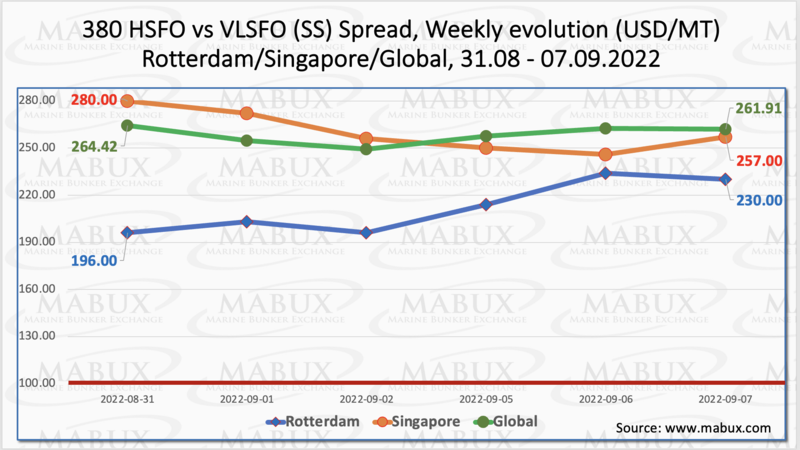

The Global Scrubber Spread (SS) weekly average - the price differential between 380 HSFO and VLSFO - fell slightly over the Week 36 by minus $3.36 ($258.43 vs. $261.79 last week). In Rotterdam, the average SS Spread, on the contrary, rose moderately: $212.17 vs. $207.33 (up $4.84 compared to last week). In Singapore, the average weekly price differential of 380 HSFO/VLSFO showed a downtrend: minus $12.33 ($260.17 vs. $272.50 last week). In general, SS Spread still does not have any stable trend. More information is available in the Price Differential section on mabux.com.

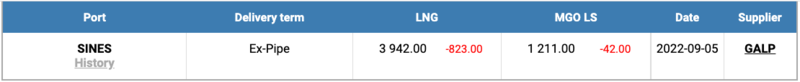

Natural gas prices in Europe are still on records levels. The EU approved a bloc-wide 15-percent gas consumption reduction plan, which is voluntary but if the cuts do not materialize could become obligatory. Meantime, LNG as a bunker fuel at the port of Sines (Portugal) fell on September 05 by 823 USD/MT to 3942 USD/MT (versus 4765 USD/MT a week earlier). LNG prices are still more than three times higher than the most expensive type of traditional bunker fuel: the price of MGO LS at the port of Sines was quoted on September 07 at 1211 USD/MT.

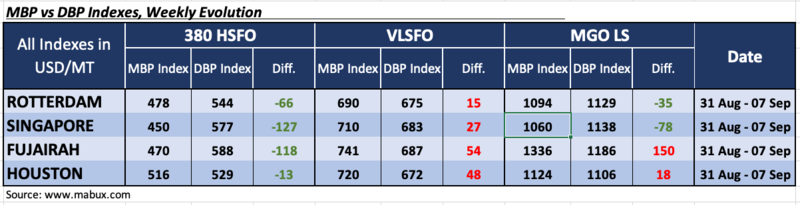

Over the Week 36, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an undervaluation of 380 HSFO fuel in all four selected ports: Houston moved into the undervaluation zone with a minus $13. In other ports, the underestimation grew slightly and amounted to: Rotterdam - minus $66, Singapore - minus $127 and Fujairah - minus $118.

VLSFO fuel grade, according to MDI, remained, on the contrary, overpriced in all four selected hubs: plus $15 in Rotterdam, plus $27 in Singapore, plus $54 in Fujairah and plus $48 in Houston. Downward trend in overcharge margins continued in all ports.

As for MGO LS, MDI registered an overpricing of this fuel grade in two ports out of four selected: Houston joined Fujairah - plus $ 18 and plus $ 150, respectively. In Rotterdam and Singapore, MGO LS fuel remained undervalued: minus $35 and minus $78. Undervaluation as well as overvaluation ratio grew moderately in all ports.

Stena Line, DFDS, Ørsted and Liquid Wind are partnering with the Port of Gothenburg to establish an electromethanol (e-fuels) hub. Green electrofuel, e-methanol, is made from 100% biogenic sources combined with 100% renewable wind energy, and, claim the companies, does not add CO2 to the atmosphere. As the largest port in Scandinavia, the partners noted that Gothenburg is the ‘ideal choice’ for the first delivery and bunkering point for the green e-fuels. Swedish ferry line Stena Line and shipping and logistics company DFDS are partnering with FlagshipONE which is jointly owned by Ørsted and Liquid Wind. FlagshipONE, which is in late-stage development and approaching a final investment decision, will be the largest e-fuels facility in the world, producing 50,000 tonnes of e-methanol annually. This collaboration is supported by the Port of Gothenburg, said to be the first shipping port to actively pursue a green fuels policy ensuring carbon neutral operations by 2030.

There are no upward drivers in the global bunker market so far. We expect fuel prices to fluctuate about the present levels.

By Sergey Ivanov, Director, MABUX

All news