The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

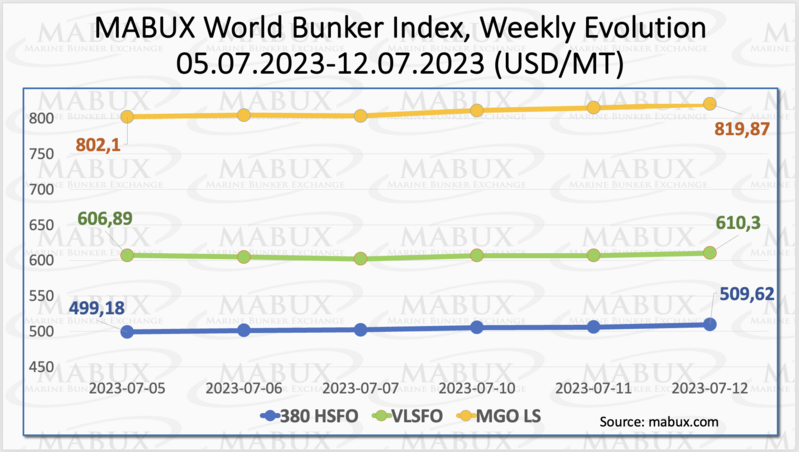

As of Week 28, the MABUX global bunker indices continued a sustainable uptrend. The 380 HSFO index rose by 10.44 USD: from 499.18 USD/MT last week to 509.62 USD/MT, breaking the psychological mark of 500 USD. The VLSFO index, in turn, increased by 3.41 USD (610.30 USD/MT versus 606.89 USD/MT last week). The MGO index added 17.77 USD (from 802.10 USD/MT last week to 819.87 USD/MT). At the time of writing, the uptrend continued in the market.

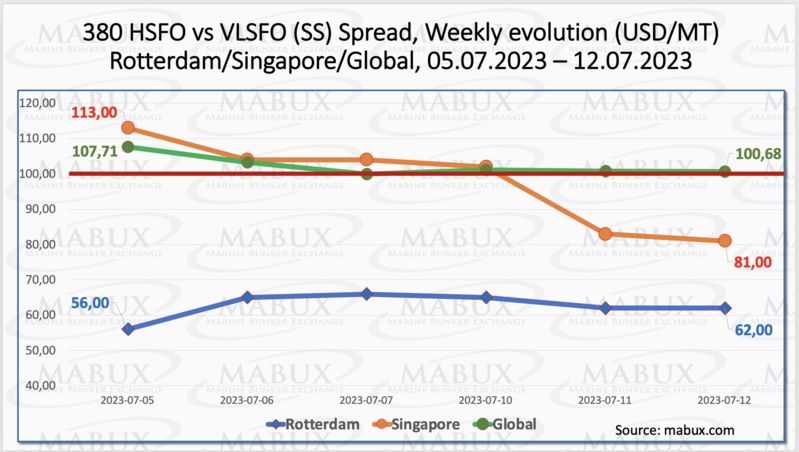

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - continued its steady decline, dropping by $7.03 compared to last week. It reached $100.68, coming close to the SS breakeven point of $100. Meantime, the weekly average also decreased by $10.44. In Rotterdam, SS Spread, on the contrary, showed a slight increase: from $56.00 last week to $62.00 - plus $6.00. The weekly average of SS Spread in Rotterdam also rose by $10.17. In Singapore, the price difference between 380 HSFO and VLSFO continued to decrease: minus $32.00 ($81.00 versus $113.00 last week), breaking the $100.00 mark for the first time since May 05, 2022. The weekly average dropped by $31.50. The sustainable decline in the SS Spread creates favourable conditions for the further expansion of the alternative bunker fuel market segment. More information is available in the "Differentials" section of www.mabux.com.

Europe’s purchases of U.S. LNG have lately dwindled, with June’s volumes clocking in at 4.15 million metric tons, down from 5.63 million tons in May. Europe’s gas inventories, including in the United Kingdom, have been rapidly increasing and have now hit 889 terawatt-hours (TWh). Stocks are now +246 TWh +38% above the 10-year seasonal average, although the surplus has narrowed from +280 TWh +81% in March.

