The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

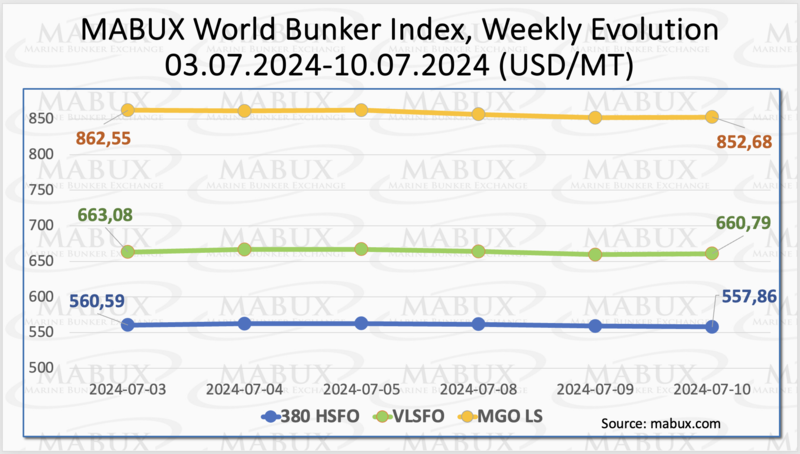

Over the Week 28, the MABUX global bunker indices exhibited a moderate downward movement. The 380 HSFO Index fell by 2.73 USD, from 560.59 USD/MT last week to 557.86 USD/MT, remaining within the 550-560 USD range. The VLSFO index decreased by 2.29 USD (660.79 USD/MT versus 663.08 USD/MT last week). The MGO index dropped by 9.87 USD (from 862.55 USD/MT last week to 852.68 USD/MT). At the time of writing, the global bunker market continued to trend moderately downward.

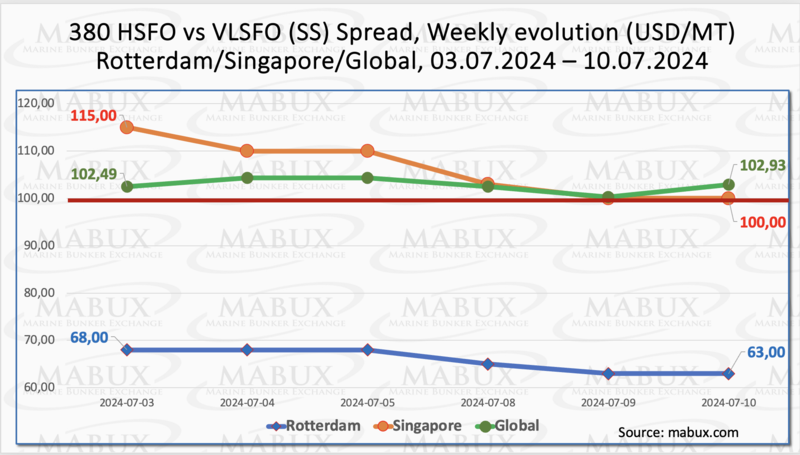

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - showed a slight increase: plus $0.44 ($102.93 versus $102.49 last week), remaining close to the $100.00 breakeven mark. The weekly average increased by $3.76. In Rotterdam, SS Spread values decreased by $5.00 to $63.00 versus $68.00 last week, with the weekly average at the port decreasing symbolically by $0.84. In Singapore, the price difference for 380 HSFO/VLSFO dropped significantly by $15.00 ($100.00 versus $115.00 last week), falling again to $100.00. The weekly average at the port, on the contrary, increased by $1.00. Currently, the SS Spread lacks a stable trend, and we expect the dynamics of multidirectional fluctuations to continue next week. More information is available in the “Differentials” section of www.mabux.com.

