The Weekly Outlook was contributed by Marine Bunker Exchange (MABUX)

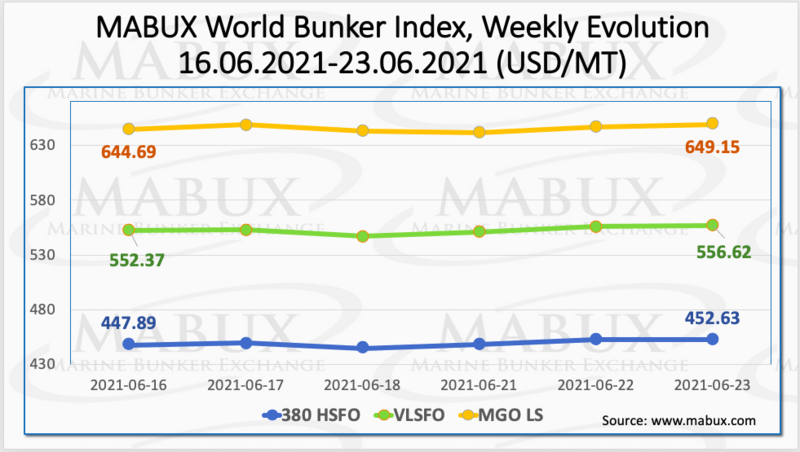

During Week 25, MABUX World Bunker Index continued slight upward trend. The 380 HSFO index has increased by USD 4.74: from 447.89 USD/MT to 452.63 USD/MT, the VLSFO index has risen by 4.25 USD: from 552.37 USD/MT to 556.62 USD/MT, while the MGO index has added 4.46 USD (from 644.69 USD/MT to 649.15 USD/MT).

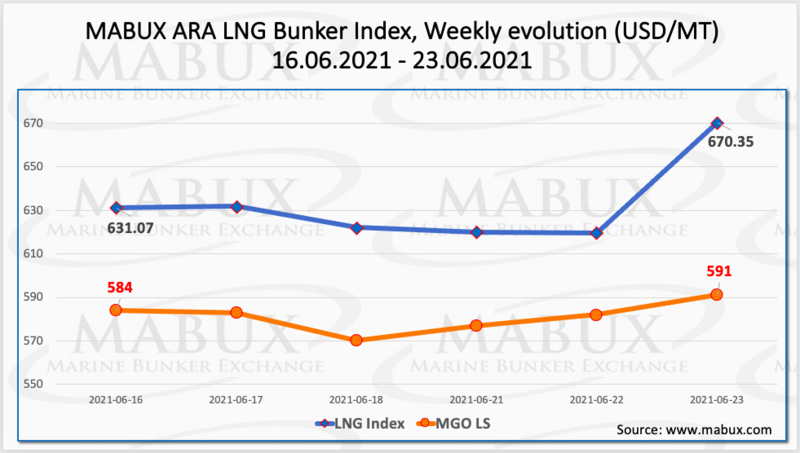

MABUX ARA LNG Bunker Index - the average price of LNG as a marine fuel in the ARA region, has increased by 39.28 USD during the week from 631.07 USD/MT to 670.35 USD/MT. At the same time, the average value of LNG Bunker Index has decreased by 0.67 USD versus last week. The average price for MGO LS in Rotterdam has risen by 4.67 USD/MT during the same period. Meantime, the average price difference between bunker LNG and MGO LS in Rotterdam has decreased slightly and is at 51.39 USD (versus 56.73 USD last week). More information is available in the new LNG Bunkering section at www.mabux.com.

