The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

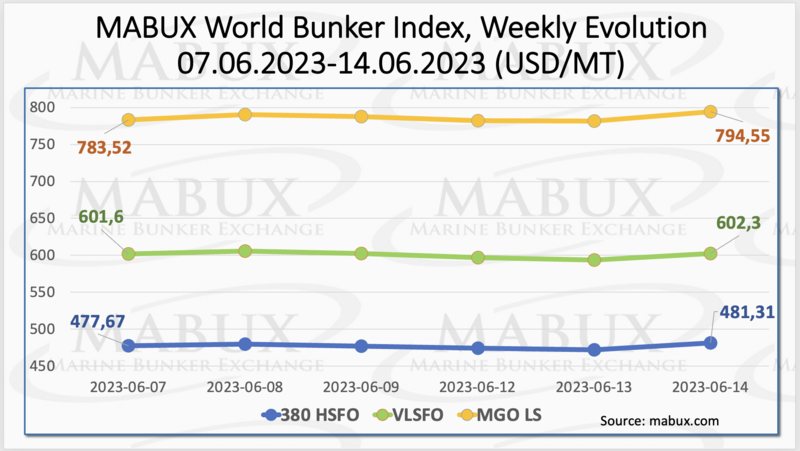

The global MABUX bunker indices showed a moderate upward movement in Week 24. The 380 HSFO index rose by 3.64 USD from 477.67 USD/MT last week to 481.31 USD/MT. Despite the increase, it remained well below the 500 USD mark. The VLSFO index saw a small gain of 0.70 USD, reaching 602.30 USD/MT compared to 601.60 USD/MT in the previous week. It approached the psychological level of 600 USD. The MGO index climbed by 11.03 USD, going from 783.52 USD/MT to 794.55 USD/MT, but it remained below 800 USD. At the time of writing, the market was in an upward trend.

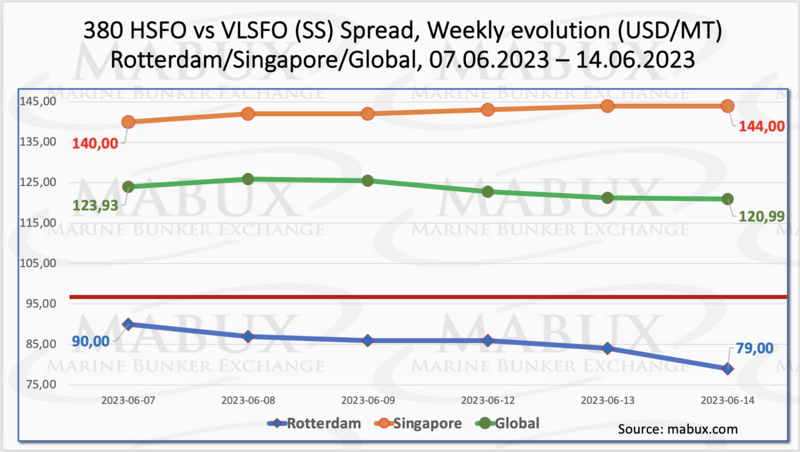

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - was down moderately by $2.94 ($120.99 vs. $123.93 last week). Despite this decline, the weekly average increased by $1.77. In Rotterdam, the SS Spread continued its downward trajectory, falling by $11.00 to $79.00, breaking through the $80 mark. The average weekly value of the SS Spread in Rotterdam also decreased by $3.17. In Singapore, the price difference of 380 HSFO/VLSFO widened by $4.00 during the week ($144 vs. $140.00 last week), while the weekly average increased by $7.50. In general, the dynamics of SS Spread changes does not have a stable trend. However, the significant reduction in SS Spread in Northern Europe creates favorable conditions for the further expansion of LNG bunkering operations. More information is available in the Differentials section of www.mabux.com.

Despite the lowest natural gas prices in two years, Europe’s natural gas demand continues to be weak and fell in May from a year earlier as industries are slowing, and major economies enter a recession. Natural gas demand in the biggest European economies – Germany, the UK, France, Italy, Spain, and the Netherlands – dropped by 9.7% last month compared to May 2022.

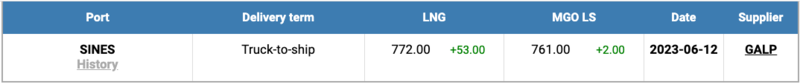

However, there has been a slight increase in the price of LNG as bunker fuel at the port of Sines in Portugal. On June 12, the price reached 772 USD/MT, marking a rise of 53 USD compared to the previous week. As a result, the price difference between LNG and conventional fuel on June 12 favoured marine gas oil (MGO), with MGO being quoted at 761 USD/MT in the port of Sines, just 9 USD lower than LNG. More information is available in the LNG Bunkering section of www.mabux.com.

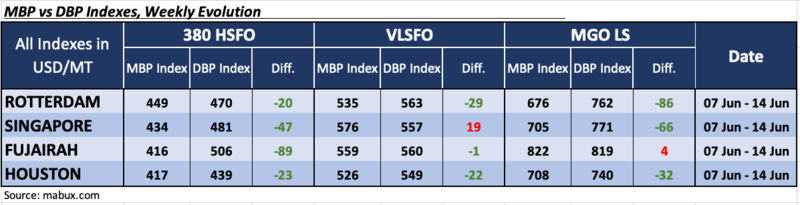

During week 24, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and MABUX digital bunker benchmark MABUX (MABUX DBP Index)) consistently indicated an undervaluation of 380 HSFO fuel in all four selected ports. The weekly average undercharge decreased by 4 to 7 points in Rotterdam, Fujairah, and Houston. However, in Singapore, the MDI showed an increase of $3. Overall, the changes in MDI for the 380 HSFO segment were minimal.

In the VLSFO segment, based on MDI data, Singapore remained the only overvalued port. The average overcharge here increased by 4 points. The remaining three ports continued to be undervalued, with averages down 4 points in Rotterdam, down 13 points in Fujairah (nearly 100% market price-to-digital benchmark correlation), and Houston decreasing by 11 points.

In the MGO LS segment, Rotterdam, Singapore, and Houston remained undervalued. The average weekly underestimation increased by 3 to 5 points in all three ports. Fujairah, on the other hand, continued to be the only overvalued port, with the overpricing showing a further reduction of minus $9.

More information on the correlation between market prices and MABUX digital bunker benchmark is available in "Digital Bunker Prices" section at www.mabux.com.

A new study published by DNV and co-sponsored by the Singapore Maritime Foundation (SMF) has indicated that seafarers are calling out for more training on the new marine fuels and propulsion technologies. More than four fifths (81%) of the seafarers surveyed indicated that they require either partial or complete training to effectively work with the advanced technology that will be present onboard future ships. Similarly, 75% expressed a requirement for partial or complete training on new fuel types such as LNG, batteries or synthetic fuels. The report added that this ‘training deficit’ rose to 87% of survey respondents for emerging fuels such as ammonia, hydrogen and methanol. The study recommends that seafarer training should be ‘prioritised for fuels that are most likely to be predominant in the current decade’. It also offered the upbeat conclusion that: ‘Career advancement and development opportunities for seafarers will improve with the trend towards decarbonisation and digitalisation, complemented by the expected prevalence of complementary shore-based roles in the future.’

We expect minimal changes in the global bunker market over the upcoming week. Bunker indices may continue slight irregular fluctuations.

By Sergey Ivanov, Director, MABUX

All news