The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

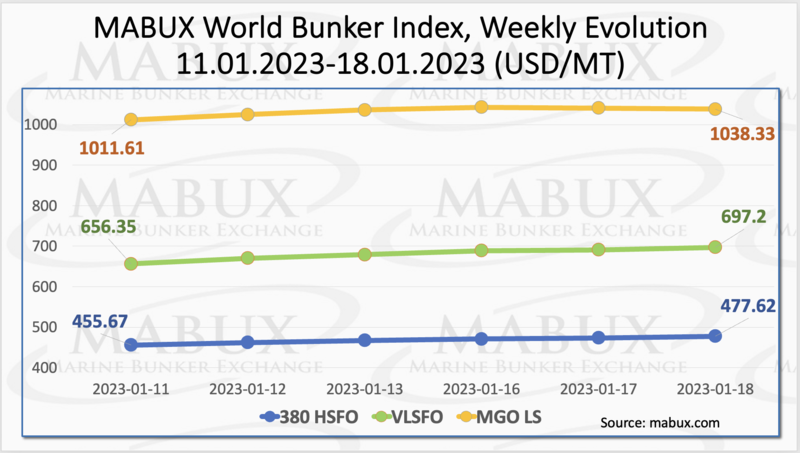

Over the Week 03, MABUX global bunker indices turned into an upward movement. The 380 HSFO index rose by 21.95 USD: from 455.67 USD/MT last week to 477.62 USD/MT. The VLSFO index, in its turn, added 40.85 USD (697.20 USD/MT versus 656.35 USD/MT last week), coming closer again to 700 USD mark. The MGO index also increased by 26.72 USD (from 1011.61 USD/MT last week to 1038.33 USD/MT. At the time of writing, the Global bunker market was in a state of downward correction.

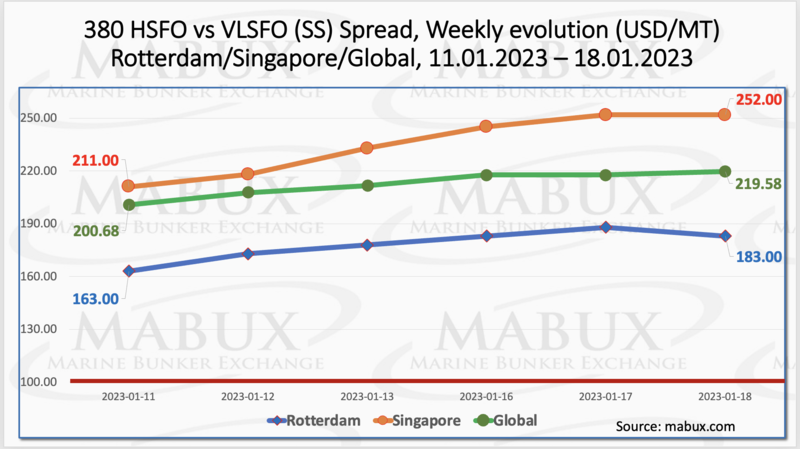

Global Scrubber Spread (SS) - the price differential between 380 HSFO and VLSFO - continued to rise over the Week 03 - plus $18.90 ($219.58 vs. $200.68 last week), once again exceeding 200 USD mark. In Rotterdam, SS Spread rose by $20.00 to $183.00 from $163.00 last week. In Singapore, the price differential of 380 HSFO/VLSFO also widened by $41.00 ($252.00 vs. $211.00 last week). The SS Spread weekly averages in Rotterdam and Singapore also rose by $18.50 and $23.50 respectively. More information is available in the "Differentials" section at www.mabux.com.

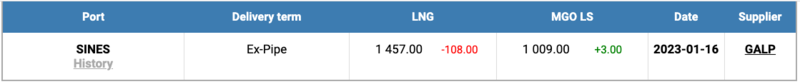

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to decline slightly and reached 1457 USD/MT on January 16 (minus 108 USD compared to the previous week). The price difference between LNG and conventional fuel on January 16 was 448 USD: MGO LS at the port of Sines was quoted at 1009 USD/MT that day.

There were 90 biofuel operations at the Port of Singapore in 2022 accounting for a total volume of 140,000 tonnes, but high global gas prices last year impacted demand for LNG bunkers, with volumes dropping from 50,000 metric tonnes in 2021 to just 16,000 tonnes.

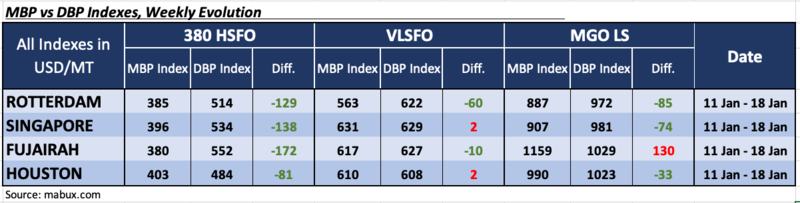

During the Week 03, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) remained fuel 380 HSFO underestimated in all four selected ports. Undervaluation levels widened moderately and amounted to: in Rotterdam - minus $ 129, Singapore - minus $138, Fujairah minus - $172 and Houston - minus $81.

In the VLSFO segment, according to MDI, Singapore and Houston moved into the overprice zone: plus $ 2 in each port. At the same time, Rotterdam and Fujairah remained in the undervaluation zone - minus $60 and minus $1, respectively.

In the MGO LS segment, Fujairah remains the only overvalued port: plus $130 (the overcharge premium has decreased). In all other ports, the MDI registered an underpricing of MGO LS: Rotterdam - minus $ 85, Singapore - minus $ 74 and Houston - minus $ 33. The undercharge ratio increased slightly.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section at www.mabux.com.

The 2022 throughput statistics for the Port of Antwerp-Bruges offer a stark picture of the impact of geopolitical tensions on the shipping supply chain and energy flows, with coal throughput rising sharply by 210% and a 61.3% increase in demand for LNG. The merger of the ports of Antwerp and Zeebrugge was completed last April. Container traffic took a knock last year, with throughput down 0.7% year-on-year to 286.9 million tons of cargo. Global disruptions within this segment, and the resulting congestion with peak call sizes and delays, put pressure on volumes across 2022. The situation in Ukraine also translated into a 59% fall in Russia-related traffic at the port. While congestion problems began easing in Q3 2023, the Port noted that high energy prices and economic uncertainty have caused a drop in demand for container traffic. As a result, container throughput fell 8.6% in tons and 5.2% in TEUs in 2022, compared with a strong 2021 where throughput had climbed back to pre-pandemic levels. The impact of the war in Ukraine, subsequent sanctions against Russia and a growing energy crisis have changed the energy landscape in Europe, and this has resulted in strong growth in bulk cargo. Dry bulk throughput increased by 13.8% in 2022 and the dramatic rise in coal throughput was due to the upswing in demand for coal powered generation. The sharp rise in demand for LNG was explained by a switch from natural gas supplied by pipelines from Russia, and the liquid bulk segment as a whole grew by 10%. Demand for LPG rose by 30%), as did demand for gasoline (+7%), diesel/fuel oil (+9.9%) and naphtha (+7.5%).

A moderate uptrend has formed in the global bunker market ahead of the European Union’s ban on Russian oil products set to come into force on February 5. We expect bunker indices to continue upward evolution next week.

By Sergey Ivanov, Director, MABUX

All news