The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

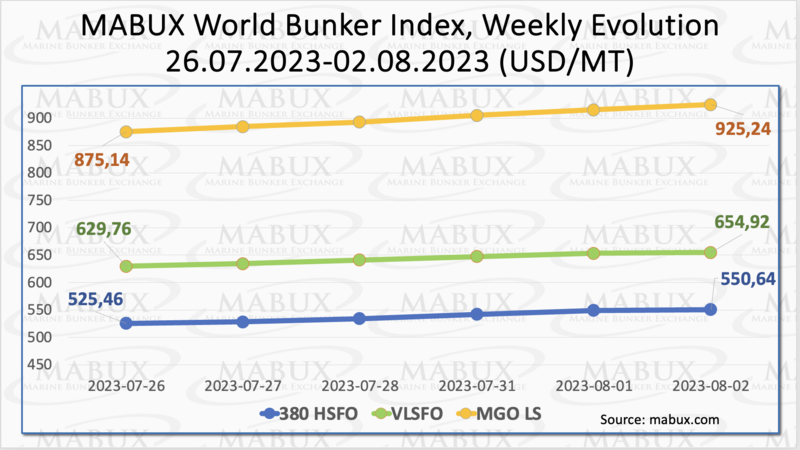

Over the Week 31, the MABUX global bunker indices continued a firm upward movement. The 380 HSFO index rose by 25.18 USD: from 525.46 USD/MT last week to 550.64 USD/MT. The VLSFO index added 25.16 USD (654.92 USD/MT versus 629.76 USD/MT last week). The MGO index also gained 50.10 USD (from 875.14 USD/MT last week to 925.24 USD/MT). At the time of writing, the market was still in an uptrend.

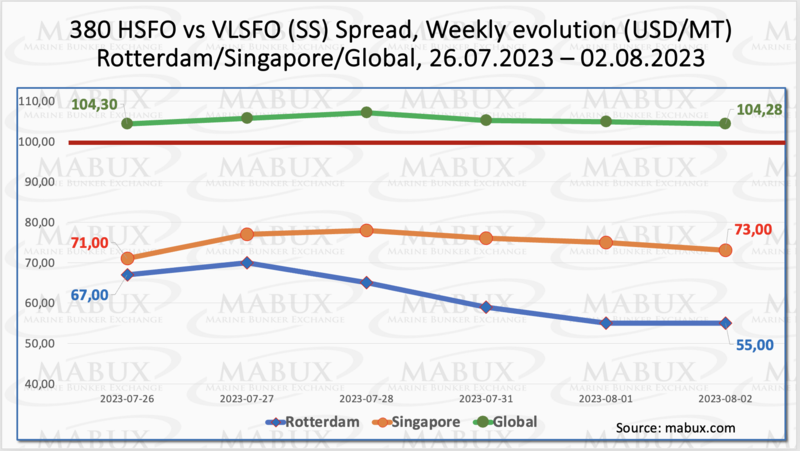

The Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - was virtually unchanged, dropping only $0.02 ($104.28 vs. $104.30 last week). The average weekly value, on the contrary, increased by $6.30. In Rotterdam, SS Spread dropped another $12 from $67.00 last week to $55.00, hitting November 2020 lows again. The weekly average of SS Spread in Rotterdam also decreased by $1.34. In Singapore, the price difference between 380 HSFO and VLSFO increased by $2.00 ($73.00 vs. $71.00 last week). The weekly average also increased by $6.83. At present, the SS Spread has stabilized at its current levels, remaining well below $100 (SS breakeven) in the largest hubs. More information is available in the "Differentials" section of www.mabux.com.

Europe’s benchmark natural gas prices fell during the week as the heatwave across southern Europe started to abate and gas inventories are high with storage sites on track to be full well in advance of EU targets. The EU gas storage sites were 84% full as of July 24. The EU has set a target to reach 90% full gas storage by November 1, 2023. Not only will it hit that target ahead of schedule, but it could also fill its storage tanks to 100% by early September. In the near term, Europe’s gas prices could rise due to the planned maintenance offshore Norway in August, which will include the massive Troll gas field, the Vesterled pipeline, and the Kollsnes gas processing plant.

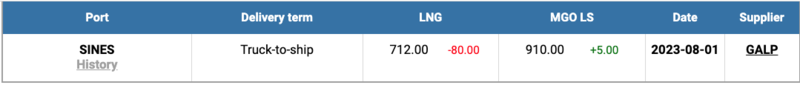

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to decline and reached 712 USD/MT on August 01. This marked a decrease of 80 USD compared to the previous week. Consequently, the price difference between LNG and conventional fuel increased to 198 USD, favoring LNG. On the same day, MGO LS was quoted at 910 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

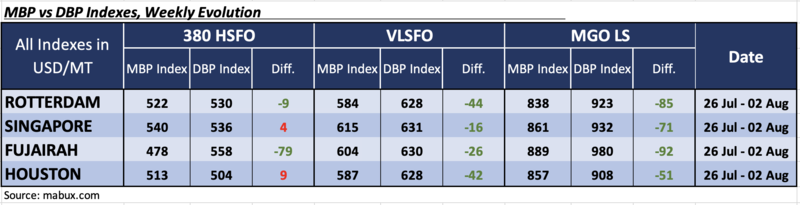

During Week 31, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the digital bunker standard MABUX (MABUX DBP Index)) registered some changes in the undervalued trend and the transition of certain ports into the overvalued zone. So, in the 380 HSFO segment, Rotterdam and Fujairah remained undervalued, while the average weekly MDI increased by 9 and 5 points, respectively. Meantime, Singapore and Houston moved into the overcharge zone, with the average weekly MDI rosing by 9 points in both ports.

For the VLSFO segment, all four selected ports were in the underestimation zone. The average underpricing increased by 7 points in Rotterdam, 10 points in Singapore, and 7 points in Fujairah, but decreased by 8 points in Houston.

In the MGO LS segment, the MDI indicated a decline in average undercharge levels by 7 points in Rotterdam, 7 points in Singapore, and a significant 25 points in Fujairah. However, Houston experienced an 8-point increase in the average undercharge level.

For further information on the correlation between market prices and the MABUX digital benchmark, please refer to the "Digital Bunker Prices" section on www.mabux.com.

Data from analytics platform Xeneta shows that long-term shipping rates have fallen 9.5% since June and 57.8% year-on-year, while the record number of vessels entering the market will only add further pressure on rates. June saw the highest ever monthly deliveries of new ships, with more than 300,000 TEU of capacity from a total of 40 new ships added to the market. In the first six months of the year, a total of 990,000 TEU was delivered, and there will be a similar pattern in the second half of 2023. Xeneta highlighted that low demand is still the underlying factor affecting rates and the figures for July were gloomy across the board. The Xeneta Shipping Index (XSI) for Far East exports fell by just 2.7% to 188.62 in July, but this is now the lowest this index has been since April 2021, and a 69.5% drop from July last year. European imports were down by 12.0% from the previous month and this sub-index is now down by 52.7% since the start of this year. A slight fall of 2.9% in the XSI for US imports has brought the index to 231.6 points in July.

We expect that the global bunker indexes are likely to continue their upward movement in the upcoming week.

By Sergey Ivanov, Director, MABUX

All news