Bunker indices are expected to turn into a moderate decline next week

The Bunker Review was contributed by Marine Bunker Exchange (MABUX)

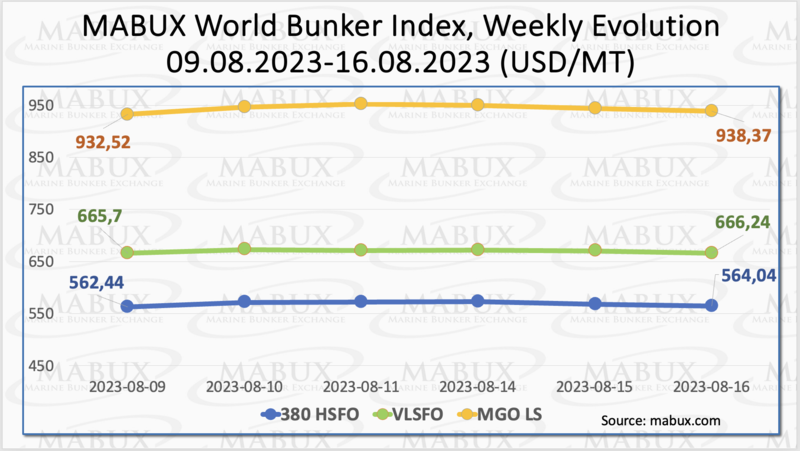

Over the Week 33, the MABUX global bunker indices showed moderate growth with no significant changes. The 380 HSFO index rose by 1.60 USD from 562.64 USD/MT last week to 564.04 USD/MT. The VLSFO index, in turn, added a symbolic 0.54 USD (666.24 USD/MT versus 665.70 USD/MT last week). The MGO Index also gained 5.85 USD (from 932.52 USD/MT last week to 938.37 USD/MT). At the time of writing, the market was in a state of a steady downtrend.

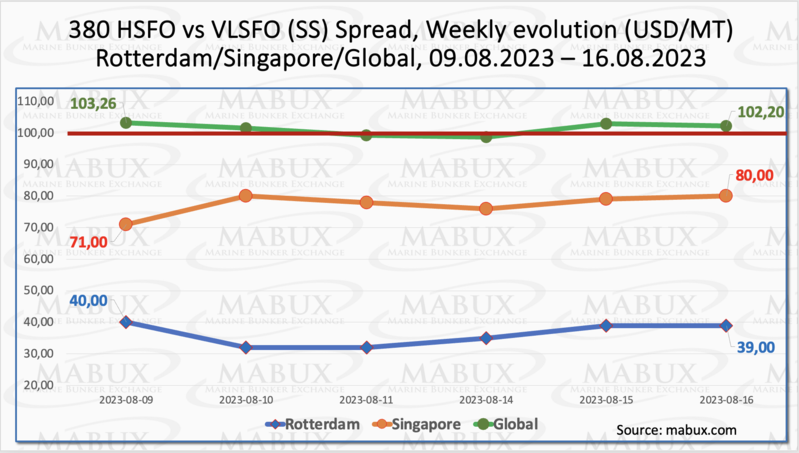

The Global Scrubber Spread (SS) - the difference in price between 380 HSFO and VLSFO - remained relatively stable, decreasing by $1.06 to $102.20 USD (compared to $103.26 USD last week), staying close to the $100.00 mark (SS breakeven point). The weekly average also dropped by $2.92. In Rotterdam, SS Spread dropped by another $1.00, reaching $39.00 from the previous $40.00 last week, the lowest since September 17, 2020. The average weekly SS Spread in Rotterdam continued to decrease, shedding another $15.83. Conversely, only in Singapore did the price difference of 380 HSFO/VLSFO increase during the week by $9.00, going from $71.00 to $80.00. The weekly average for SS Spread in Singapore also rose by $29.50. The deceleration in the narrowing of the SS Spread suggests that the indicators might have reached their lowest points, potentially indicating an upcoming upward correction. More information is available in the "Differentials" section of www.mabux.com.

Earlier this month, natural gas prices in Europe experienced a substantial increase of up to 40%. This surge was attributed to reports indicating potential industrial action by gas platform workers in Australia. Presently, European gas inventories are at an all-time high for this period of the year. In the previous year, liquefied natural gas (LNG) accounted for 34% of the European Union's total gas imports in 2022. This figure is projected to climb to 40% this year. Remarkably, this anticipated increase would mirror the market share previously held by Russian pipeline gas within the European Union prior to February 2022. Consequently, this shift implies that the EU has essentially substituted one form of gas dependency for another. This transition aligns with ongoing concerns about austerity measures and the declining competitiveness faced by some of the continent's most crucial industries.

