The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

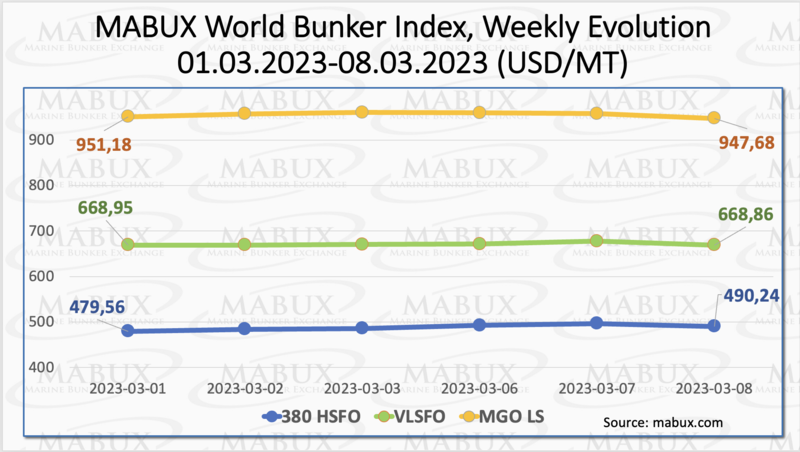

Over the Week 10, MABUX global bunker indices remained rangebound with no firm trend. The 380 HSFO index rose by 10.68 USD: from 479.56 USD/MT last week to 490.24 USD/MT, approaching again 500 USD mark. The VLSFO index, in turn, fell by a symbolic 0.09 USD (668.86 USD/MT versus 668.95 USD/MT last week). The MGO index also lost 3.50 USD (from 951.18 USD/MT last week to 947.68 USD/MT). At the time of writing, the market was in a slight downtrend.

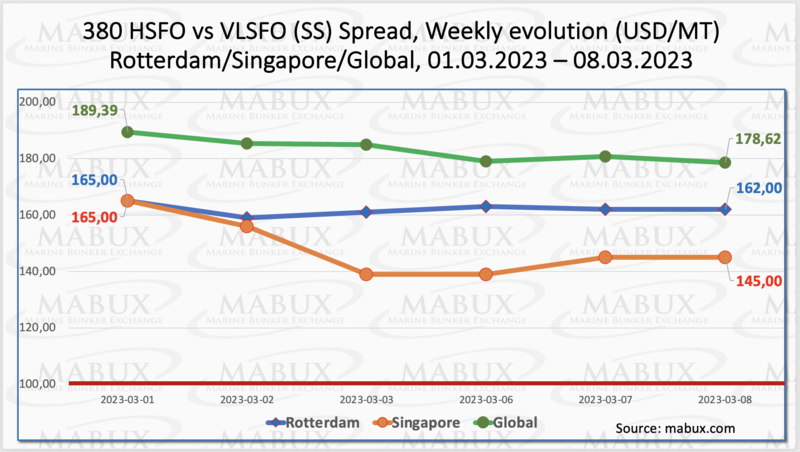

Global Scrubber Spread (SS) - the price differential between 380 HSFO and VLSFO - showed a moderate decline in a Week 10 - minus $10.77 ($178.62 vs. $189.39 last week). At the same time, the weekly average decreased less significantly - by $ 3.90. In Rotterdam, SS Spread also fell by $3.00 to $162.00 (versus $165.00 last week), while the weekly average rose by $15.83. In Singapore, the 380 HSFO/VLSFO price difference showed the most significant reduction: minus $20, dropping to $145. The weekly average fell by $21.66. We expect that SS Spread still remains some potential for contraction next week. More information is available in the "Differentials" section of www.mabux.com.

The Energy Information Administration has decreased its forecast for natural gas prices for 2023 and 2024. The EIA now sees natural gas prices averaging $3.02 per MMBtu this year, down 11.2 percent from its previous forecast of $3.40 per MMBtu. For comparison, natural gas prices averaged $6.42 per MMBtu in 2022, the EIA estimates. The EIA has also lowered its forecast for natural gas prices for next year, to $3.89 per MMBtu, down from its estimate of $4.04 per MMBtu made its previous report.

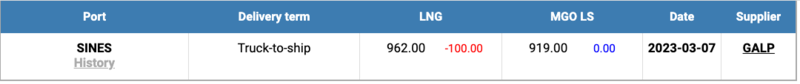

The price of LNG as a bunker fuel at the port of Sines (Portugal) continued to decline and reached 962 USD/MT on March 07 (minus 100 USD compared to the previous week). The price difference between LNG and conventional fuel on March 07 was only 43 USD: MGO LS at the port of Sines was quoted at 919 USD/MT that day. The price difference at the moment is almost levelled. We expect LNG price to continue downtrend next week. More information is available in the “LNG Bunkering” section at www.mabux.com.

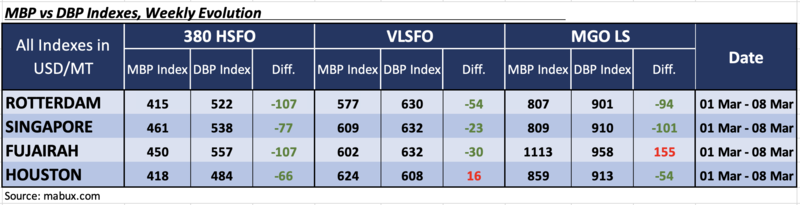

Over the Week 10, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) kept fuel 380 HSFO underestimated in all four selected ports. The underestimation weekly average did not have a sustainable trend, widening in Rotterdam and Houston to minus $107 and minus $66, respectively, but narrowing in Singapore and Fujairah to $77 and $107.

In the VLSFO segment, according to MDI, the three selected ports - Rotterdam, Singapore and Fujairah - remain undervalued by minus $54, minus $23 and minus $30, respectively. The underestimation weekly average at three ports changed irregular. Houston remained the only overvalued port in this fuel segment - plus $16, the overpricing rate has been halved.

There are still three ports in the MGO LS segment: Rotterdam, Singapore and Houston. The weekly average underpricing premium rose moderately in Rotterdam and Singapore to $94 and $101 respectively but decreased in Houston to $54. Fujairah remained the only overvalued port - plus $155. In general, the MDI changes in this fuel segment were insignificant.

More information on the correlation between market prices and MABUX digital benchmark is available in the “Digital Bunker Prices” section at www.mabux.com.

According to DNV, there were 22 orders and confirmations for methanol-fuelled vessels in February. There are now 106 confirmed orders for methanol-fuelled ships, with 25 vessels currently in operation – 22 of which are in the oil/chemical segment. When it comes to the order book, then the box ship segment is still way out in front, with 68 orders. In February, Hyundai Merchant Marine (HMM) ordered nine 9,000 TEU containerships, and Korea Shipbuilding & Offshore Engineering Co. (KSOE) said it has won an order for 12 methanol-fuelled box ships, with the purchaser widely reported to be France’s CMA CGM. Although methanol had a record month for orders in February, LNG also scored a very respectable 10 orders. There are now 886 confirmed LNG-fuelled ships, with 368 already in operation. The containership segment leads the pack, with 189 vessels on order and 45 in operation. The car carrier segment comes in some way behind, with 118 on order and 11 in operation.

The global bunker market remains relatively stable. We expect Global bunker indices to keep irregular fluctuations next week.

By Sergey Ivanov, Director, MABUX

All news