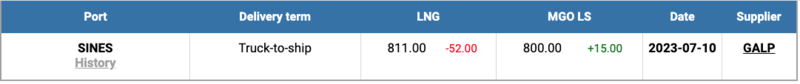

The price of LNG as a bunker fuel at the port of Sines (Portugal) showed a sharp decline and reached the level of 811 USD/MT on July 10 (minus 52 USD compared to the previous week). The price difference between LNG and conventional fuel narrowed down to 11 USD, favouring MGO which was quoted at 800 USD/MT in the port of Sines that date. More information is available in the LNG Bunkering section of www.mabux.com.

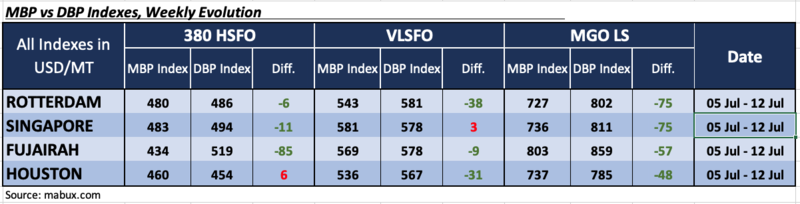

During Week 28, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the digital bunker benchmark MABUX (MABUX DBP Index)) recorded an underestimation of 380 HSFO fuel in three out of the four selected ports: Rotterdam moved into the undervaluation zone and joined Singapore and Fujairah. The average weekly undervaluation margins increased by 22 points in Rotterdam, decreased by 14 points in Singapore, and remained unchanged in Fujairah. Houston was the only overvalued port in this fuel segment, with the overcharge average increasing by 1 point.

In the VLSFO segment, based on MDI data, only Singapore remained overcharged. The overprice average here decreased by 31 points. Fujairah moved into the underprice zone and joined Rotterdam and Houston. The average undercharge ratio decreased in Rotterdam by 14 points but increased in Fujairah and Houston by 24 points and 4 points, respectively.

In the MGO LS segment, MDI registered underestimation in all four selected ports. The average undervaluation levels widened in Rotterdam by 11 points, in Singapore - by 11 points, in Fujairah - by 35 points and in Houston by 10 points.

More information on the correlation between market prices and MABUX digital bunker benchmark is available in "Digital Bunker Prices" section on www.mabux.com.

Hecla Emissions Management has estimated that, taking into account the ratcheted phase-in period for shipping’s inclusion in the EU’s Emissions Trading System (ETS), the industry could be seeing carbon allowances costs of €3.1 billion in 2024, rising to €8.4 billion in 2026. As reported by Hecla, the 2022 EU MRV statistics show that total ETS-applicable emissions for the maritime industry amounted to 83.4 million metric tonnes of CO2 equivalent (tCO2e) in 2022, a slight decrease of 0.22% from 2021. At the current market value of €90 per emissions allowance (EUA), shipping emissions carried a total worth of €7.5 billion for the year. Taking into account the ETS phase-in period covering 40% of emissions in 2024, 70% in 2025 and 100% in 2026, and utilising the forward curve in EUAs, Hecla estimates indicate that the shipping industry could be liable for €3.1 billion in 2024, €5.7 billion in 2025 and €8.4 billion in 2026. The company’s analysis of the data showed emissions decreases across multiple shipping segments, including tankers, container ships, general cargo ships, reefers, Ro-Ros and chemical tankers. The container sector showed the largest reduction, falling by 8.95% equating to 2.3 million metric tonnes of CO2 equivalent (tCO2e) saved. However, passenger ships and LNG carriers logged substantial increases. The former scored highest, with a 118% year-on-year rise equating to 2.8 million (tCO2e), the latter recording a 63% increase equating to 2.1 million tCO2e.

We expect the sustainable uptrend in the Global bunker market to continue next week.

By Sergey Ivanov, Director, MABUX

All news