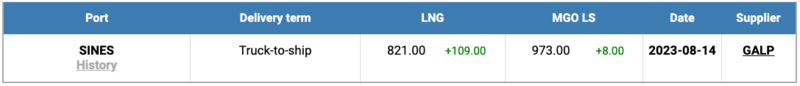

The price of LNG as bunker fuel in the port of Sines (Portugal) has once again experienced a notable increase, reaching 821 USD/MT on August 14. This marks an uptick of 109 USD in comparison to the previous week. Concurrently, the price gap between LNG and traditional fuel as of August 14 has contracted to 152 USD, favoring LNG. On the same day, MGO LS was priced at 973 USD/MT at the Sines port. More information is available in the LNG Bunkering section of www.mabux.com.

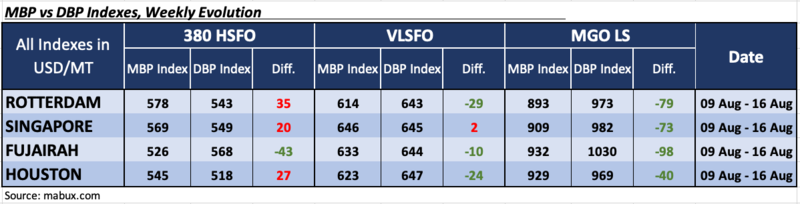

In Week 33, the MDI index, which compares market bunker prices (MABUX MBP Index) to the digital bunker benchmark MABUX (MABUX DBP Index), indicated a continuing shift of certain ports towards the overcharge zone, despite the prevailing trend of underpricing.

During this period, Fujairah stood as the sole underestimated port within the 380 HSFO segment, with its weekly average declining by 6 points. In contrast, the MDI index detected overpricing in the other three ports. Rotterdam observed a 16-point increase in its weekly average, while Singapore experienced a 12-point decrease, and Houston recorded a 3-point drop.

Within the VLSFO segment, the MDI revealed that Singapore transitioned into the overprice zone, as its weekly average surged by 4 points. On the other hand, the remaining ports continued to be undervalued, with Rotterdam and Fujairah showing a 2-point increase in their weekly averages, while Houston witnessed a significant 16-point narrowing.

In the MGO LS segment, all selected ports remained undervalued. Rotterdam and Fujairah both saw an average underpricing increase of 1 point, whereas Singapore's underpricing decreased by 1 point, and Houston's decreased by 2 points.

For further information on the correlation between market prices and the MABUX digital benchmark, please refer to the "Digital Bunker Prices" section on www.mabux.com.

Sales of marine fuel – including bio-blends, LNG and methanol – reached 4,517,500 metric tonnes (mt) in the global bunker hub of Singapore last month, 9.7% up on the 4,119,200 mt registered in July 2022. Low sulphur fuel oil (LSFO) sales (2,665,200 mt) accounted for over half (59%) of bunkers sold. This figure marked a 13% increase on June and a 6.6% increase on July 2022. Sales of high sulphur fuel oil (HSFO) increased from 1,237,500 mt in June to 1,484,000 mt in July. Last month’s total was also 15.3% up on July 2022. Elsewhere, sales of low sulphur marine gasoil (287,600 mt) saw a month-on-month (m-o-m) increase but year-on-year (y-o-y) decrease. In terms of bio-blends, the 39,400 mt of bio-blended LSFO represented an increase on the 34,300 mt sold in June and the 3,200 mt sold in July 2022. Some 500 mt of bio-blended HSFO were sold last month – down on the 1,000 mt sold in June but an increase on July 2022 when there were no sales registered. There were no sales of bio-blended LSMGO or MGO last month. The 18,300 mt of LNG sales marked the highest monthly total of the year. Last month also saw the first ship-to-ship methanol bunkering at the Port of Singapore when Maersk’s first methanol-powered containership was supplied with approximately 300 metric tonnes of bio-methanol via Hong Lam Marine’s Singapore-registered tanker, MT Agility.

There are early signs of a downtrend in the market. We expect world bunker indices may turn into a moderate decline next week.

By Sergey Ivanov, Director, MABUX

All news