The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

In the absence of clear movers in the global bunker market, the moderate downward trend in bunker prices will persist next week

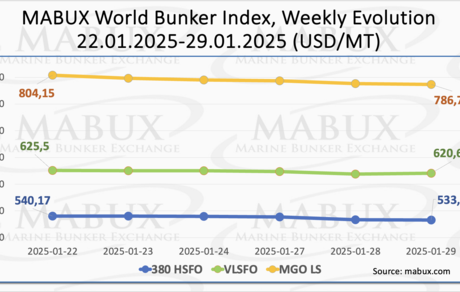

Over the fifth week, the MABUX global bunker indices experienced a sustained decline. The 380 HSFO index dropped by 7.03 USD, decreasing from 540.17 USD/MT the previous week to 533.14 USD/MT. The VLSFO index fell by 4.89 USD, from 625.50 USD/MT to 620.61 USD/MT. The MGO index declined by 17.40 USD, slipping from 804.15 USD/MT to 786.75 USD/MT, once again falling below the 800 USD mark. At the time of writing, no clear trend was observed in the global bunker market.

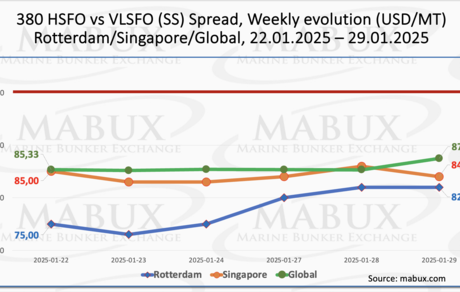

MABUX Global Scrubber Spread (SS) - the price difference between 380 HSFO and VLSFO - recorded a moderate increase of $2.14, rising from $85.33 last week to $87.47, though it remained well below the $100.00 breakeven mark. Conversely, the index's weekly average saw a slight decline of $1.31. In Rotterdam, the SS Spread rose by $7.00 ($82.00 versus $75.00 last week), while the port's weekly average decreased by $2.50. In Singapore, the 380 HSFO/VLSFO price difference fell by $1.00, from $85.00 last week to $84.00, with the weekly average dropping by $6.66. Throughout the week, no clear trend emerged in the Global SS Spread or regional indices, which remained well below the $100.00 mark. We anticipate continued irregular fluctuations in the SS Spread next week. More detailed information is available in the "Differentials" section of www.mabux.com.

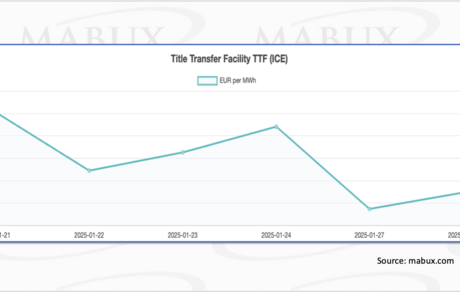

LNG exports from the United States to Asia are being sharply redirected to Europe, where gas prices are higher, and demand has surged due to winter weather and the disruption of pipeline gas supplies through Ukraine. In January, at least seven U.S. LNG tankers originally bound for Asia via the Cape of Good Hope were rerouted in the South Atlantic and are now en route to European LNG terminals. As of January 28, European regional storage facilities were 55.46% full, reflecting a decline of 3.92% compared to the previous week and 15.87% since the beginning of the year. The gas withdrawal process remains ongoing. At the end of the 05th week, the European gas benchmark TTF dropped by 1.803 EUR/MWh, once again falling below the 50.00 EUR/MWh threshold (48.224 EUR/MWh vs. 50.027 EUR/MWh last week).

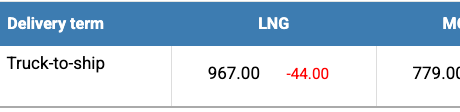

The price of LNG as a bunker fuel in the port of Sines (Portugal) decreased by $44 over the week, reaching $967/MT on January 27. Meanwhile, the price difference between LNG and conventional fuel also narrowed on January 27. The price of MGO LS was $779/MT in the port of Sines, resulting in a $188 difference in favor of MGO LS, compared to a $209 difference the previous week. More detailed information is available in the LNG Bunkering section on www.mabux.com.

During Week 05, the MABUX Market Differential Index (MDI)—the ratio of market bunker prices (MBP Index) to the MABUX digital bunker benchmark (DBP Index)—registered mixed trends across the four major hubs: Rotterdam, Singapore, Fujairah, and Houston.

• 380 HSFO segment: Singapore remained the only overvalued port. The overprice weekly average widened by 14 points. Meanwhile, Rotterdam, Fujairah and Houston were undervalued, though their undervaluation narrowed by 14 points, 8 points, and 7 points, respectively.

• VLSFO segment: Singapore moved into the overvalued zone, with its weekly average rising by 9 points. The other three ports were undervalued. The weekly average fell by 14 points in Rotterdam and 9 points in both Fujairah and Houston. The MDI in Rotterdam and Singapore neared the 100% correlation mark between the market price (MBP) and the MABUX digital bunker benchmark (DBP).

• MGO LS segment: Rotterdam and Singapore both shifted into the overcharge zone, with the overvaluation index increasing by 17 points in Rotterdam and 6 points in Singapore. Fujairah and Houston remained undervalued, with weekly averages decreasing by 12 and 9 points, respectively. The MDI in Singapore remained at the 100% correlation mark between MBP and DBP, while Fujairah’s index approached the $100.00 mark.

The balance of overvalued and undervalued ports is gradually shifting toward overpricing. One overcharged port was recorded in the 380 HSFO and VLSFO segments, while two ports entered the overvaluation zone in the MGO LS segment. We anticipate that the gradual transition toward bunker fuel overvaluation may continue next week, though undervaluation will remain the prevailing trend for now.

Further insights on the correlation between market prices and the MABUX digital benchmark are available in the Digital Bunker Prices section of www.mabux.com.

According to the DNV report, the future of biofuels will largely depend on the availability of affordable biomass and competition from other sectors, such as automotive fuels. Currently, most biofuels are used in road transport, particularly in countries like the US, Brazil, and Norway, where blending mandates are in place. While biofuel consumption is increasing in aviation and shipping, its share remains relatively small compared to road transport. As per The International Energy Agency (IEA), biofuel consumption in 2023 reached approximately 0.6 million tonnes of oil equivalent (Mtoe) in aviation and 0.7 Mtoe in shipping. In the shipping industry, several shipowners have voluntarily participated in biofuel trials, which serve as a key driver for the adoption of biofuels as marine fuels. FAME (fatty acid methyl ester) and HVO (hydrotreated vegetable oil) are now significant feedstocks for marine biofuel blends, with B20 and B30 grades being successfully marketed in the global fuel market. However, in the medium term, growth in the marine biofuel market will face challenges due to the limited availability of sustainable feedstocks, competition from other sectors, and logistical barriers.

We expect that, in the absence of clear movers in the global bunker market, the moderate downward trend in bunker prices will persist next week.

By Sergey Ivanov, Director, MABUX