The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

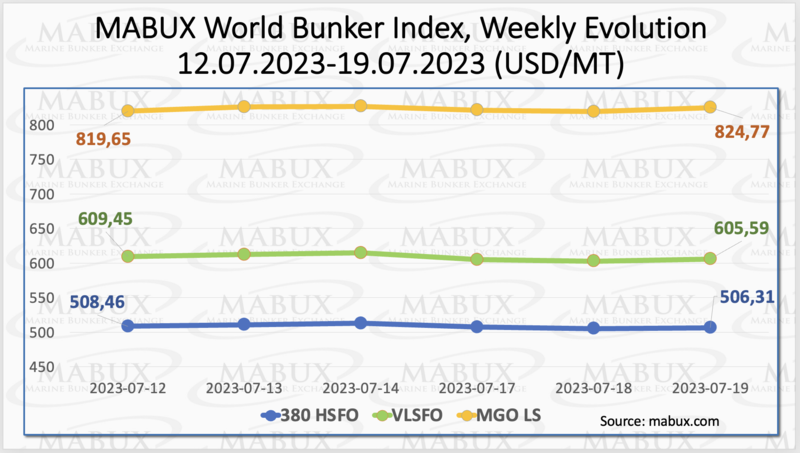

As of Week 29, the MABUX global bunker indices did not show a sustainable trend and changed sideways. The 380 HSFO index fell by 2.15 USD: from 508.46 USD/MT last week to 506.31 USD/MT, approaching the psychological mark of 500 USD. The VLSFO index lost 3.86 USD (605.59 USD/MT versus 609.45 USD/MT last week). Conversely, the MGO index showed an increase of 5.12 USD, rising from 819.65 USD/MT to 824.77 USD/MT. At the time of writing, there was not a firm trend in the market.

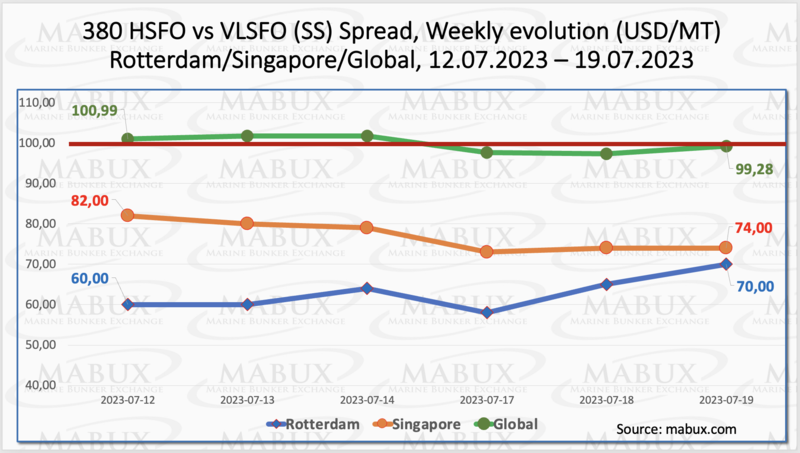

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - continued to decline and breached the SS breakeven line of $100 for the first time since October 13, 2021. The reduction amounted to $1.71, with a value of $99.28 compared to $100.99 in the previous week. Additionally, the weekly average also decreased by $2.47. Conversely, in Rotterdam, the SS Spread witnessed a slight increase, rising from $60.00 to $70.00, representing a gain of $10.00. The average weekly value of SS Spread in Rotterdam remained nearly unchanged, with an increase of only $0.16. In Singapore, the price difference between 380 HSFO and VLSFO continued to decrease, reaching minus $8.00 ($74.00 versus $82.00 last week). The weekly average experienced a decline of $20.83. The current state of the SS Spread provides an advantage for selecting conventional VLSFO bunker fuels over usinbg a combination of HSFO and scrubber. For further details, please refer to the "Differentials" section on www.mabux.com.

Europe’s natural gas stockpiles are at elevated levels and on track to be full sooner than planned. This gives governments and industries confidence that last year’s energy crisis will not be repeated. The benchmark natural gas prices are one-tenth of the records seen last summer when Russia slashed pipeline supply to Europe. Ahead of the 2023/2024 winter, Europe can only hope for another winter of milder temperatures without prolonged periods of freezes that would boost demand for heating and for gas-fired power generation. In case of that< according to Morgan Stanley, Europe’s gas prices could plunge from current levels and halve to $16.85 (15 euros) per megawatt-hour (MWh).