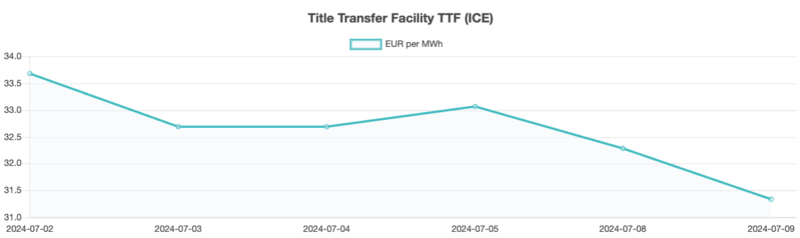

European gas demand continued its downfall in the first half of 2024, primarily due to collapsing gas-fired generation and lower gas use in buildings. During week 28, the European gas benchmark TTF showed a moderate decrease: minus 2.350 EUR/MWh (31.335 EUR/MWh versus 33.685 EUR/MWh last week).

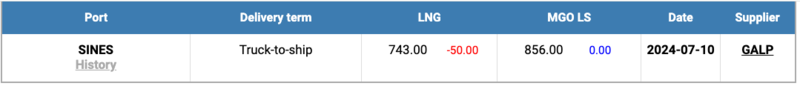

The price of LNG as bunker fuel in the port of Sines (Portugal) showed a significant decrease, reaching 743 USD/MT on July 10 (minus 50 USD compared to last week). At the same time, the price difference between LNG and conventional fuel on July 10 widened sharply to 113 USD in favor of LNG, compared to 47 USD a week earlier, with MGO LS quoted at 856 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of www.mabux.com.

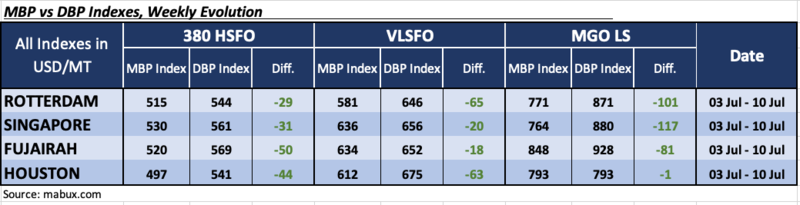

In Week 28, the MDI index (the correlation ratio of market bunker prices (MABUX MBP Index) vs. MABUX digital bunker benchmark (MABUX DBP Index) indicated undervaluation across all fuel segments in the world's four largest hubs: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, weekly underprice averages fell by 6 points in Rotterdam and 5 points in Houston, but rose by 1 point in Singapore and 7 points in Fujairah.

In the VLSFO segment, average weekly undervaluation levels decreased by 5 points in Rotterdam and 2 points in Fujairah, but increased by 1 point in Singapore and 4 points in Houston.

In the MGO LS segment, Houston moved into the undervalued zone, making all four selected ports undercharged. The weekly underprice average increased by 4 points in Rotterdam, 8 points in Singapore, 10 points in Fujairah, and 4 points in Houston. The MDI index in Rotterdam surpassed the $100 mark, while Singapore consistently remained above this level.

Over the week, the balance of overvalued/undervalued ports shifted in favor of undervaluation, with all segments of bunker fuel underpriced in all selected ports. We expect the trend towards fuel underestimation to continue next week.

For more details on the correlation between market prices and the MABUX digital benchmark, visit the “Digital Bunker Prices” section on www.mabux.com.

According to Clarksons Research, alternatively-fuelled ships comprised about a third of ships ordered in the first half of the year, accounting for 41% of tonnage orders. The report highlights 109 orders for LNG-fuelled ships (51 excluding LNG carriers), 49 for methanol, 15 for ammonia, 42 for LPG, and four for hydrogen. In comparison, 54% of tonnage orders were alternatively fuelled in the same period of 2022. Currently, about 50% of the total orderbook can operate on alternative fuels. It is forecasted that over a fifth of all fleet capacity will be capable of using alternative fuels by the end of the decade. However, investments in port infrastructure and the availability of "green" fuels continue to lag behind. While there are 273 ports with LNG bunkering and 251 ports with shore power connections either in place or planned, only 29 ports have methanol bunkering available or planned. Additionally, 28.3% of total tonnage in the global fleet, or 5,838 ships, are now equipped with scrubbers. Meanwhile, 33.5% of global tonnage, or 8,713 ships, have energy-saving technologies on board.

We expect next week the downward trend in the global bunker market to lose its momentum, and bunker indices will return to moderate growth.

By Sergey Ivanov, Director, MABUX

All news