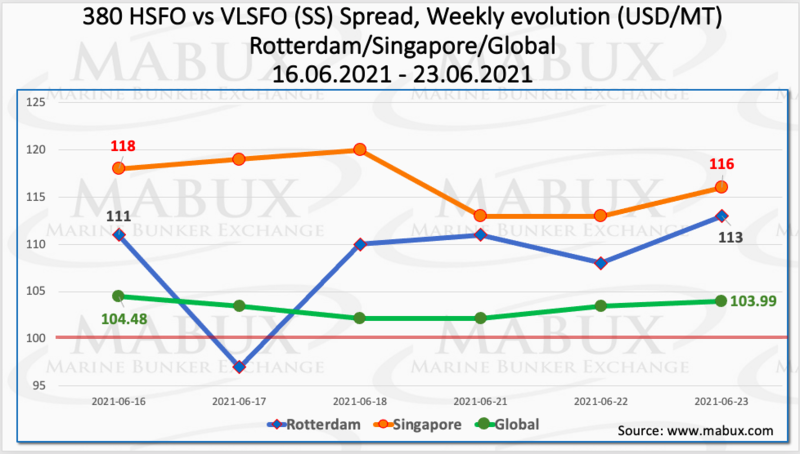

The average weekly Global Scrubber Spread (SS) - the difference in price between 380 HSFO and VLSFO - has fallen by $ 1.38 but is still above the psychological $ 100 mark: $ 103.30 (versus $ 104.68 last week). The average value of SS Spread in Rotterdam also decreased by $ 5.67 and reached $ 108.33 ($ 114.00 last week). On June 17, the SS Spread index in Rotterdam briefly dropped below the $ 100 mark. In Singapore, the average SS Spread also has dropped by $ 1.67: $ 116.50 versus $ 118.17 last week. The SS Spread averages at both ports remain above the $ 100 mark. More information is available in the Differentials section at www.mabux.com.

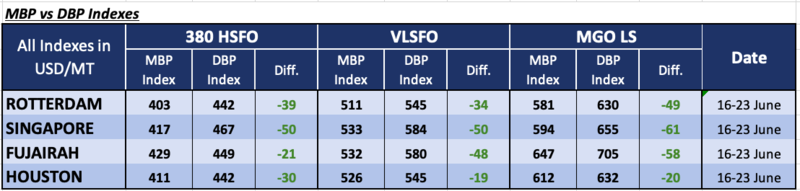

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week has shown that 380 HSFO fuel remained undervalued in all four selected ports ranging from minus $ 30 in Houston (unchanged compared to last week) and minus $ 21 in Fujairah (versus minus $ 20) to minus $ 39 in Rotterdam (unchanged) and minus $ 50 in Singapore (versus minus $ 52). In general, the 380 HSFO’s MBP Index has not had any significant changes.

VLSFO fuel, according to the MABUX DBP Index, was also underestimated in all four selected ports: in Houston the underpricing was minus $ 19 (minus $ 11 last week), in Rotterdam - minus $ 34 (vs. minus $ 26), in Fujairah - minus $ 48 (versus minus $ 44), in Singapore - minus $ 50 (versus minus $ 49). The most significant changes of VLSFO underestimation margins were recorded in Houston and Rotterdam (up $ 8 in each port).

As for MGO LS, MABUX DBP Index has registered an undercharge of this grade at all selected ports ranging from minus $ 20 (minus $ 22 compared to last week) in Houston to minus $ 49 (vs. minus $ 45) in Rotterdam, minus $ 61 (vs. minus $ 49) in Singapore and minus $ 58 (versus minus $ 44) in Fujairah. The most significant changes of MGO LS underpricing were recorded in Singapore (up $ 12) and Fujairah (up $ 14).

Shipping organizations have welcomed the ‘growing momentum’ for a $5 billion R&D Fund for shipping at MEPC 76 - but called on governments to ‘act in line with their climate commitments’ and ‘not waste more time’ in moving forward with decisive action to support the decarbonisation of the industry. BIMCO, CLIA, INTERCARGO, INTERFERRY, International Chamber of Shipping INTERTANKO, IPTA and World Shipping Council noted that the world’s governments had agreed to continue work on the IMO-supervised R&D Fund programme, to be led by a new International Maritime Research and Development Board (IMRB). However, they also expressed their disappointment that ‘yet again we must wait for the next meeting before we can get going’. The $5 billion R&D Fund programme is designed to accelerate the development and introduction of zero-emission technologies and fuels for maritime transport.

Source: www.mabux.com

All news