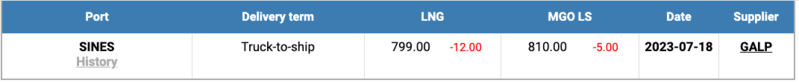

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to decline and reached the level of 799 USD/MT on July 18 (minus 12 USD compared to the previous week). The price difference between LNG and conventional fuel on July 18 showed 11 USD in favor of LNG: MGO LS was quoted in the port of Sines at 810 USD/MT that date. More information is available in the LNG Bunkering section of www.mabux.com.

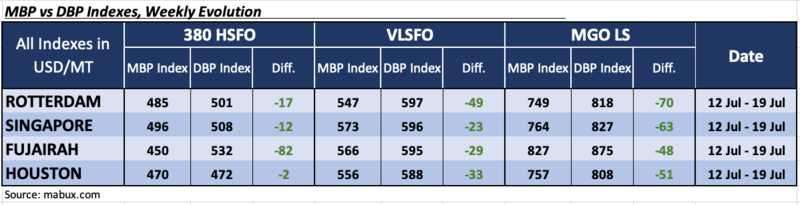

During Week 29, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the digital bunker benchmark MABUX (MABUX DBP Index)) registered an underestimation for all types of fuel in the selected ports of Rotterdam, Singapore, Fujairah and Houston. Specifically, in the 380 HSFO segment, the average underestimation widened by 11 points in Rotterdam, 1 point in Singapore, and 8 points in Houston, while it narrowed by 3 points in Fujairah.

In the VLSFO segment, based on MDI data, the average underprice ratio increased by 11 points in Rotterdam, 26 points in Singapore, 20 points in Fujairah, and 2 points in Houston.

In the MGO LS segment, the MDI recorded a reduction in the undercharge margins by 5 points in Rotterdam, 12 points in Singapore, and 9 points in Fujairah. However, in Houston, the MDI showed an increase of 3 points.

The consistent underpricing of all fuel types in the key ports indicates that the changes in bunker prices are lagging behind the trends observed in oil futures dynamics in the global fuel market. For further information on the correlation between market prices and the MABUX digital benchmark, please refer to the "Digital Bunker Prices" section on www.mabux.com.

According to the NGO Transport & Environment (T&E), European shipping emissions grew 3% year-on-year in 2022, hitting a ‘three year high’ and ‘edging closer to pre-pandemic levels’, Cruise ship emissions in 2022 were up significantly on the year before while ‘a high number of vessels transporting LNG contributed to driving up emissions’. T&E also noted that ships visiting European ports emitted nearly 130 million tonnes of CO2 in 2022, with cargo ships responsible for the bulk of the emissions. The shipping companies responsible for the most emissions included MSC, CMA CGM, Maersk, COSCO and Hapag-Lloyd – but, given that they also have the biggest fleets, this isn't surprising. Meanwhile, cruise ship emissions in 2022 were almost double what they were in the previous year – but the COVID disruptions to international travel in 2021 do skew annual comparisons.

Bureau Veritas VeriFuel published the report on fuel quality trends for very low sulphur fuel oil (VLSFO), DMA 0.10% and high sulphur fuel oil (HSFO). HSFO: the global average for off-spec fuel in Q2 was 2.2%, a slight increase from the 1.7% posted in Q1 2023. In terms of the monthly average for off-specs, May was notably high in Q2 at 4.2%. The principal causes of off-spec fuel in Q2 were water content, followed by density and viscosity. As for port averages for the last quarter, ports to highlight include Algeciras, where Al+Si (cat fines) content was 32, compared to 15 and 12 in Q1 and Q4 2022, respectively. Viscosity was lower at Klaipeda (223) in comparison with 355 (Q1 2023) and 371 (Q4 2022). DMA 0.10%: the global quarterly average for off-specs was 2.7%, a slight fall from 3.2% in Q1, and the main causes were seen to be appearance (not clear and bright) and water content. When looking at VLSFO quality in terms of port quarterly averages, Al+Si content at Piraeus was 25 in Q2, compared to 8 for Q1 and 0 for Q4 2022. In ARA ports, Al+Si was 63, compared to 40 in Q1 and 28 in Q4 2022. Some 6.4% of VLSFOs were off-spec at Las Palmas in the last quarter, whilst there was an improvement in ARA, where 2.6% of fuels were off-spec, which is the best result in the last four quarters.

We expect that the global bunker market will maintain its potential for continued moderate growth in the upcoming week.

By Sergey Ivanov, Director, MABUX

All news